Rishi Sunak unveiled his first Budget today. Despite a nervous start he was soon in his stride as went on to announce a huge spending spree.

Going into the Budget concerns over coronavirus were front and central. The Chancellor acknowledged these concerns and also highlighted that they should be temporary. He pledged £30 billion stimulus package to counter the impact of the coronavirus hit, aimed at mainly helping the small and medium sized businesses address the supply/demand shock that coronavirus is expected to bring, and its impact on cashflow.

However, his spending didn’t end there, and Rishi Sunak went on to announce a wide array of measures from duty freezes, to flood defence spending to huge spending on infrastructure projects. The measures in total will cost £175 billion over the coming 5 years. The Budget will put government borrowing at the highest level in 30 years. This marks a sharp turnaround from his predecessors and brings an end to years of austerity.

The OBR expect GDP to reach 1.1% this year and 1.8% in 2021.

Debt to GDP will be 2.1% this year, rising to 2.8% in 2021. These figures don’t take into account the hit to the economy that coronavirus could bring.

Market reaction

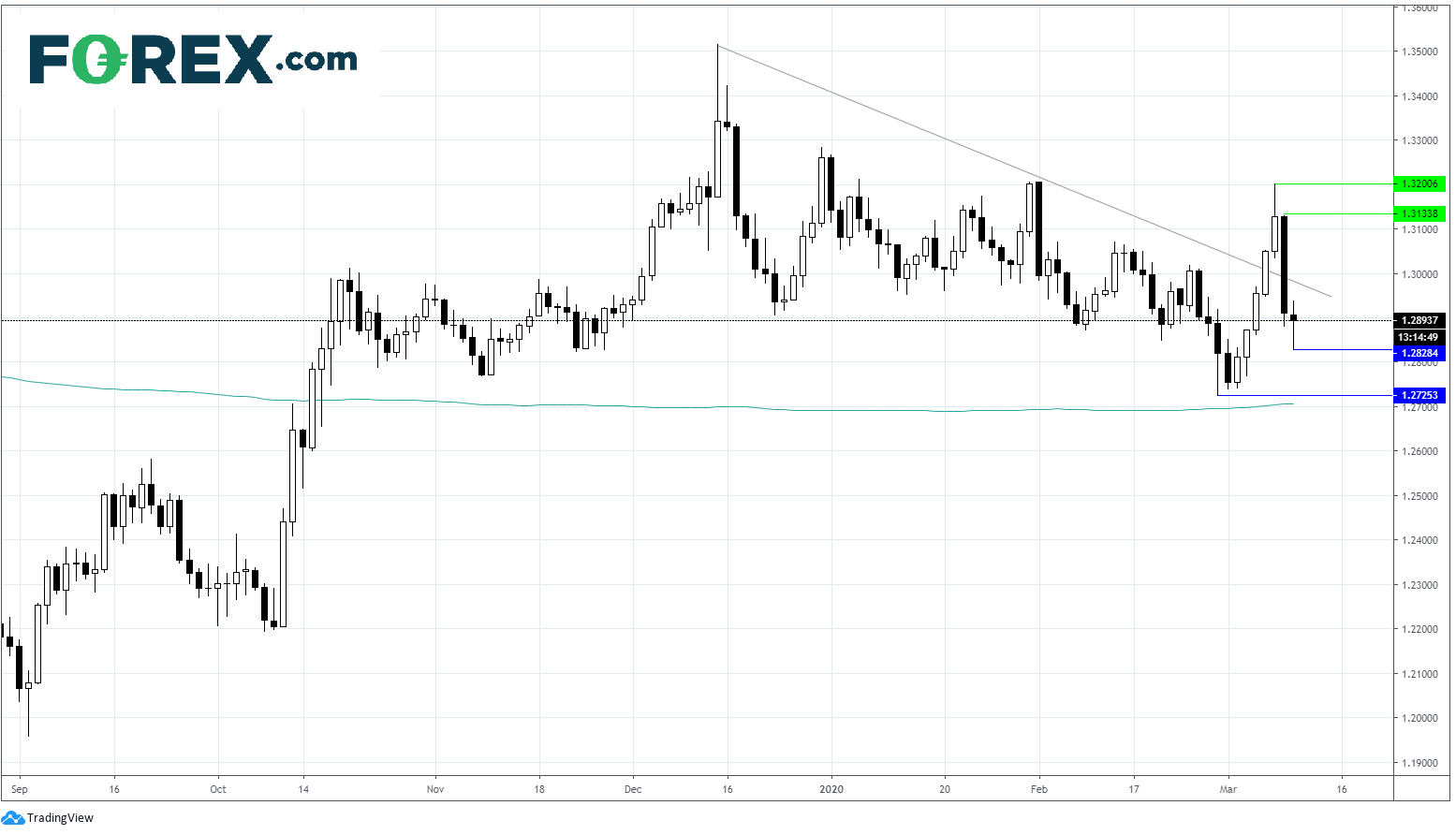

The pound’s reaction has been fairly muted given today’s events. With the BoE cutting interest rates by 50 basis points this morning and the Chancellor unveiling a huge spending plan in the afternoon the overall impact appears to be one of stability. This is the coordinated response that the markets have been looking for. GBP/USD

The Pound is holding steady at $1.2950 slightly off the high of the day, whilst the FTSE is also trading steadily at -0.2% lower. The FTSE 250 which has a more domestic focus and is often considered a truer reflection of the UK economy than the more international FTSE 100, was trding slightly off -0.1%.

Equity Winners & Losers

Firms with big exposure to the infrastructure space such as Kier (+16% )and Balfour Beatty (+12%) are performing well, along with broadband providers BT and Spirent Communications. The pub sector should theoretically benefit from the freeze on beer duty and discounts on business rates although, this is not showing through owing to the coronavirus disruption. House builders have also failed to react despite £12.2 billion investment in affordable housing.