- Risk assets rallied today on hopes for a deal on both Brexit and US-China trade. UK PM Johnson had a “positive and promising” meeting with Irish PM Varadkar, stoking optimism that the UK and EU will be able to reach a deal next week (prediction markets remain skeptical).

- Separately, reports suggested there was a chance of a partial trade deal around agricultural purchases and currency levels between the US-China. While it would be far from the “big”, all-encompassing deal that President Trump has expressed a desire for, any progress would be better than traders expected earlier this week.

- FX: The pound was by far the strongest major currency on the day, rising by more than 1.5% against its major rivals. The yen was the weakest major currency in risk-off trade.

- US data: In another sign of a potentially slowing economy, US CPI came in at +1.7% y/y, below the 1.8% reading expected. Core CPI (ex food and energy) came in at 2.4% y/y as expected. That said, initial jobless claims dropped to 210k vs. 219k expected and previous, as the US labor market remains an economic bright spot.

- Commodities: Gold dropped -1% on the day on declining safe haven demand, while oil tacked on more 2% today.

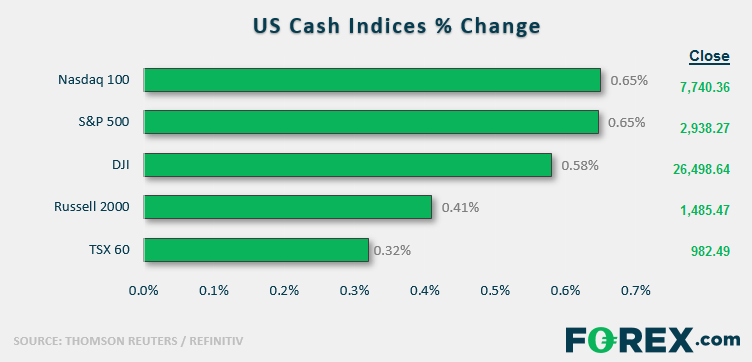

- US indices closed higher on the day, though off their highest levels.

- Energy (XLE) was the strongest sector on the day, boosted by the big rally in oil prices. Utilities (XLU) were the weakest.

- Stocks on the move:

- Utility PG&E (PCG) dumped -29% after a judge ruled to allow bondholders to push for the company’s bankruptcy.

- Delta Airlines (DAL) dropped -2% after issuing weaker-than-expected guidance for next quarter.

- Ra Pharmaceuticals (RARX) exploded 101% higher after Belgian pharmaceutical company UCB agreed to acquire the company for $2.5B.

- Kroger (KR) shed -3% after an analyst at Jefferies criticized the grocer’s investment in Ocado.

- Retailer Bed, Bath, and Beyond (BBBY) rocketed 21% higher after announcing former Target executive Mark Tritton as CEO.

Latest market news

Today 08:00 AM

Yesterday 04:00 PM

December 25, 2024 08:00 PM

December 25, 2024 02:00 PM

December 25, 2024 07:00 AM

December 25, 2024 02:00 AM