- In its highly-anticipated monetary policy meeting, the ECB cut deposit rates by 10bps to -0.5%, reintroduced QE (with no end date!), and introduced a tiering system for banks – see our initial review of the decision. The central bank also cut growth and inflation forecasts.

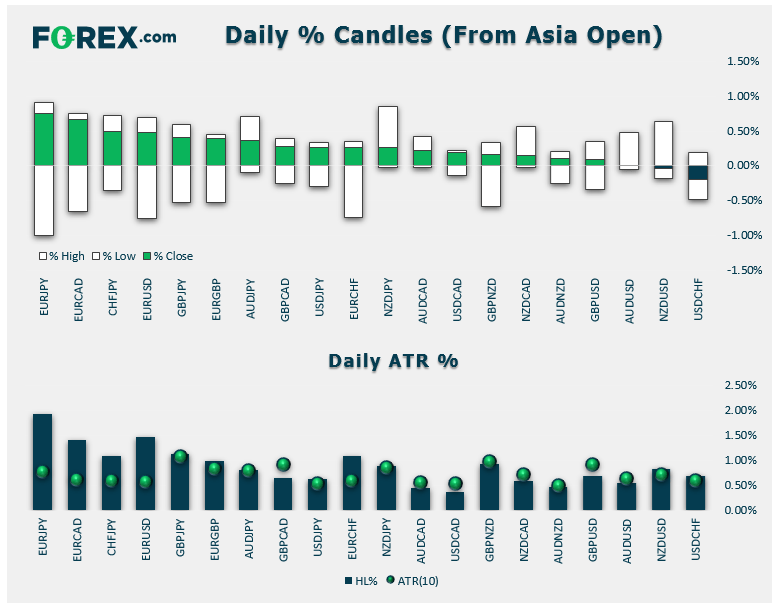

- FX: After an initial drop, the euro rallied back to become the strongest major currency on the day in a classic “sell the rumor, buy the news” dynamic around the ECB. The Japanese yen was the weakest major currency.

- Optimism about a possible interim US-China trade deal to delay tariffs boosted risk appetite (though that rumor was subsequently denied by a White House spokesperson)

- US data: August CPI came in softer than expected at 1.7% y/y vs. 1.8% eyed, while initial jobless claims met expectations at 204k.

- Commodities: Gold ticked higher while Oil shed over 1% on the day.

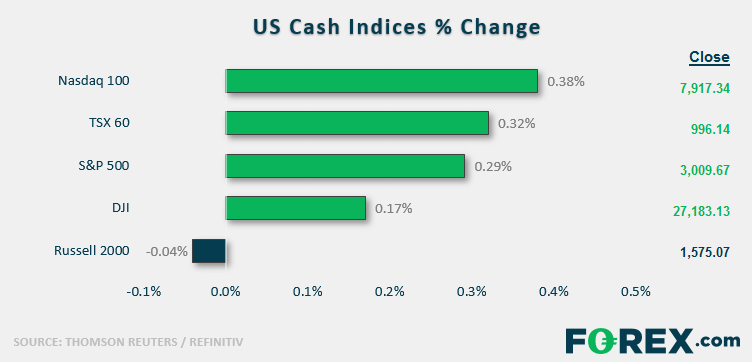

- US indices traded higher across the board, marking the seventh straight rally for the Dow Jones Industrial average. This is the longest winning streak since last May.

- Financials (XLF) were the strongest sector while Energy (XLE) was the weakest, hurt by the drop in oil prices.

- Stocks on the move:

- Oracle (ORCL) gained 1% after co-CEO Mark Hurd announced he would take a leave of absence for health reasons.

- Car rental firm Hertz Global Holdings (HTZ) gained 20% after billionaire investor Carl Icahn increased his stake in the company above 30%.

- New IPO SmileDirectClub dropped -28% in its first day of trading.

Latest market news

Today 09:11 AM

Yesterday 11:57 PM

Yesterday 08:25 PM