- The combination of USD/CNH rising through 7.00 (a move President Trump dubbed “currency manipulation…a major violation”) and news that China’s government has stopped US agricultural purchases led to big risk-off moves across the globe as markets price in the risk of a worsening trade/currency war.

- FX: The euro and Swiss franc were the strongest major currencies, while the trade-correlated Aussie brought up the rear.

- EUR/CHF is at 2-year lows, prompting some traders to speculate on the potential for the SNB to intervene in the market and sell the Swiss franc.

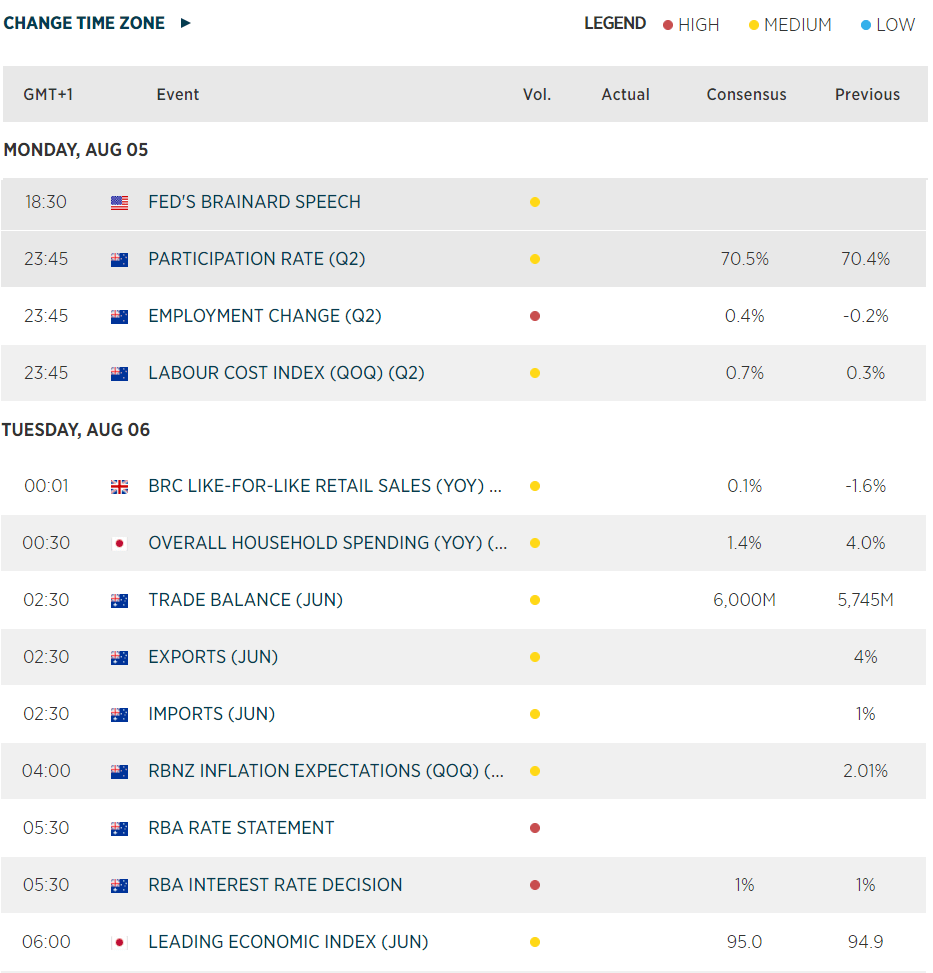

- Beyond China-related developments, traders will also look forward to New Zealand jobs data and the RBA in today’s Asian session trade.

- Commodities: Gold rallied again today, hitting a six-year high above 1470, while oil dropped 1% despite ongoing tensions in the Middle East.

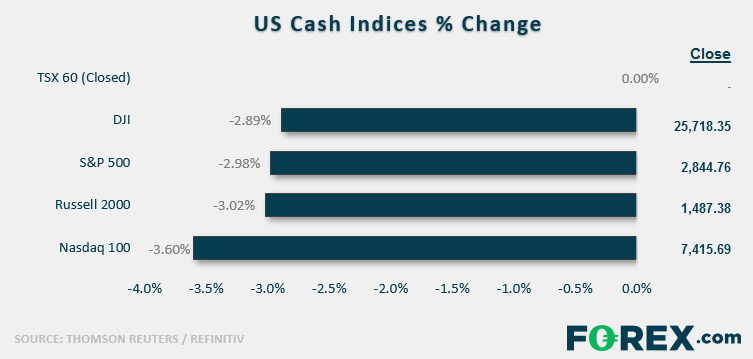

- US indices bore the brunt of the selling pressure, losing roughly 3% on the day.

- Utilities (XLU) were the strongest sector, but still dumped nearly 2%. Technology stocks (XLK) were the weakest, losing over 4% on the day.

- Stocks on the Move:

- Apple (AAPL, -6%) and Visa (V, -5%) were the biggest contributors to the Dow’s drop today.

- Tyson Foods (TSN) gained 5% to buck the weakness in broader markets after reporting strong earnings.

- Cars.com (CARS) dumped nearly 35% after reporting weak earnings, cutting guidance, and announcing there were no new bidders for the company.

Latest market news

Yesterday 06:30 PM

Yesterday 05:17 PM

Yesterday 03:50 PM

January 2, 2025 08:49 PM

January 2, 2025 08:32 PM

January 2, 2025 06:30 PM