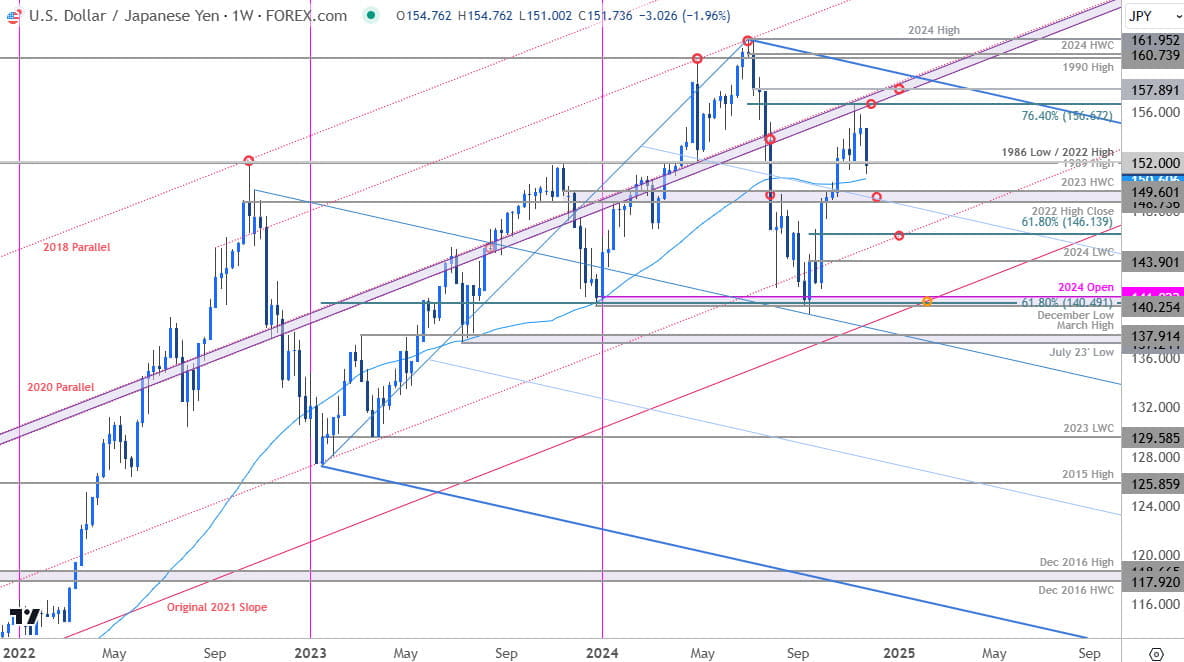

Japanese Yen Technical Forecast: USD/JPY Weekly / Daily Trade Levels

- USD/JPY reversal off key resistance breaks initial uptrend support

- USD/JPY risk for deeper correction into monthly cross

- Resistance 152, 153.40, 154.34 (key)- Support ~150.50, 149.60-150.19, 148.16 (key)

The Japanese Yen is poised to mark a third consecutive daily advance against the US Dollar with a break below the November opening-range lows in USD/JPY now threatening a deeper correction. Battle lines drawn on the USD/JPY weekly & daily technical charts into the December open.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this Yen setup and more. Join live on Monday’s at 8:30am EST.Japanese Yen Price Chart – USD/JPY Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

Technical Outlook: In my last Japanese Yen Technical Forecast we noted that the USD/JPY had, “responded to Fibonacci resistance with price poised to mark an outside-reversal on the heels of a four-week rally- risk for a larger pullback within the broader uptrend. From a trading standpoint, losses should be limited to the median-line / 153 IF price is heading for a breakout on this stretch…” USD/JPY has now plunged more than 3.7% off those highs with price breaking below the 153-handle today.

On a weekly basis, the focus is on a weekly close sub-152- to keep the immediate short-bias viable into the December open. Note that 152 is defined by the 1989 high, the 1986 low, the 2022/2023 highs, and currently converges on the 200-day moving average. A close below this threshold would suggest a larger pullback is underway.

Japanese Yen Price Chart – USD/JPY Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

A closer look at the daily chart shows USD/JPY breaking below the median-line yesterday with price now attempting a break the objective monthly opening-range lows. Initial support rests along the 25% parallel (currently ~150.50s) and is backed closely a key technical range at 149.60-150.20- a region defined by the 2023 high-week close (HWC) and the 38.2% retracement of the September advance. Broader bullish invalidation now raised to the lower parallel / 50% retracement at 148.16.

Resistance now eyed at back at 153.40 with a breach / close above the median-line / monthly high-day reversal close at 154.34 needed to mark uptrend resumption. Key resistance unchanged at 156.67.

Bottom line: A break below the median-line suggests the potential for a larger correction within the September uptrend with initial support objectives now coming into view. From a trading standpoint, look to reduce short-exposure / lower protective stops on a stretch towards 150 IF reached. Ultimately, we are looking for an exhaustion low ahead of 148 for the September rally to remain viable with a breach / close above 154.34 needed to mark uptrend resumption.

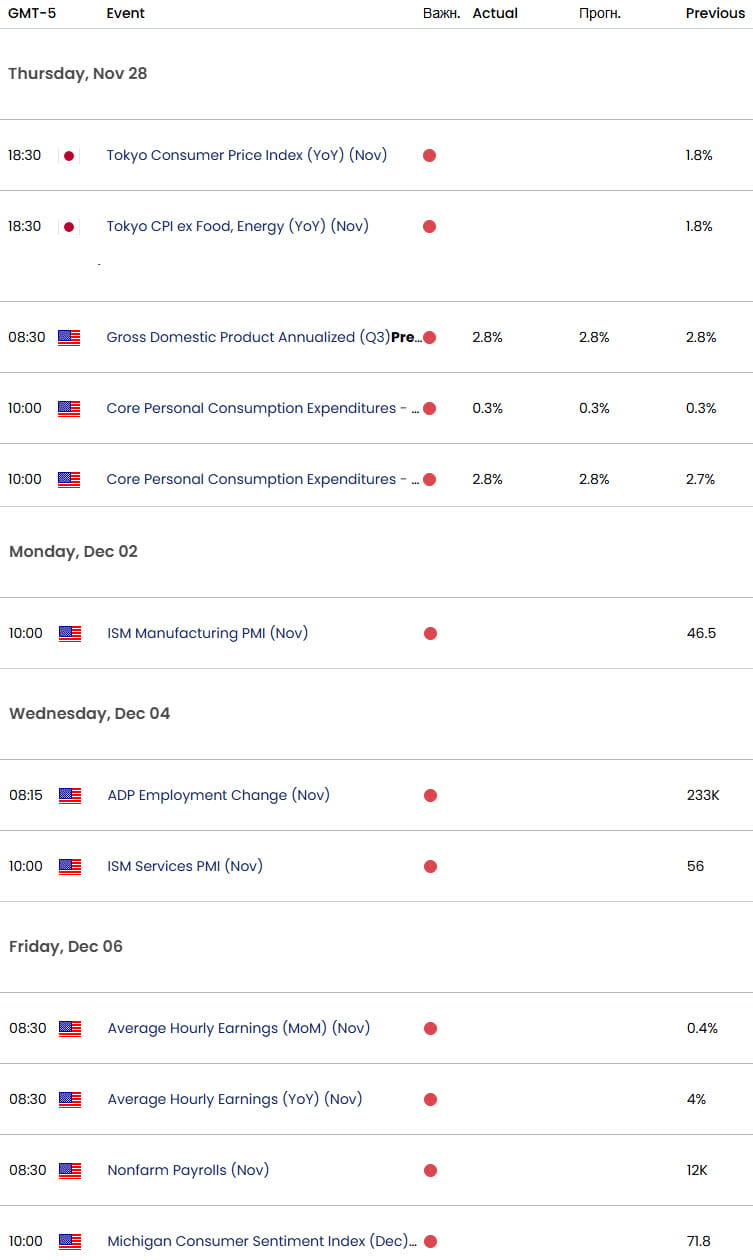

Keep in mind we are heading into the Thanksgiving holiday and the close of the month with US non-farm payrolls on tap next week. Stay nimble into the monthly cross and watch the weekly closes for guidance here. Review my latest Japanese Yen Short-term Outlook for a closer look at the near-term USD/JPY technical trade levels.

USD/JPY Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- Crude Oil (WTI)

- Canadian Dollar (USD/CAD)

- British Pound (GBP/USD)

- Euro (EUR/USD)

- Australian Dollar (AUD/USD)

- Swiss Franc (USD/CHF)

- US Dollar Index (DXY)

- Gold (XAU/USD)

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex