Japanese Yen technical outlook: USD/JPY short-term trade levels

- Japanese Yen reversal off confluent uptrend resistance threatens larger pullback

- USD/JPY testing short-term downtrend resistance- broader outlook still constructive

- Resistance 134.77, 135.25, 136.66-137.65 (key) – support 132.50, 130.56-131.30 (key),

The Japanese Yen turned from a key pivot zone we’ve been tracking for weeks now with USD/JPY threatening a deeper correction in the days ahead. Although the broader outlook remains constructive, a short-term downtrend is in focus and we’re looking to validate a low in the days ahead. These are the updated targets and invalidation levels that matter on the USD/JPY short-term technical charts.

Discussing this USD/JPY price setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

Japanese Yen Price Chart – USD/JPY Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

Technical Outlook: In last month’s Japanese Yen short-term outlook we noted that USD/JPY was approaching, “a critical resistance zone at 136.66-137.65- a region defined by the 38.2% retracement at of the October decline, the 200-day moving average, and the November swing lows.” Price briefly registered an intraday high at 137.91 before reversing sharply lower with a decline of more than 4% rebounding yesterday off the 50% retracement of the yearly range near 132.50s.

Japanese Yen Price Chart – USD/JPY 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

Notes: A closer look at the Yen price action shows USD/JPY trading within the confines of a descending pitchfork formation with a rebound just pips from the lower parallel now testing initial resistance at the January highs / 75% parallel around 134.77. Subsequent resistance is eyed just higher at the monthly opening-range lows at 135.25 with a breach above the upper parallel ultimately needed to suggest a more significant low is in place. The near-term advance may be vulnerable into these levels.

A break lower from here would expose key support at the objective 2023 yearly open / 61.8% retracement of the yearly range at 131.10/30- an are of interest for possible downside exhaustion / price inflection IF reached.

Bottom line: A reversal off uptrend resistance is now threatening a test of uptrend support. From at trading standpoint, rallies should be limited to the March open (136.11) IF price is indeed heading lower towards the 131-hadle. A topside breach / close above this formation would likely fuel another test of critical resistance around the 200-day moving average.

Review my latest Japanese Yen weekly technical forecast for a longer-term look at the USD/JPY trade levels.

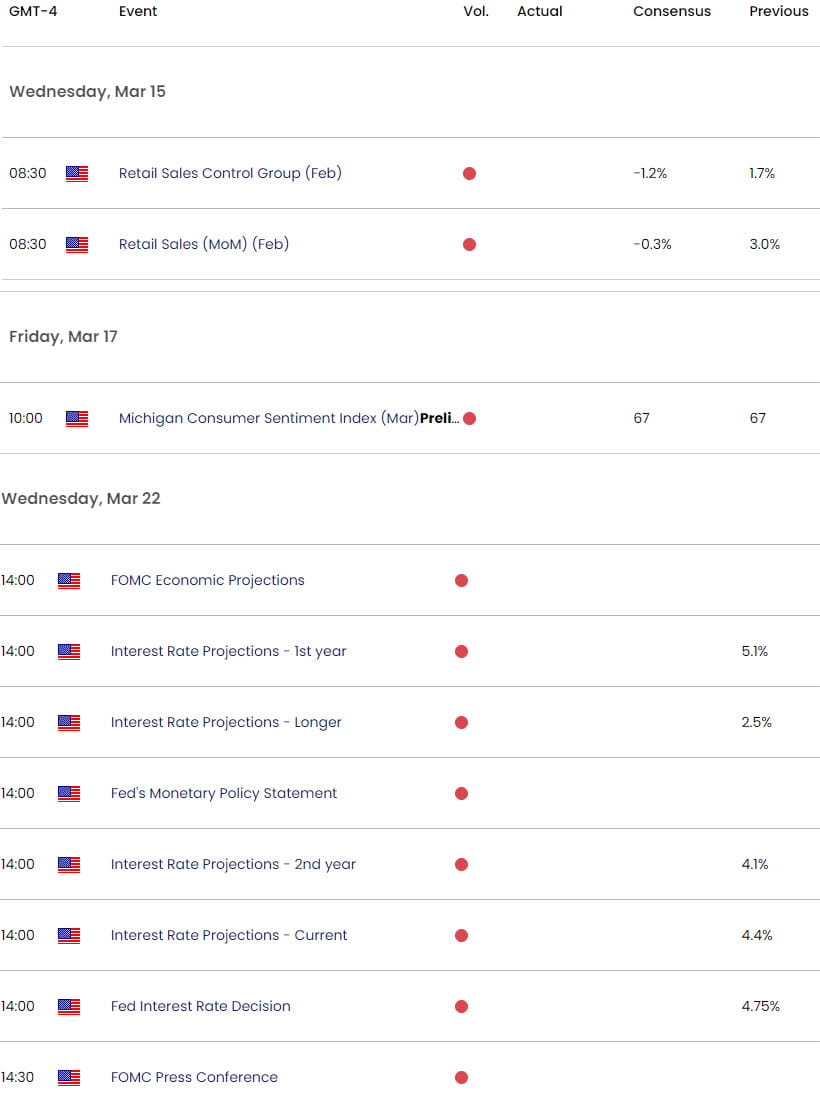

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Equities short-term outlook: S&P 500, Nasdaq, Dow breakdown levels

- Gold short-term price outlook: XAU/USD reversal gathers pace

- Canadian Dollar short-term outlook: USD/CAD breakout levels

- Euro short-term technical outlook: EUR/USD breakdown underway

- US Dollar short-term price outlook: DXY looks for a low

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex