Japanese Yen technical outlook: USD/JPY short-term trade levels

- Japanese Yen threatens outside-day reversal off Fibonacci resistance

- USD/JPY threatens deeper correction within yearly uptrend

- Resistance 133.35, 133.77, 134.75/77 (key)- support 132.18, 130.56-131.30 (key), 129.63

The Japanese Yen rebounded off a key pivot zone at yearly uptrend support last week with a breakout of a multi-month downtrend in USD/JPY fueling a rally of more than 8.2% off the January low. Price is poised to mark an outside-day reversal off Fibonacci resistance today and while the move does threaten a deeper correction near-term, the broader technical outlook remains constructive while above December lows. These are the updated targets and invalidation levels that matter on the USD/JPY short-term technical charts.

Discussing this USD/JPY price setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

Japanese Yen Price Chart – USD/JPY Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

Technical Outlook: In last month’s Japanese Yen short-term outlook our bottom line noted that, “A reversal off uptrend resistance is now threatening a test of uptrend support.” A key support zone at the December lows / 61.8% retracement of the yearly range at 130.56-131.30 was tested for over a week and although price registered an intra-day low at 129.63, the bears could not hold a daily close. USD/JPY rallied more than 3.1% off the lows with price poised to mark an outside-day reversal into the April open- watch today's close.

Japanese Yen Price Chart – USD/JPY 120min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

Notes: A closer look at Yen price action shows USD/JPY trading within the confines of an ascending pitchfork formation extending off the March lows with the 25% parallel highlighting near-term support at the 38.2% Fibonacci retracement at 132.18. Key support steady at 130.56-131.30- a break / daily close below this threshold is needed to put the bears back in control with such a scenario exposing the March low at 129.63 and the yearly low-day close at 128.46.

Weekly / monthly open resistance at 133.35 with a breach / close above 133.77 needed to mark resumption of the uptrend towards the January highs / 61.8% retracement at 134.75/77- look for a larger reaction there IF reached.

Bottom line: A rebound off uptrend support may be exhausting here in the short-term. From at trading standpoint, looking for possible exhaustion low / price inflection early in the month. Ultimately, losses should be limited to 130.56 IF the January rally is to remain viable. Keep in mind we are heading into the open of a new month / quarter- tread lightly here and stay nimble as we carve out the April opening-range. Review my latest Japanese Yen weekly technical forecast for a longer-term look at the USD/JPY trade levels.

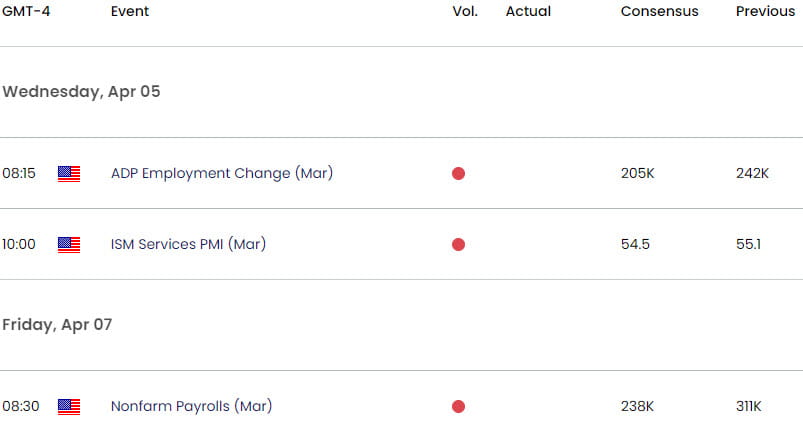

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Gold short-term price outlook: XAU/USD breakout pending

- Canadian Dollar short-term outlook: USD/CAD teases the break

- Euro short-term outlook: EUR/USD support test at prior resistance

- US Dollar short-term price outlook: six-days down into support

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex