Japanese Yen Technical Outlook: USD/JPY Short-term Trade Levels

- Japanese Yen coils just below uptrend resistance ahead of FOMC / BoJ rate decisions

- USD/JPY June opening-range in contraction- breakout pending

- Resistance 140.33 (key), 141.30s, 142.50- support 137.36/91, 135.70, 134.08

The Japanese Yen has continued to coil just below uptrend resistance with major event risk on tap into the close of the week. The focus is on a breakout of the monthly opening-range for guidance. These are the updated targets and invalidation levels that matter on the USD/JPY short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this USD/JPY technical setup and more. Join live on Monday’s at 8:30am EST.

Japanese Yen Price Chart – USD/JPY Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

Technical Outlook: In last month’s Japanese Yen Short-term Outlook we noted that USD/JPY was approaching, “key resistance around 137.36/90- a region defined by the yearly high / high-day close and converges on basic trendline resistance extending off the December highs.” Price ripped through this threshold in the following days with the rally exhausting into uptrend resistance into the close of May. A near-term consolidation pattern has taken shape just below and we’re looking for a breakout of the monthly opening-range for further guidance here.

Japanese Yen Price Chart – USD/JPY 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; USD/JPY on TradingView

Notes: A closer look at Yen price action shows the USD/JPY consolidating into the June opening-range, just below uptrend resistance. A downside break of this formation would threaten a deeper correction with towards the median-line / key support back at 137.35/90- this region is now also defined by the 100% extension of the decline off the highs and the 200-day moving average (~137.28). Look for a larger reaction there IF reached.

A breach / close above the 100% extension of the yearly ascent at 140.33 is needed to mark resumption of the broader uptrend towards the upper parallel (currently 141.30s) and the 61.8% Fibonacci retracement of the 2022 decline at 142.50- an area of interest for possible topside exhaustion / price infection IF reached.

Bottom line: The USD/JPY rally is in consolidation just below uptrend resistance- looking for a breakout of the June opening-range in the days ahead. From a trading standpoint, losses should be limited by 137.28 IF price is heading higher on this stretch with a close above 140.33 needed to mark resumption of the broader uptrend. The FOMC & BoJ interest rate decisions are on tap into the close of the week- stay nimble here and watch the Friday close. Review my latest Japanese Yen Weekly Technical Forecast for a longer-term look at the USD/JPY trade levels.

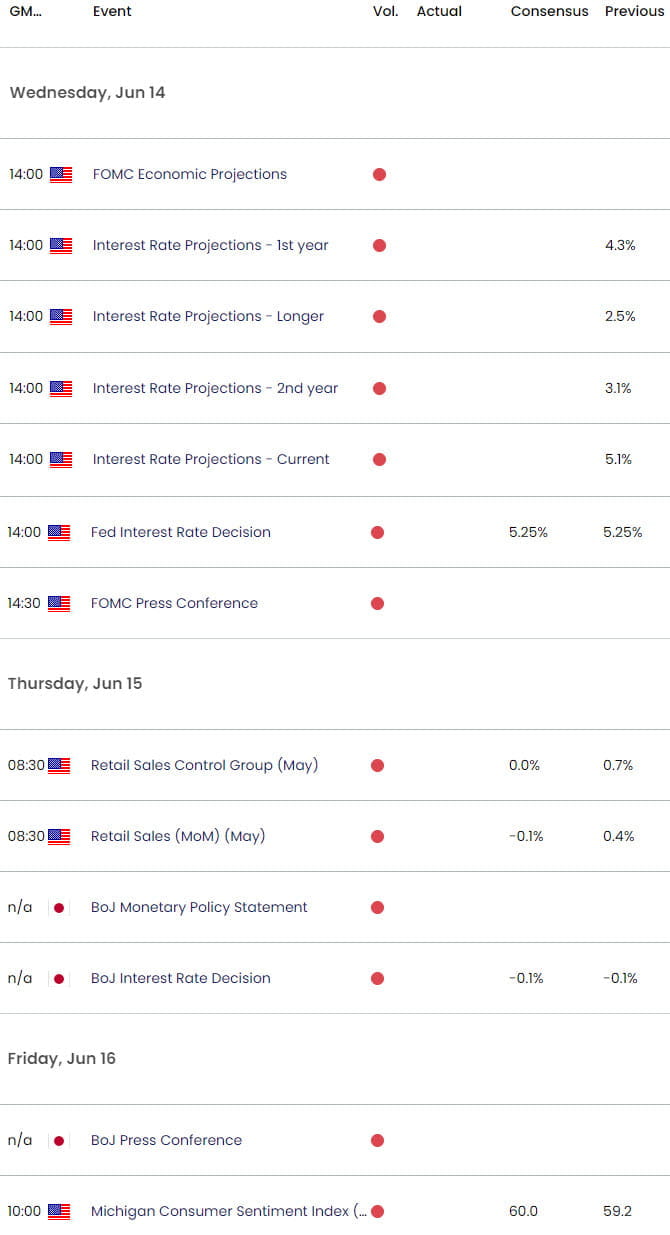

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Canadian Dollar Short-term Outlook: USD/CAD Plunge Halted at Support

- British Pound Short-Term Outlook: GBP/USD Coils Above Uptrend Support

- Euro Short-term Outlook: EUR/USD Yearly-Open Support Pivot in Play

- US Dollar Short-term Outlook: USD Rips into Make-or-Break Resistance

- Australian Dollar Short-term Outlook: AUD/USD Moment of Truth at Support

- Gold Short-term Price Outlook: XAU/USD Plunge Searches for Support

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex