USD/JPY, EUR/JPY, GBP/JPY Key Points

- The Japanese yen hasn’t seen a meaningful weekly rally against the US dollar yet this year, weighed down by weaker-than-expected economic data and dovish comments from the BOJ.

- Intervention is still likely a ways away, but it’s worth having on the radar.

- USD/JPY is consolidating while EUR/JPY and GBP/JPY remain in healthy uptrends.

Japanese Yen Fundamental Analysis

Friday is a bank holiday in Japan to celebrate the Emperor’s birthday, and the Japanese economy could certainly use a reason to celebrate. Last week, we learned that the Japanese economy saw an outright contraction in the 4th quarter, pushing it into a technical recession and allowing Germany’s economy to leapfrog it as the world’s 4th largest.

Weighed down by weaker-than-expected economic data and dovish comments from the Bank of Japan (BOJ), the Japanese yen hasn’t seen a meaningful weekly rally against the US dollar yet this year.

With little in the way of Japanese economic data on the calendar for the rest of the week, traders will be keyed in to any comments from policymakers. Recently, both the Ministry of Finance (MOF) and BOJ have warned that they’re watching the Japanese yen’s exchange rate closely and are willing to intervene directly into the market to strengthen the yen.

As experienced readers know, this type of “jawboning” is still a step or two below outright intervention, especially when volatility in the exchange rate remains low and the fundamental backing for the move (weak Japanese economic performance) augurs for continued weakness. Even if it’s not necessarily imminent, traders should at least be aware of the potential for a sharp drop in XXX/JPY crosses if/when the BOJ decides to enter the market.

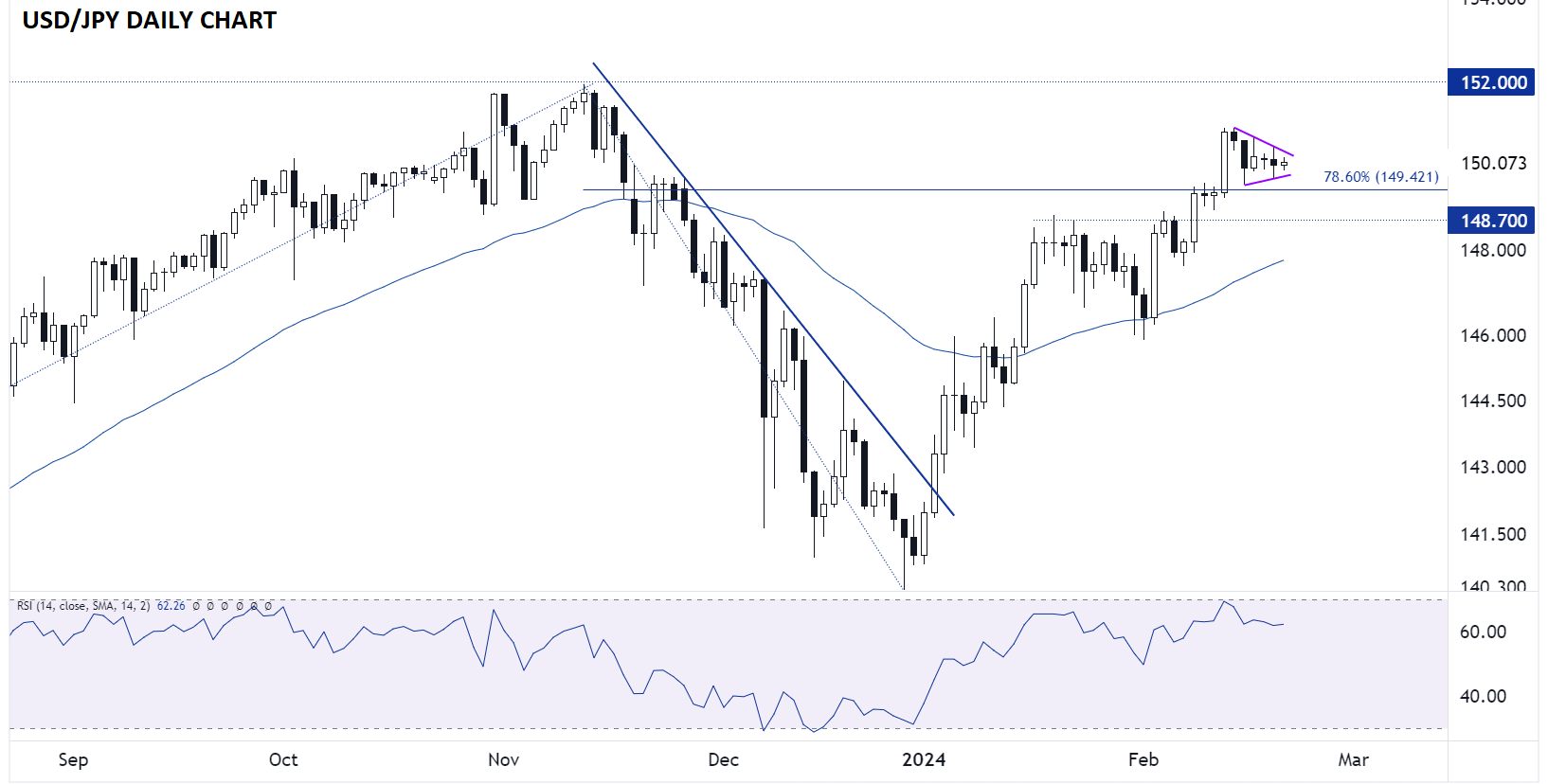

Japanese Yen Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

Looking at the chart, USD/JPY remains in a consolidation pattern within the year-to-date uptrend. In fact, the currency pair has spent the last six days treading water within the range established by last Tuesday’s big 160-pip bullish candle on the back of US CPI.

While the recent low-volatility conditions have not been particularly compelling for traders, it’s important to remember that volatility is cyclical, meaning that the current low-volatility conditions could set the stage for a potentially higher-volatility move in the coming days. Given the ongoing economic divergence on the two sides of the Pacific and the near-term uptrend, an upside break may be more likely, in which case USD/JPY could test its multi-decade highs near 152.00 (as well as the BOJ’s patience) in short order.

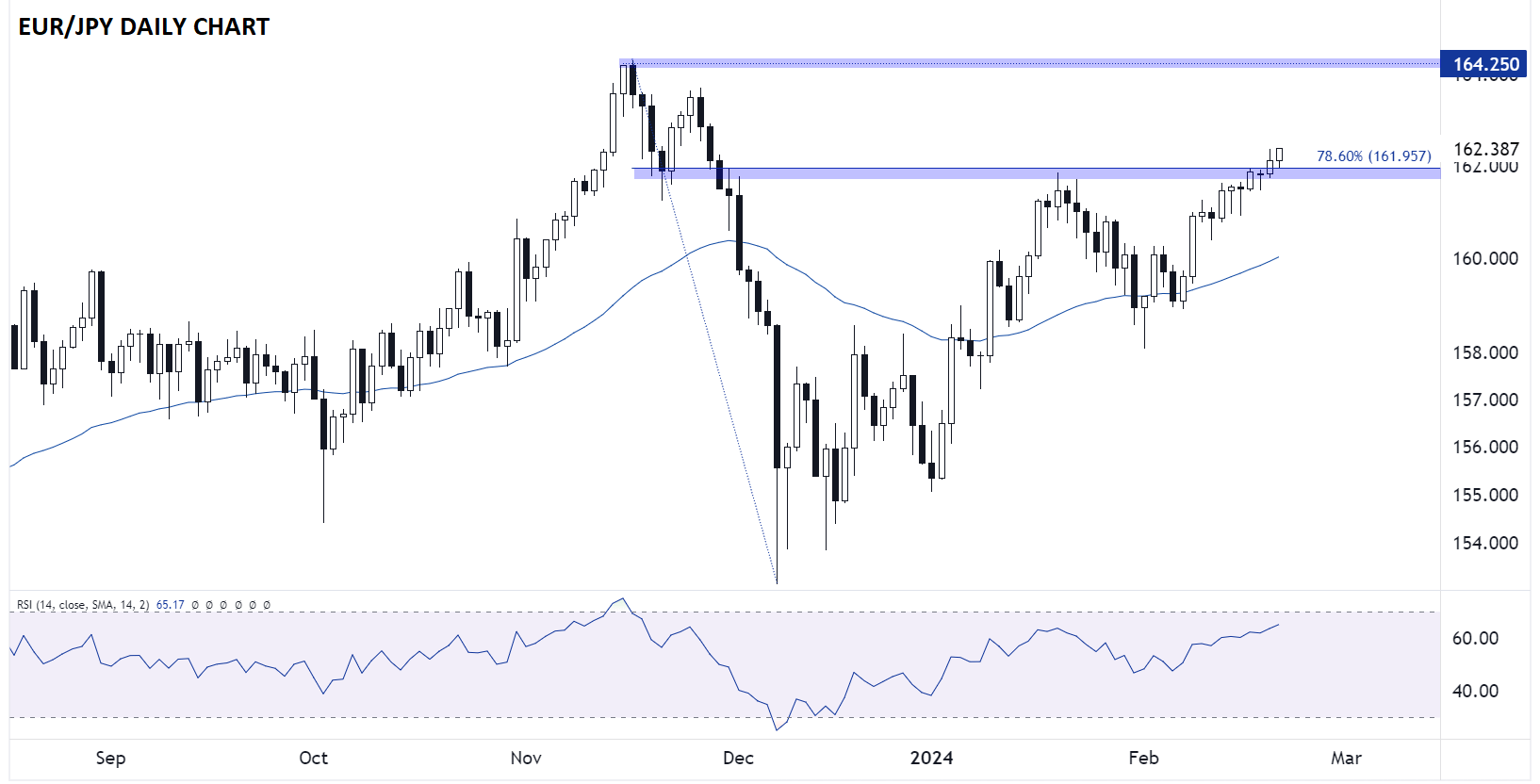

Japanese Yen Technical Analysis – EUR/JPY Daily Chart

Source: TradingView, StoneX

Relative to USD/JPY, EUR/JPY looks relatively bullish. Rather than spending the last week consolidating, EUR/JPY has steadily edged higher, breaking above the previous 2024 high and the 78.6% Fibonacci retracement of the November-December drop in the process. As long as the pair is able to hold above the 162.00 level, the path of least resistance will remain to the topside for a potential test of November’s 16-year high near 164.25 as long as the BOJ remains on the sidelines.

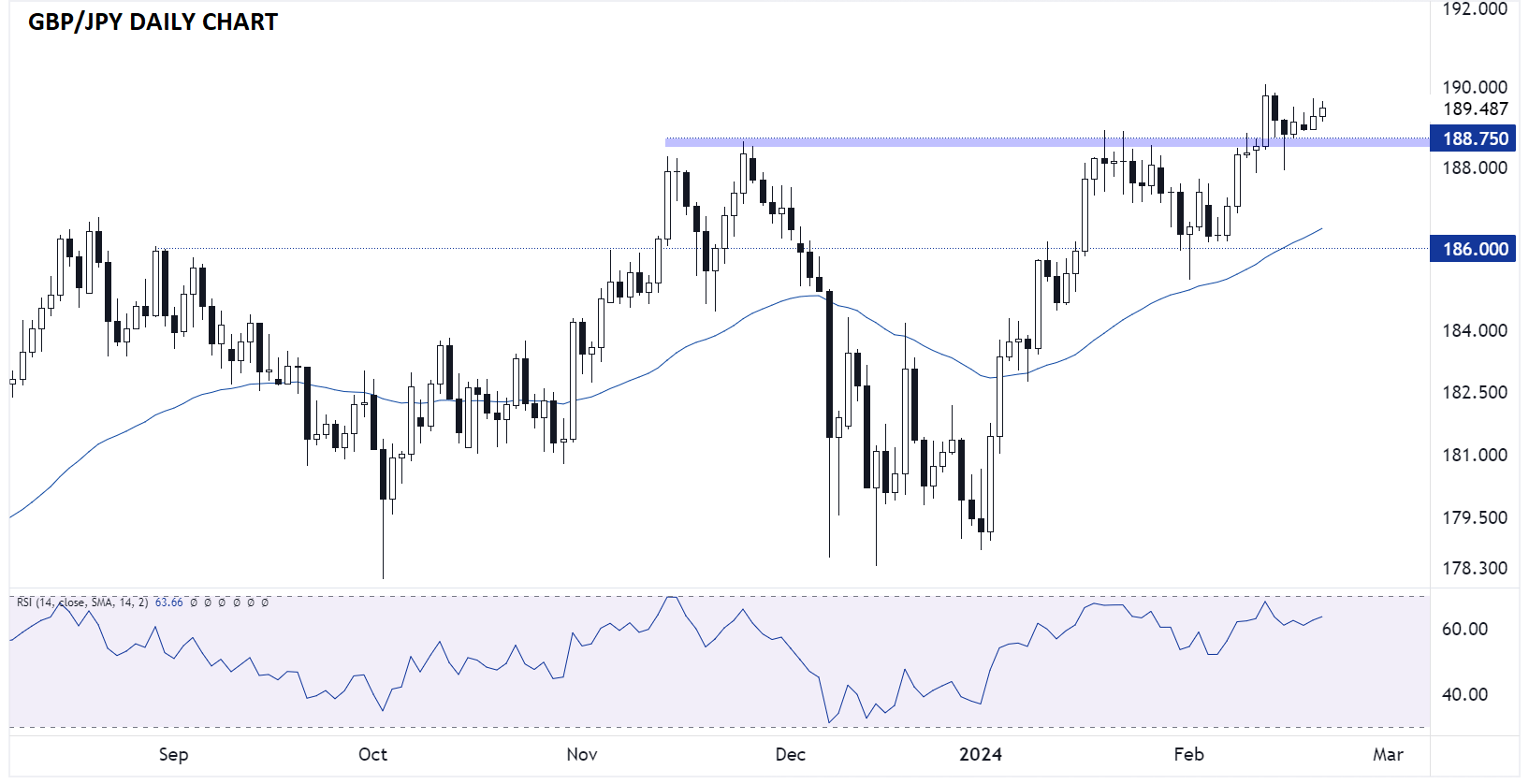

Japanese Yen Technical Analysis – GBP/JPY Daily Chart

Source: TradingView, StoneX

Last but not least, the ever-volatile GBP/JPY cross looks arguably the most bullish of all from a technical perspective. The pair broke out to an 8-year high above 188.75 early last week, then preceded to pull back and retest that area before bouncing late last week, confirming it as support moving forward. As with EUR/JPY, the technical backdrop remains clearly favorable for bulls at the moment, with potential for a break above last week’s high near 190.00 to re-confirm the established uptrend later this week.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX