- USD/JPY strongly correlated with Fed 2024 rate outlook right now

- Soft US CPI limits upside risks for US PPI, core PCE inflation

- Stable Fed rate expectations may assist JPY carry trades

- GBP/JPY, NZD/JPY break higher, AUD/USD next?

Soft US inflation and stability in the Fed interest rate outlook point to an ideal environment for Japanese yen FX crosses, assuming prevailing conditions are maintained. GBP/JPY and NZD/JPY are two pairs on the radar.

Green-light for risk taking?

With the Fed signaling it may only cut rates once this year, keeping market expectations broadly steady relative to where they were before the June FOMC meeting, it points to the likelihood of stability in USD/JPY given it’s been heavily influenced by US rate expectations recently.

Simultaneously, with the latest US inflation report skewing risks for the core PCE deflator to the downside, the backdrop for risker asset classes has arguably improved, limiting the potential for bond yields to push to higher ranges. Lower yields have positive effects on both the real economy and markets, reducing borrowing costs and lifting asset valuations.

Combined, it points to favourable conditions for Japanese yen carry trades in the near-term.

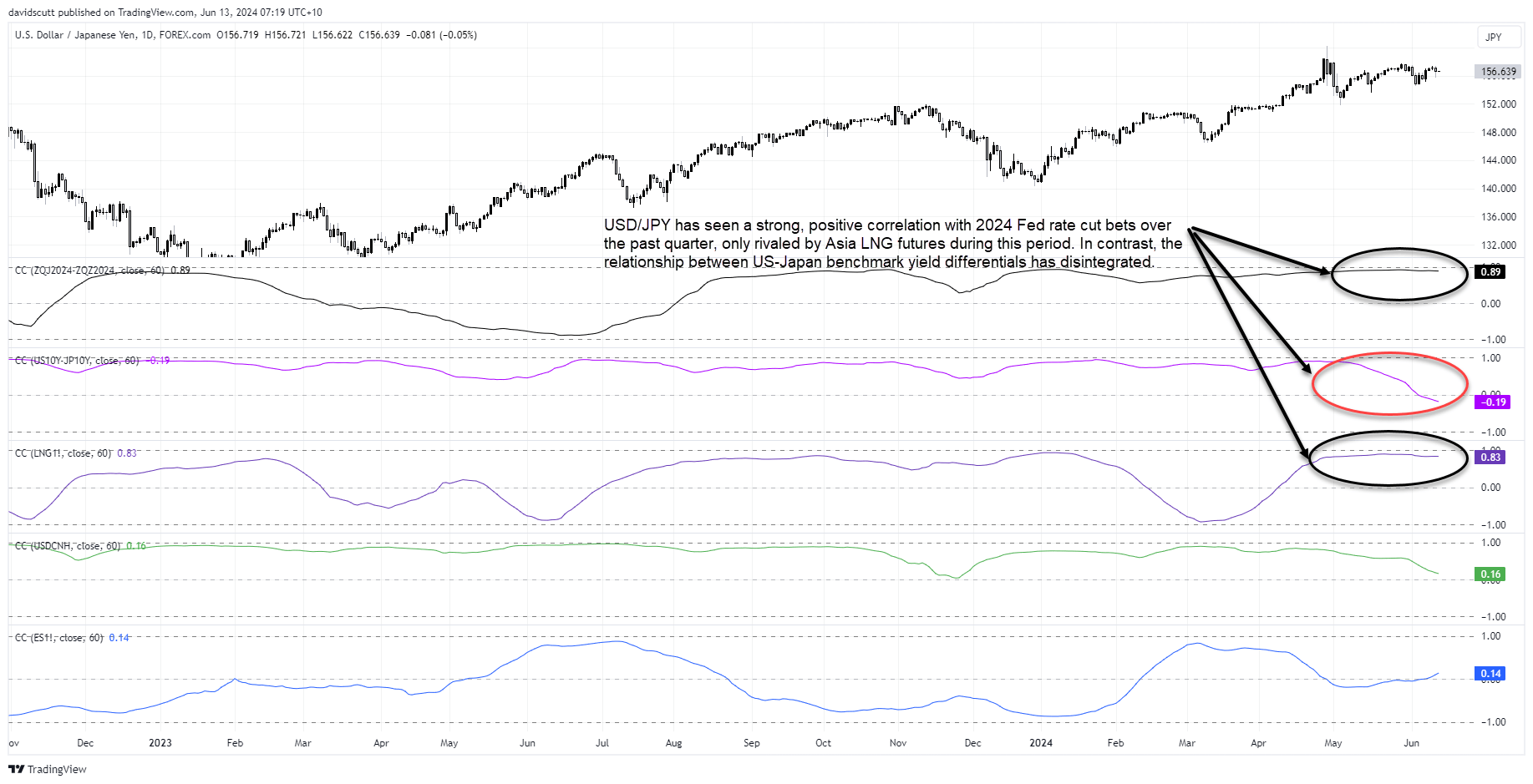

Fed rate expectations driving USD/JPY

Before we look at trade ideas, this chart tracks the rolling daily correlation of USD/JPY over the past three months, providing context as to what’s been influencing its movements.

While rate differentials often drive USD/JPY, that’s not been the case recently with the relationship between the shape of the 2024 Fed funds curve far stronger. The curve can be used to track relative market pricing for rate movements from the Fed.

The strong, positive relationship between the variables shows USD/JPY has been moving in line with Fed rate expectations on most days during this period. In contrast, the prior relationship with benchmark 10-year yield differentials between the United States and Japan has fallen apart.

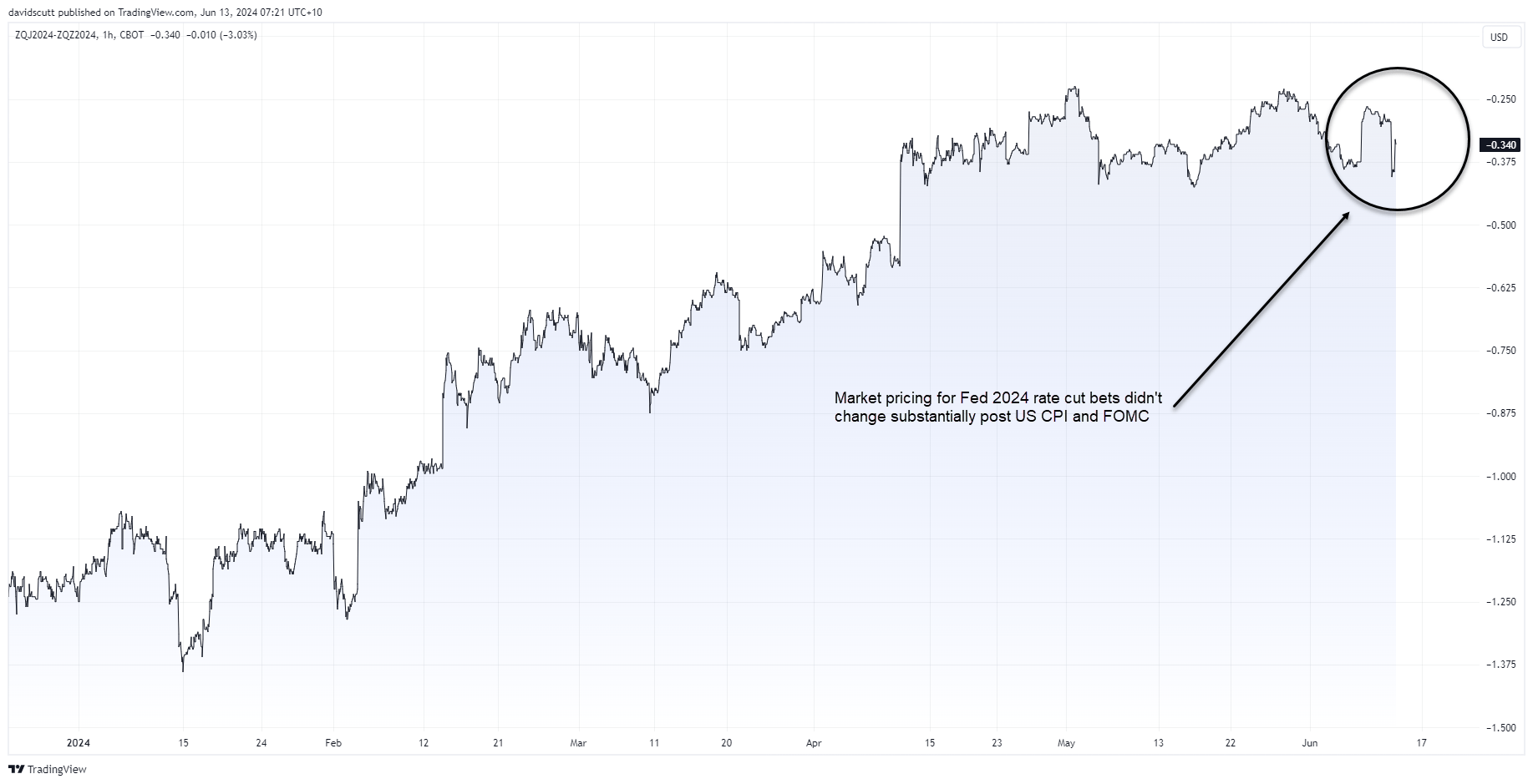

Markets eye one or two Fed rate cuts in 2024

With the Fed funds futures curve indicating market expectations for rate cuts continue to oscillate between one and two this year, it goes someway to explaining the relative stability in USD/JPY since the BOJ intervention episodes around the start of May.

That suggests that unless we see a big increase in Fed rate cut bets, or an unlikely shift towards pricing the risk of renewed hikes, USD/JPY is likely to remain relatively stable in the near-term. That’s important when evaluating trades involving Japanese yen crosses.

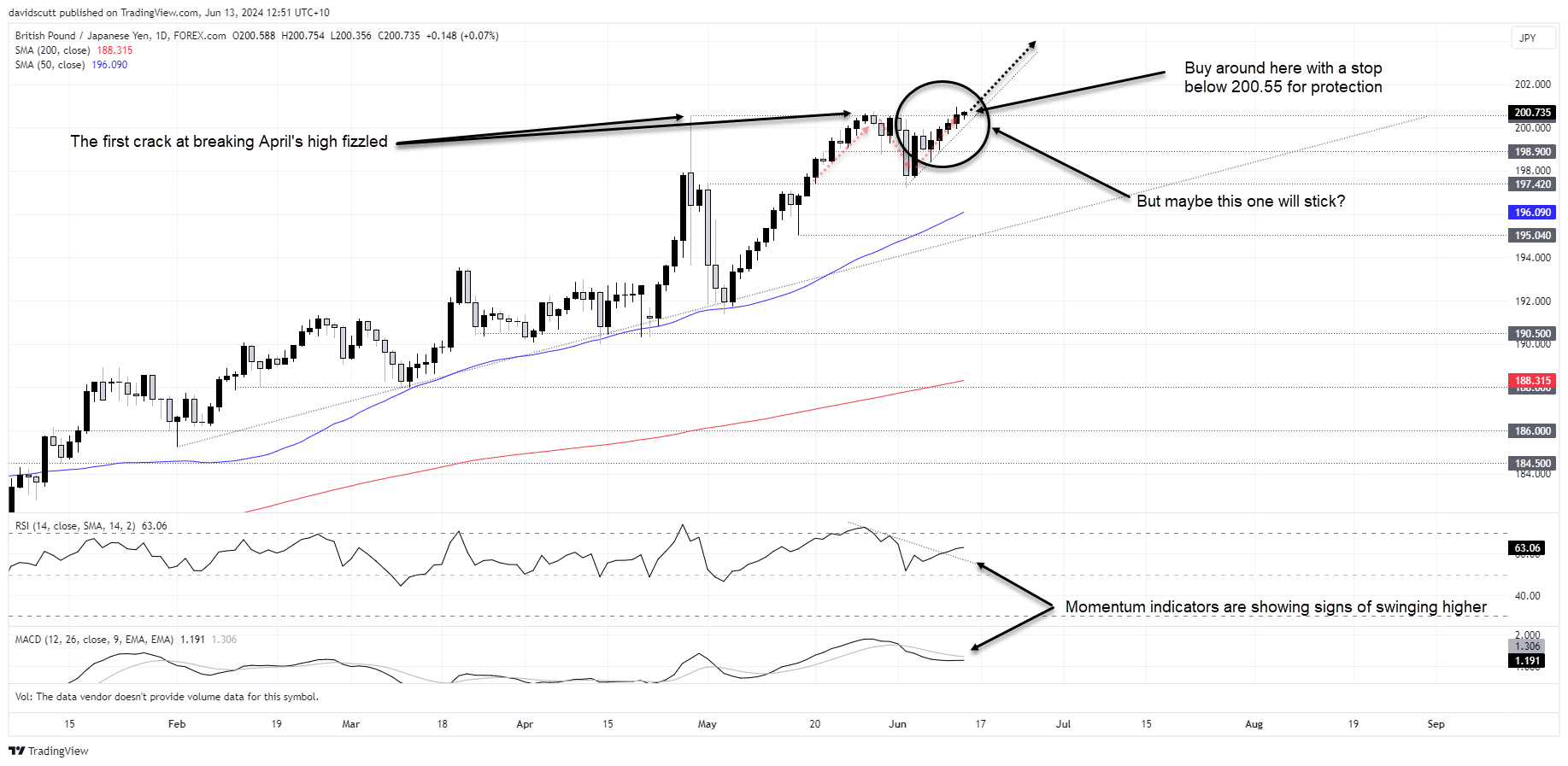

GBP/JPY contemplates bullish breakout

As mentioned in last week’s outlook, GBP/USD has been heavily influenced by risk appetite recently, often moving in the same direction as bitcoin, Nasdaq futures and even Nvidia’s share price over the past month. As such, it came as no surprise to see cable pop higher following the US inflation report and Fed meeting, mirroring the performance of other risk assets.

With USD/JPY finishing the session near where it started, GBP/JPY staged a bullish breakout, pushing above former horizontal resistance at 200.55. Having closed above this level, the retest and bounce off it on Thursday suggests it may now act as technical support.

With momentum indicators showing signs of turning higher (with the caveat that we’re looking at divergence between RSI and price which is one warning signal), buying around these levels with a stop below 200.55 screens as a decent setup, especially when you zoom out and see the break is from a far larger triangle pattern over a longer timeframe. This points to the potential for meaningful upside ahead.

The first hurdle arrives as 200.91, the high struck on Wednesday. Above that, there’s not of visible resistance until above 215.90, the peak seen in July 2008.

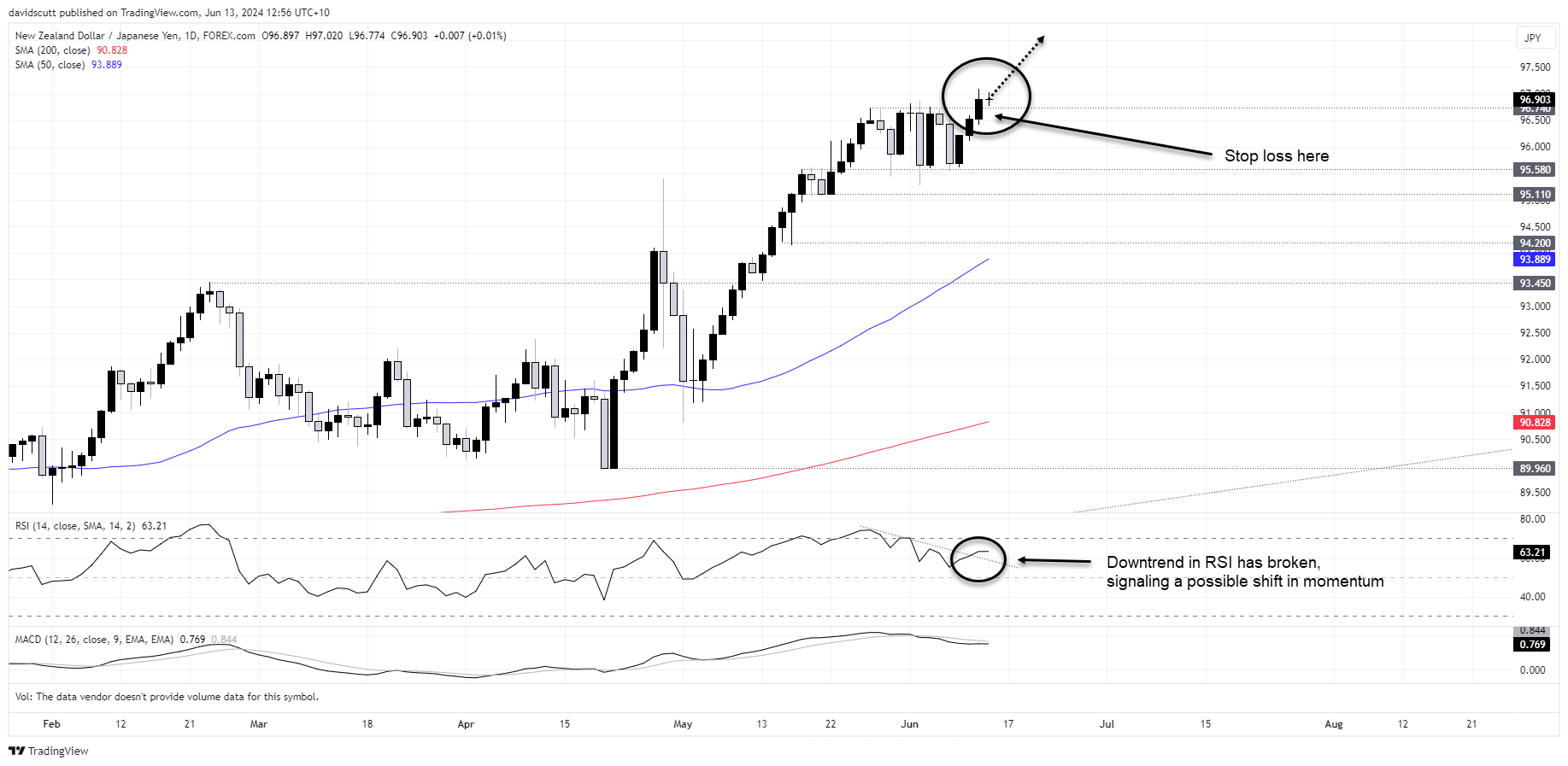

NZD/JPY hits fresh highs

The setup in GBP/JPY is not dissimilar to that in NZD/JPY which also broke to fresh highs on Wednesday before pulling back to test former horizontal resistance. While it too has divergence between RSI and price, creating some caution towards the break, the counterargument is RSI has broken its downtrend, pointing to a possible shift in momentum.

Those keen to take on the long trade could buy around these levels with a stop below 96.74 for protection. The initial target would be 97.80, the peak hit in July 2007.

-- Written by David Scutt

Follow David on Twitter @scutty