- Chinese iron ore port inventories sit well above seasonal norms

- Record iron ore shipments were sent from Brazil and Australia in April

- Buying dips in iron ore futures is preferred near-term

Despite bourgeoning Chinese port inventories, widespread loss making at steel mills and no guarantee that measures to stablise China’s property sector will boost construction activity, there’s seemingly no shortage of willing buyers of iron ore out there right now.

China stockpiling iron ore aggressively

I was taken aback when I saw this chart posted on X showing Chinese iron ore port inventories were not only being replenished rapidly but that they now sit at elevated levels relative to seasonal norms. While the initial statement may explain the constant bid in iron ore prices seen this year, the latter raises concerns over just how long it will last.

Source; X, Westpac Bank

As the creator of the chart, Westpac's Head of Commodity and Carbon Strategy Robert Rennie noted, iron ore supply from top exporters Australia and Brazil surged to unprecedented levels last month.

“Brazilian iron ore supply in April was a record 30 million tonnes while shipments from Port Hedland neared 50 million tonnes, also an all-time high for the month,” he wrote on X. “That is adding to a surge in iron ore port inventory in China at a time when it would ‘normally’ be falling sharply.”

However, mirroring what’s been seen in other industrial metals this year, such as copper, Chinese demand remains robust, seeing stockpiles swell to unusually high levels.

Dips being bought in iron ore futures

The inventory build is reflected in the price action seen in SGX iron ore futures this year, with a brief foray below the $100 per tonne level scooped up faster than a heavy earth mover in Australia’s Pilbara region, resulting in big price surge to levels where it trades today.

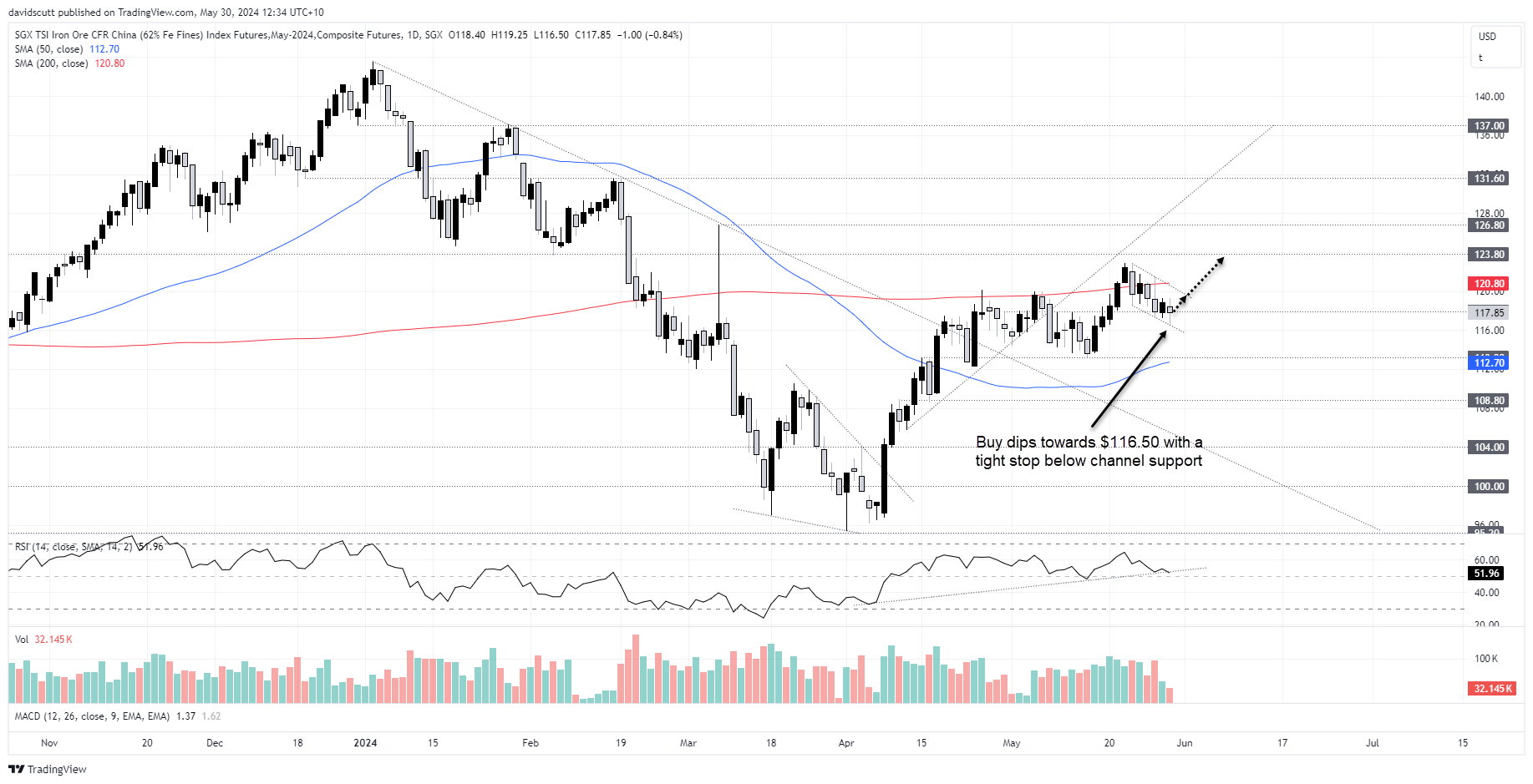

Looking at the daily chart of SGX iron ore futures, one thing that is obvious is that it often respects technical levels, providing a great market to trade given its volatile nature.

Right now, dips below $117.90 are being bought. The price is also in a possible a bullish flag, pointing to the potential of a topside break down the track. With RSI resting on trend support and weak volumes accompany the pullback, I’m inclined to buy dips rather than sell rallies.

Those keen to take on a long trade could look to enter towards Wednesday’s low with a tight stop below it for protection. The 200-day moving average would be the initial trade target, coinciding with channel resistance. Should that break, topside levels to watch include $122.90, $123.80 and $126.80.

-- Written by David Scutt

Follow David on Twitter @scutty