- China’s May “data dump” was unambiguously weak

- Property starts and sales slump over 20% in early 2024 relative to a year earlier

- Output in downstream industrial products is holding up in selective areas

- Iron ore and copper futures remain pressured

Mixed messaging on China commodity demand

Chinese property prices are tumbling nearly as fast as construction activity, amplifying downside risks for industrial metals such as iron ore and copper given bloated inventories and knowledge China’s property sector is the largest source of demand globally. Yet, despite acute weakness, fresh data on industrial activity suggests China is ramping up production of downstream refined products, creating doubt over whether the downside risk will materialise.

Given significant uncertainty on the demand outlook, it may be preferable to let the price action tell us what to do rather than pre-empt on fundamental grounds.

Chinese industrial activity softens

China’s “data dump” for May was unambiguously weak with industrial output and urban fixed asset investment undershooting already subdued market expectations.

Industrial output grew 5.6% over the year, down from 6.7% in April and below the 6% pace expected. Fixed asset investment, tracking physical structures designed to last two years or more, rose 4% between January and May relative to the same period in 2023, down on the 4.2% pace in the first four months of the year.

Property sector downturn worsens

Contributing to weakness in those measures, property sector activity continued to tumble with sales and starts sliding 20.3% and 24.2% respectively between January to May relative to a year earlier. Broader investment declined 10.1% over the same period, an acceleration on the 9.8% drop in the first four months of the year.

Separately, Chinese new home prices fell 0.7% in May, according to Reuters calculations, extending the decline over the past year to 3.9%. The monthly drop was the fastest since October 2014 and eleventh in succession.

The data weakness weighed uniformly on industrial metals prices on Monday. However, looking at trends in industrial output, it suggests there may be grounds for caution.

Curiously, crude steel output rose 8.1% to 92.86 million metric tonnes, up 2.7% on May 2023 and the highest total since March 2023. A pickup in steel exports and improved demand from infrastructure investment may have contributed to the result.

Year to date, steel production stood at 438.61 million tonnes, down 1.4% on the same period in 2023.

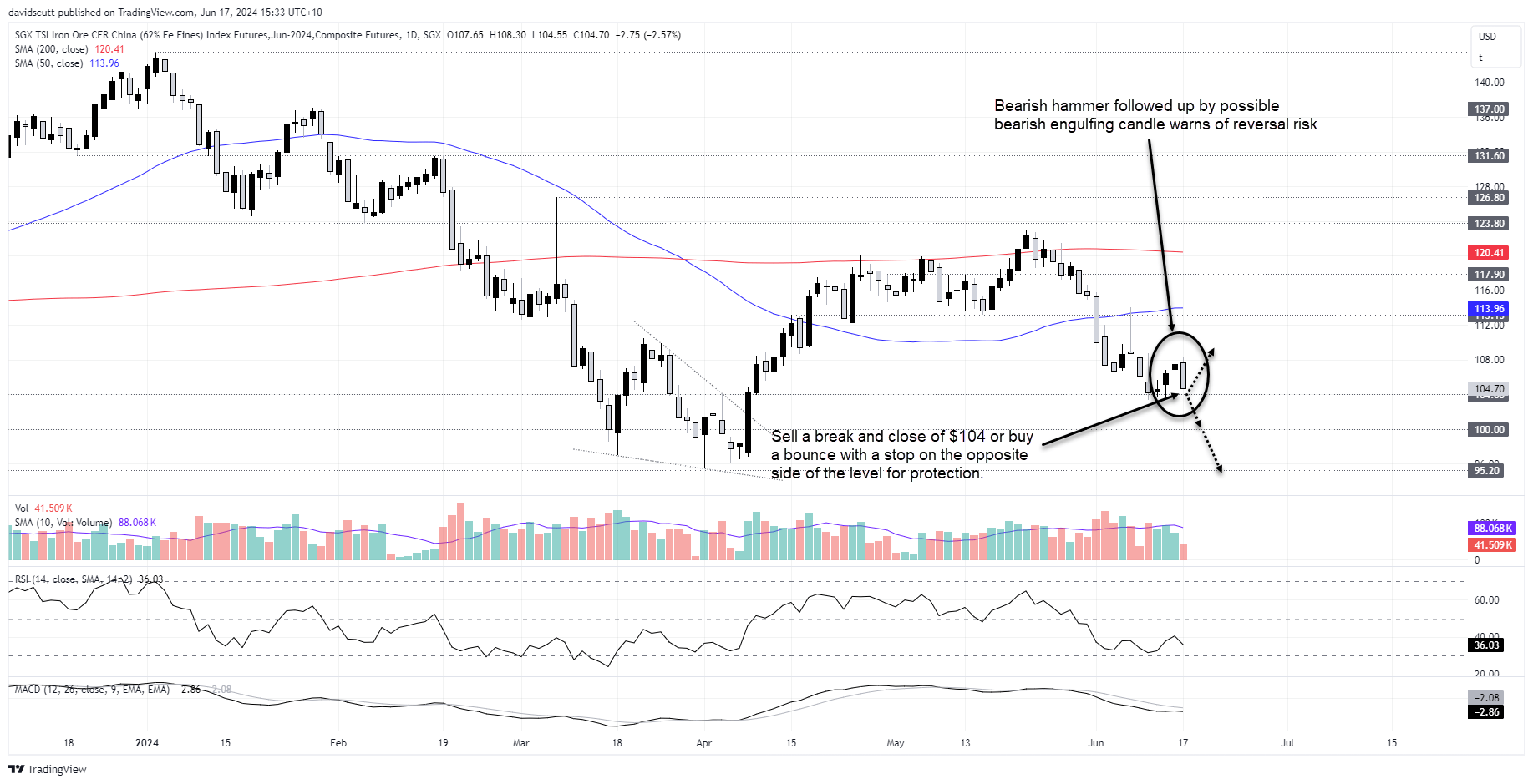

SGX iron ore facing bearish reversal?

While there’s time left in the trading session, the possible bearish engulfing candle on SGX iron ore futures looks ominous on the daily, suggesting buyers parked below $104 last week may have more offers to absorb soon.

Should futures break and close below $104, it would increase the risk of the downside flush extending below $100 with the April low of $95.40 potentially in play. Traders could sell the break with a stop above $104 for protection, should the price move in that direction.

If $104 were to hold, traders could buy the dip with a stop loss below $103.50 for protection. The initial target would be $108 where the price stalled on several occasions earlier this month. With momentum indicators and fundamentals looking bearish, this trade screens as a low probability play

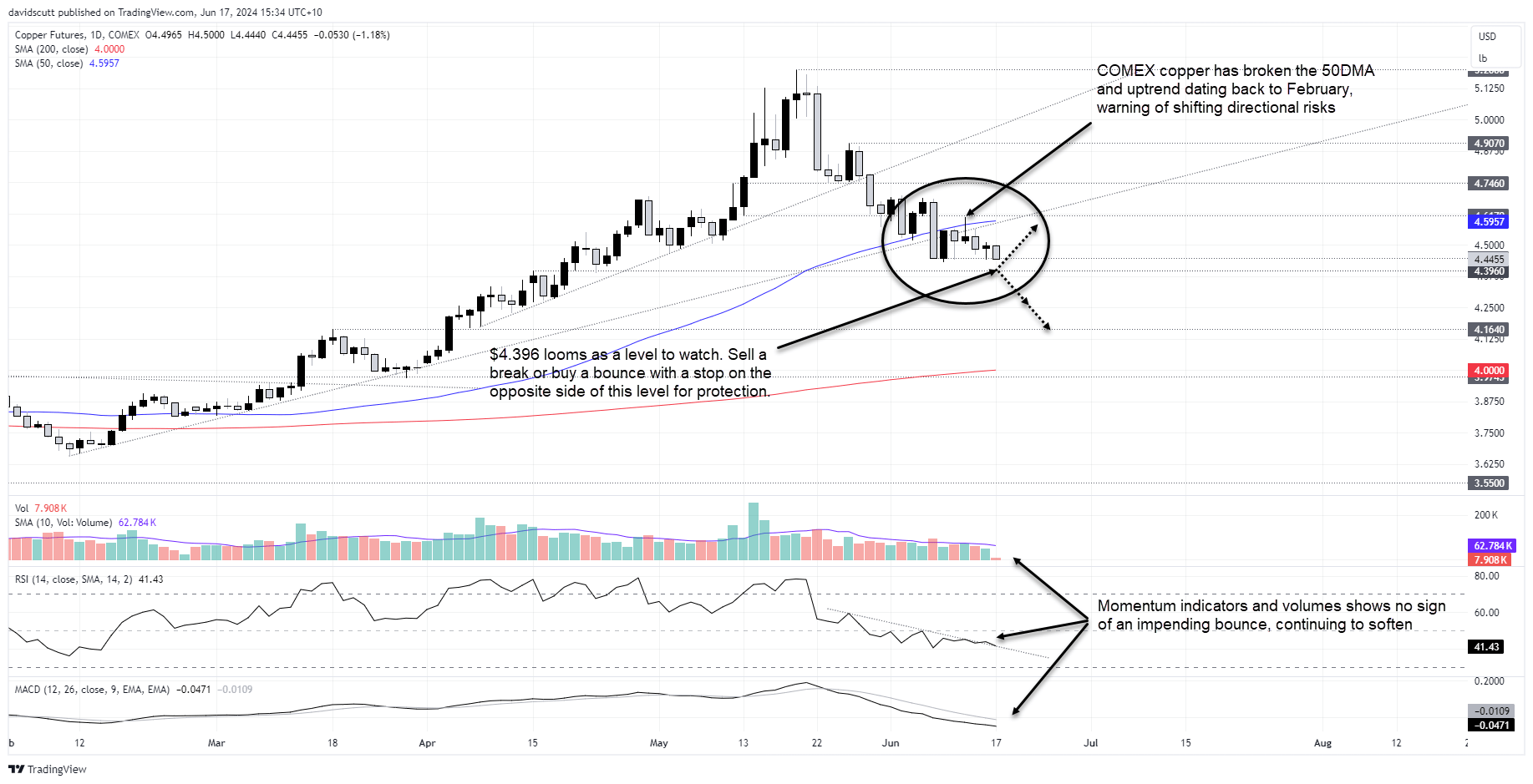

COMEX copper teetering

Copper is another contract that finds itself in an interesting level, perched on support at $4.447, continuing the pattern since June 7. While iron ore hardly screams buy right now, it does look healthier than copper which has broken its uptrend running from February and 50-day moving average, two important levels that warn of a shifting directional risks.

If $4.447 were to give way, wait to see how the price interacts with $4.396, a level that acted as support and resistance earlier this year. If that too were to buckle, traders could sell the break targeting $4.25 or even $4.164. As stop above $4.447 would offer protection.

If the price were to bounce from $4.447, you could buy targeting the 50-day moving average with a tight stop below for protection. This screens as a lower probability play given bearish momentum.

-- Written by David Scutt

Follow David on Twitter @scutty