What is market sentiment?

Market sentiment refers to the general attitude of traders in a specific market. A measure of market sentiment reflects the collective opinions, beliefs, and emotions of traders. It may also be referred to as trader sentiment or just sentiment. As you can imagine, this can be quite subjective, but there are multiple methods that market participants will use in attempt to make this a more objective variable.

When a majority of traders have open long positions, the market is described as a bull market and trader sentiment is positive. A market is said to have negative sentiment when it is in a bearish trend, meaning most of the open orders are sell orders. This idea of long being positive and short being negative comes from stock trading, where long and short positions correlate with share prices.

How to measure stock market sentiment

There are several ways to measure market sentiment, from manually reviewing comments online made by traders to using traditional indicators that gauge bearish and bullish positions. In this section, we’ll briefly review some of the most popular methods.

Social media and market coverage

Monitoring social media posts by analysts and traders can give you a broad understanding of how participants view a particular market. However, it's important to recognize that this approach can be anecdotal and may not always provide a comprehensive view of sentiment.

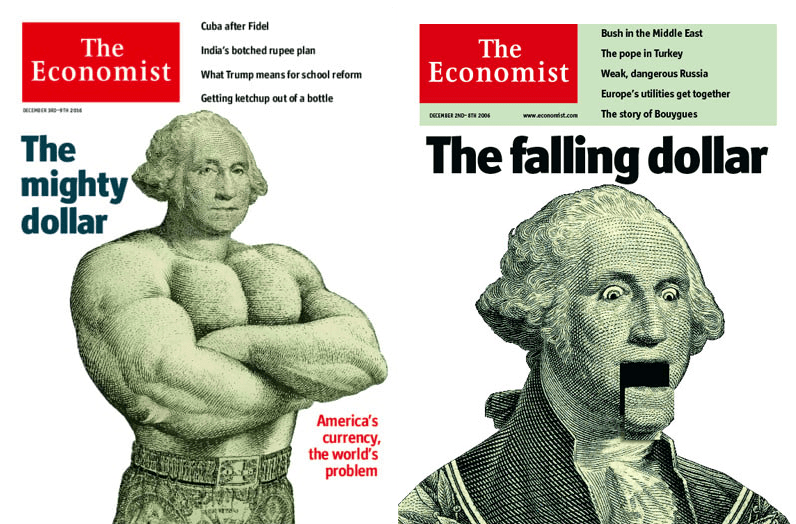

Market headlines can also be a good indicator of market sentiment. Article titles may either be bleak or uplifting, indicating current extremes on sentiment that occur during market tops and bottoms. It's essential to consider this information as part of a broader analysis.

*Dual coverage of USD sentiment from The Economist

There are also summaries of exchanged-based sentiment, such as the Commitment of Traders (COT) report, which is published weekly with data on positions held in numerous markets including options and futures markets. While informative, traders should be aware that these reports may have reporting lags and may not capture the full spectrum of sentiment.

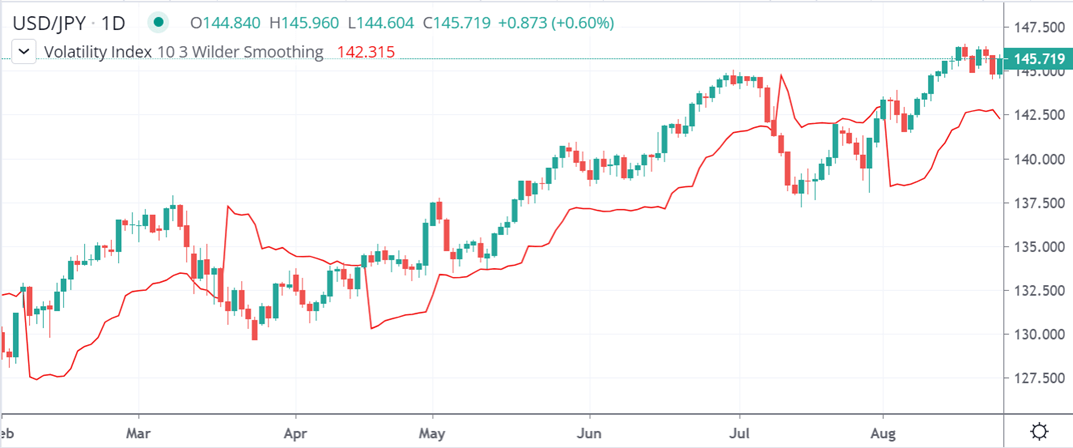

The VIX

The CBOE Volatility Index (VIX) is one of the most popular sentiment indicators. It measures 30-day options prices on the S&P 500 and is often used to track levels of ‘fear’ and ‘greed’ based on whether options prices are lower or higher than current stock market values. For this reason, it’s sometimes referred to as the fear index. While useful, traders should remember that it primarily reflects sentiment in the options market but it can be applied to other markets like currency pairs, as shown in the example below.

*Source: City Index. Past performance is not indicative of future results

Technical indicators

Technical indicators such as the bullish percent index (BPI) or 52-week highs and lows index can also be used to gauge market sentiment. Like the VIX, these are mainly applied to the broader stock market to determine bearish or bullish sentiment. Their relevance in forex trading may vary, and traders should exercise caution when interpreting their signals.

How to measure market sentiment in forex

Measuring market sentiment in forex is more difficult than for stocks and indexes because the FOREX market is over the counter and there’s not a centralized exchange a single source that tallies overall long and short positions. Consequently, traders have developed various methods to gauge sentiment, each with its advantages and limitations. While some of the technical indicators have been translated from the stock market to forex in an attempt of reading sentiment, other, newer tools may do a better job of judging market sentiment.

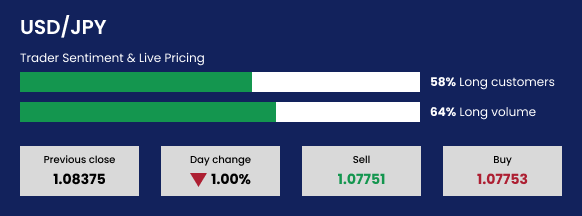

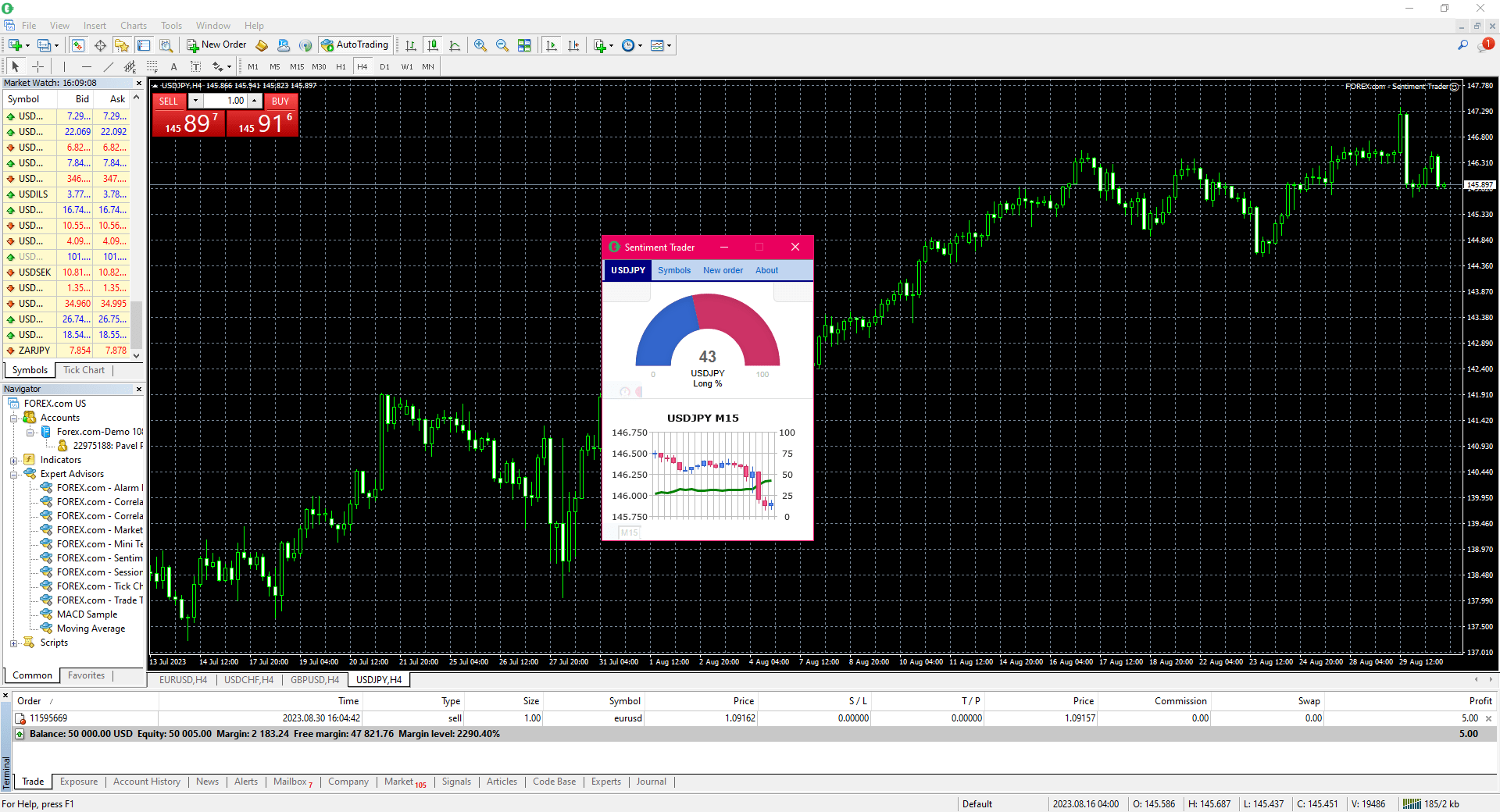

For example, the Sentiment Trader is an Expert Advisor (EA) tool available exclusively on MetaTrader charts that provides ratios of sentiment by both trader position and order volume. Learn more about the Sentiment Trader or keep reading to see it in action with a forex trading example.

The Sentiment Trader displays a ratio of long and short orders for selected currency pairs along with other general information such as the previous day’s close and the current bid-ask spread. An example of the widget shown below displays both the percentage of long traders (customers) and the percentage of long trades. But the key for reading sentiment is that this indicator shows the ratio of long positions to short positions based on actual trades placed in a live market environment, so it is a direct read on retail sentiment as derived from the data at the time.

Please note that using sentiment data from a single broker or source means that you are working with a limited dataset. This data may not represent the broader market sentiment accurately, as it only reflects the sentiment of traders associated with that specific broker.

For example, data used by the Sentiment Analysis tool is provided by FXBlue, which is integrated into Meta Trader and other popular trading platforms. So, while the tool captures a large percentage of forex trades, it does not represent the entire market. Forex markets are vast and diverse, with participants from around the world, and a single source may not capture the sentiments of all market participants.

How to trade forex on market sentiment

Strong sentiment in either a long or short direction is generally seen as imbalance, and this can often be reads as a signal to trade in the opposite direction. That’s because sentiment trading reflects what a majority of retail traders are doing. If 80 or 90% of a market is already long, at some point in the future those traders will need to close their positions, which can mean more supply in the market as longs close.

This can also mean there is less money on the sideline that can come into buy which would push the price higher. Even a strong trend may face turbulence if the majority of the market is already long, and the reason is imbalance in sentiment.

When there is a large imbalance in trader positioning, market makers are often aware of that dynamic and this can provide a hindrance to the continuation of trends if a market is overweight on either the long or short side. This is also why sentiment is often looked at as a contrarian indicator in which traders will often look to go in the opposite direction of large imbalances.

Gain insight to market sentiment on MetaTrader with FOREX.com

To access the market sentiment tool, you need to first log in to MetaTrader using your FOREX.com account. Then, look for the Sentiment Trader tool among the Expert Advisors.

Once you’re online, you can use market sentiment to trade forex in these quick steps:

- Choose the market you want to trade

- Activate the Sentiment Trader tool among MetaTrader’s Expert Advisors

- Identify if there is an overarching trend by comparing the price action to market sentiment, then confirm trends with additional technical analysis

- Execute your trading strategy according to the trend

Market sentiment trading example

The Sentiment Trader tool is most useful in markets where strong long or short positioning is displayed, like GBP/JPY (short) and USD/CAD (long) in the module screenshot above. If 60% of customers are long in a market, that means 3 out of every 5 retail traders holding positions at that time are long, and this would suggest an imbalance on the long side of the pair.

Taking a contrarian look at that scenario would denote a bearish opinion, driven by the imbalance between longs and shorts. If the trader can then identify a down-trend in that market, the imbalance of long positioning could be alerting to a possible trend scenario that they can incorporate into their approach.

Of course, you should use additional indicators and market analysis to finalize entry and exit points for your trade, also setting stop-loss orders so you don’t become stuck in the majority with a losing position.

Market sentiment is a crucial element of forex trading, impacting price movements and trading decisions. While various tools and methods are available to gauge sentiment, traders should be aware of their advantages and limitations. A balanced approach that combines sentiment analysis with other forms of analysis and robust risk management is key to successful forex trading.