Overbought stock meaning

An overbought stock is one that is trading at a price above its intrinsic value. When a stock is overbought, it’s usually expected that the market will correct itself and move to a lower level. The opposite of being overbought is oversold. This is when a stock is trading below its true value and is predicted to rise.

An asset’s price rises when the demand to buy a stock outweighs the supply of shares available. But eventually, the price will reach a level that buyers are unwilling to support. At this point, they’ll start closing their positions to take their profit, and sellers will start to outnumber buyers.

Whether or not a stock is overbought is always a slightly controversial discussion, as different traders and investors will have different views on the true value of a stock. This is especially true when you consider the different forms of analysis that can be used to create estimates of a stock’s value.

Technically overbought meaning

Those who use technical analysis will consider a stock overbought when it reaches a level on a technical indicator. A stock that is technically overbought is only based on price action and historical data, rather than any fundamental factors.

Fundamentally overbought meaning

Fundamental analysis considers a stock overbought when its market price is significantly higher than its price would be if it was based on financial statements alone. Overbought conditions are usually the result of increased speculation around a company’s share price, above and beyond what is rational at that given time.

For example, we look at a stock like Tesla, which didn’t turn a profit until 2020 but managed to generate a staggering share price growth of over 15,000% in the ten years since its IPO in 2010. Tesla’s share price was often regarded as overbought, as there was little fundamental basis for its huge rise. But for many investors, the stock wasn’t overbought as the company’s future outlook far exceeded its current profitability and so it was still worth buying.

How to tell if a stock is overbought

There are a variety of ways to tell if a stock is overbought, and your choice will ultimately depend on whether you’re using technical or fundamental analysis. Here are a few of the most popular ways to find overbought stocks:

- Bollinger Bands

- The relative strength index (RSI)

- The stochastic oscillator

- The price-to-earnings (P/E) ratio

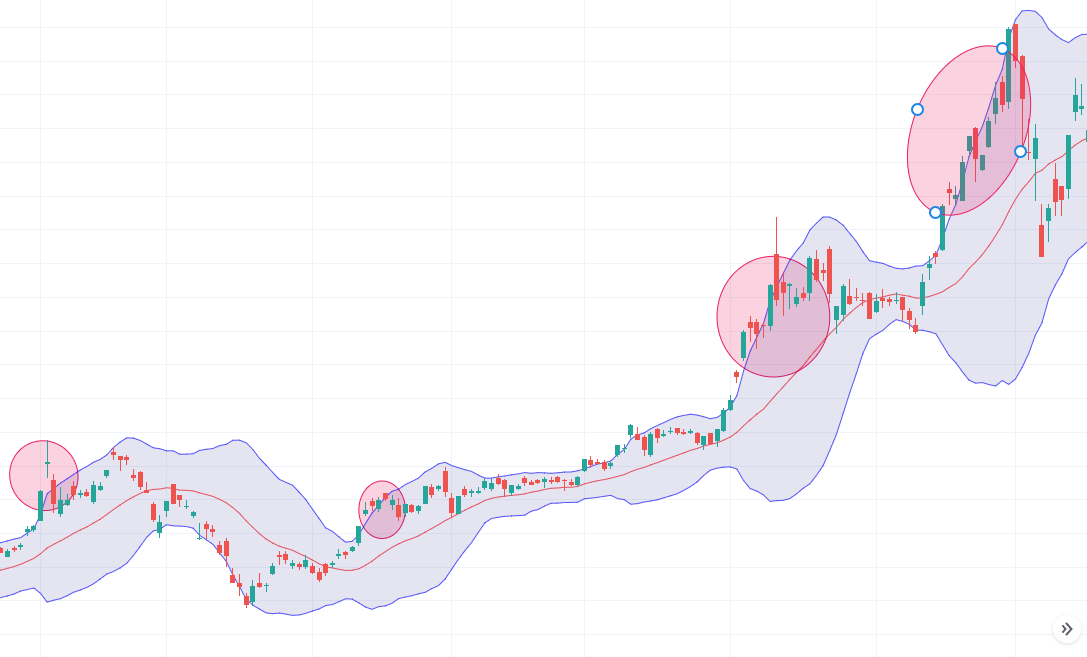

Finding overbought stocks with Bollinger Bands

Bollinger Bands are a technical indicator that are used to find entry and exit points for a trade, as well as determine whether or not a market is overbought or oversold.

Bollinger Bands consist of three lines:

- The middle band, which is a simple 20-day moving average

- The upper band, which is the middle band plus 2 x the daily standard deviation

- The lower band, which is the middle band minus 2 x the daily standard deviation

When the price of a stock rises above the upper band, the market is thought to be overbought and could be due a pullback – and if the lower band is hit, it would be oversold. However, it’s always important to take note of the overall trend when you’re using Bollinger Bands, as the indicator can present overbought (or oversold) signals regularly that may not result in a complete reversal.

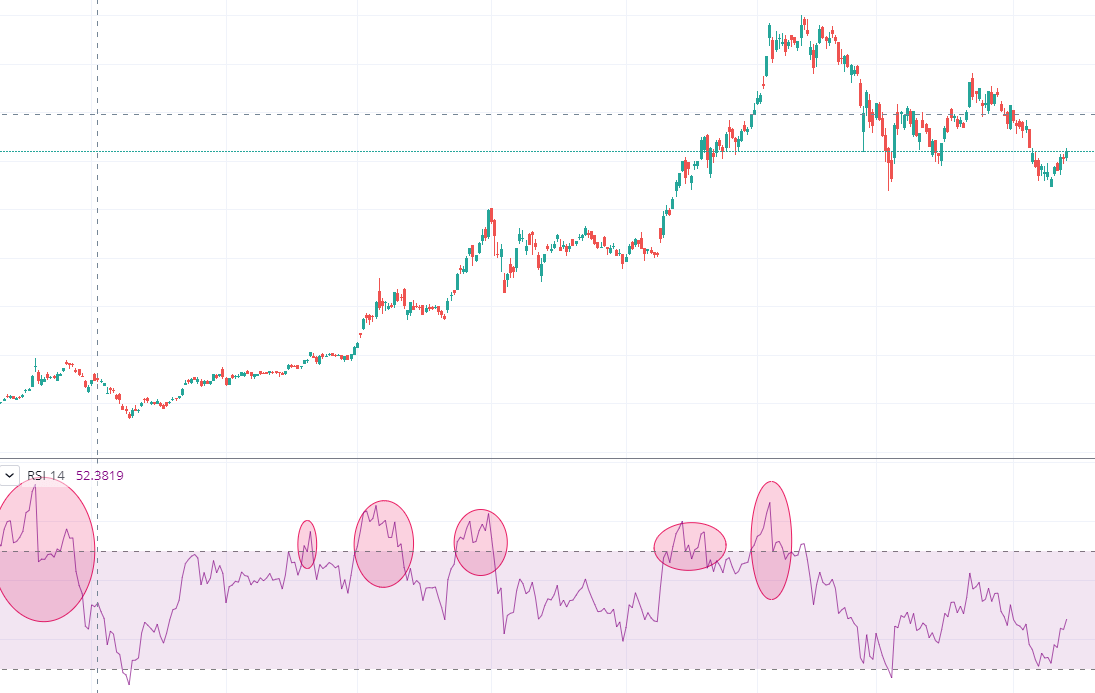

Finding overbought stocks with the RSI

The relative strength index (RSI) is a technical indicator that measures the strength of a price movement over a 14-day period – the indicator can be used over different timeframes too, but 14 days is the most common.

The RSI is an oscillator that moves between 0 and 100 on a graph, with readings shown as percentages. When the RSI gives out a reading of 70 or above, the market is considered overbought. But when the indicator shows 30 or below, the stock is undersold.

The RSI can remain in overbought territory for significant periods of time, so its important to look for reversal signals and confirm the movement with other indicators – such as Bollinger Bands.

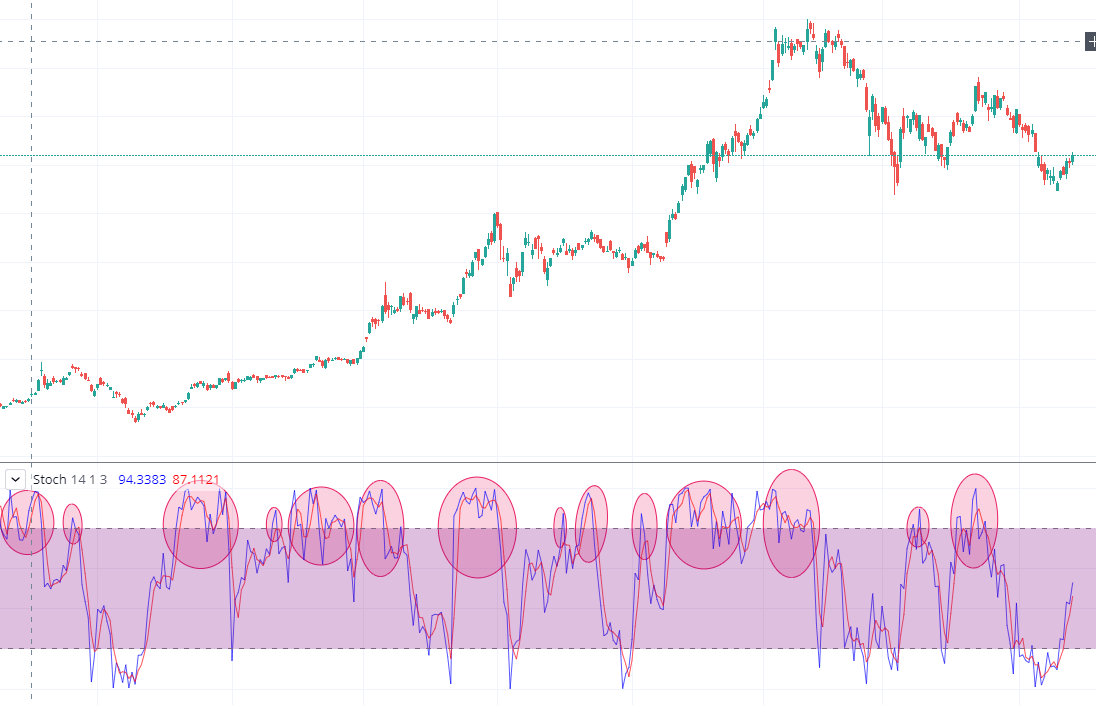

Finding overbought stocks with the stochastic oscillator

The stochastic oscillator measures the momentum of a trend by comparing the most recent closing price of a stock to its prices over a certain timeframe. Just like the RSI, it’s presented on a range between 0 to 100 but readings over 80 are considered overbought and under 20 are considered oversold. You’ll see two lines on the stochastic: one that is the oscillator’s current value, and another that is its three-day moving average. When the two lines meet is the signal for a reversal.

Not only is the stochastic oscillator itself taken as an important indicator of impending price changes, but so is a divergence between the oscillator and the price action. For example, when a rising market is making new higher highs, but the stochastic oscillator hits a lower high, it may be an indicator that the bullish momentum is slowing, and the market correction is getting ready.

Finding overbought stocks with the price to earnings (P/E) ratio

The P/E ratio is a company’s current share price relative to its earnings per share (EPS). It’s used to identify the most accurate price for a share by comparing it to historical values and industry benchmarks, such as a stock index.

If a company’s P/E ratio rises above the average of its sector or a relevant index, investors may see it as overvalued and question whether it’s safe to buy.

You can find a company’s P/E ratio in its earnings report. Find out how to read a company earnings.

To calculate a company’s P/E ratio, you simply divide the current market price of its shares by its most recent EPS. A high P/E ratio would indicate a company’s stock is overvalued, and a low P/E ratio would indicate it’s oversold.

Say Company ABC – a tech company – had recently released earnings, showing it had made a profit of $1 billion for the year. As the company has 5 billion shares outstanding, this gives it an earnings per share of $0.2.

The shares are currently trading at $10, so we’d calculate its P/E ratio as follows: $10/$0.2 = 50x

However, when we compare it to the average P/E ratio for a Nasdaq 100 company is 28x, we can see that shares of ABC are trading at a premium and could be considered overbought.

It is important to note that the P/E ratio just reflects what investors are willing to pay, and not the reasons behind that decision. So, while there may be little profit currently to split between each shareholder, the company could be about to enter a period of growth which is why there’s so much optimism.

Is it good to buy overbought stocks?

Buying overbought stocks does come with its danger, as any share in that territory can spook investors and cause a sell-off. But some shares that enter overbought conditions can remain in them for years, so its not necessarily a hard and fast rule.

You can also short overbought stocks via CFDs, which would enable you to take advantage of an impending downturn. Learn how to short stocks.

How to buy stocks with FOREX.com

Go long or short on stocks with FOREX.com in these easy steps:

- Open a FOREX.com account, or log in if you’re already a customer

- Search for the company you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade