Another week, another record high for gold. And another start to the week where I am asking myself “when is this rally going to top?”. As you can see, bears keep getting slaughtered, despite traditional COT metrics pointed to an overbought market.

Gross and net-long exposure among large speculators sit just off their highest level since the Pandemic, which could point towards a sentiment extreme. Longs outnumber shorts by a ratio of 5:1, although there is little short interest from large speculators overall.

However, total open interest is about half it was around the time of the pandemic, which could suggest plenty of investors remained sidelined and are looking for pullbacks over chasing prices higher. The recent rise of total open interest has helped pull speculative open interest (adjusted for total open interest) back from record highs. Longs outnumber shorts with a ratio of 5:1, although shorts remain low and not high by historical standards.

Therefore, I suspect that bulls remain lurking on the sidelines despite the relatively high level of gross-long exposure. And that dips on gold are more likely to be brought than not. They just need to see a dip first.

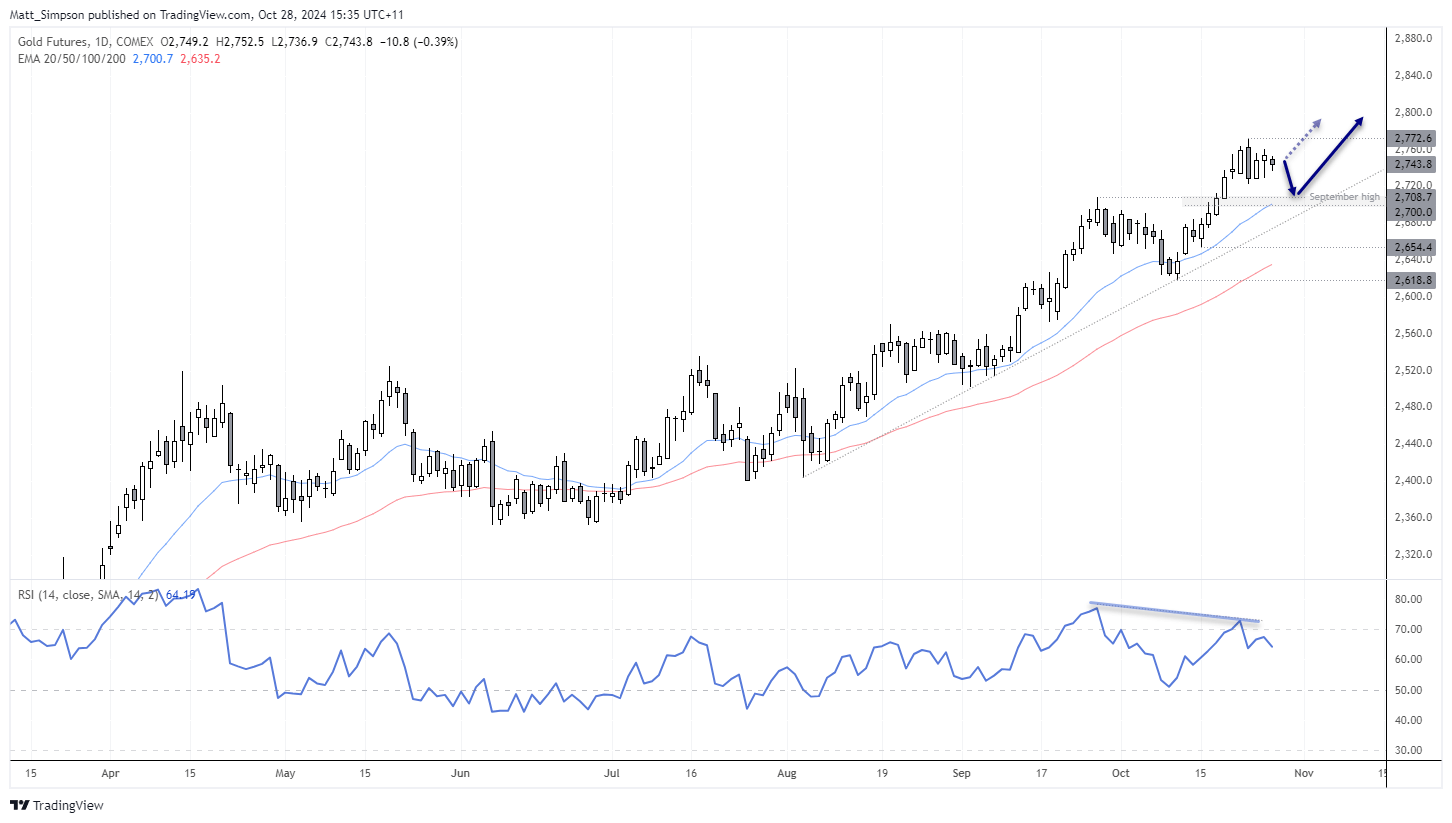

Gold futures technical analysis:

The daily chart remains in a clear bullish trend, although recent price action shows a hesitancy to simply break to a new high. The daily RSI (14) has formed a bearish divergence, ands Friday’s hanging man candle has helped form a lower high from gold’s all-time high (ATH). Perhaps some mean reversion towards the 20-day EMA could be due, near the September high and 2700 handle.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge