How CPI impacts forex trading

There are a huge range of tools to help forex traders make sense of markets, from technical indicators to economic yardsticks. The Consumer Price Index, or CPI, is one such measure. Read on for more on what the CPI is and how forex traders can use it.

What is the CPI?

The CPI, or Consumer Price Index, is an economic indicator that tracks the cost of goods and services, and serves as an important statistic for identifying inflation or deflation. Known also as ‘headline inflation’, it is a major influencer of interest rate changes based on the inflation targets set by central banks.

The CPI is important because it helps central banks to maintain price stability, keeping a steady rate of inflation over time.

The CPI figure is calculated by weighting the average price of a basket of products across goods and services such as groceries, transport costs and healthcare, and measuring their change in price over time. When the amount of the currency needed to buy the market basket increases, this is inflation, and when the amount of currency needed to buy the market basket decreases, this constitutes deflation.

The ‘core CPI’ figure is slightly different as while it still measures the change in price of goods and services, it does not include energy and food prices. These are omitted for this measure as such prices have the tendency to be highly volatile and therefore capable of creating a misleading impression of inflationary pressures.

Why follow the CPI?

Following the CPI releases can be useful for forex traders as its influence on interest rates has a knock-on effect on currency strength. CPI data can also be interpreted as a way of assessing the efficacy of a government’s economic policy.

The CPI need not be examined in isolation. It can also be used alongside other indicators, such as the Producer Price Index and the GDP Price Deflator, for a bigger picture on the state of inflation.

When is CPI released?

The CPI is released monthly by the US Bureau of Labor Statistics, and has been reported since 1913. However, in countries such as Australia, the data is released on a quarterly basis, and in Germany, an annual report is issued.

How does CPI affect forex?

CPI is a broad measure of inflation, so when the CPI changes, central bank monetary policy may follow suit. Higher inflation in the form of a higher CPI naturally makes an individual unit of currency worth less, as there are more units of that currency needed to buy a given item.

However, it may inspire interest rate hikes by a central bank in an attempt to control the inflationary trend. When a country’s interest rates are higher, it is likely that its currency will strengthen as demand for it increases. Conversely, lower inflation may lead to lower interest rates and weaker demand for a country’s currency, prompting consumers to spend, put more money into circulation, and overall stimulate a slower economy.

So given this information, it’s no surprise that when CPI date is released, forex swings can happen in kind. Sometimes, it can create volatile conditions with extreme pip movement, creating potential for large profits – as well as proportionate risks.

CPI trading strategy

A CPI trading strategy for forex traders should centre around being aware of the expectations the market holds for inflation and the likely outcomes for the currency if these expectations are met or missed. Sometimes an environment for increased inflation will be welcomed (EG, in a deflationary landscape such as Japan) while in more inflationary conditions (such as Brazil) an increased rate of inflation may be considered bad for the economy.

Analysts’ expectations for inflation are released on a monthly basis, with their judgments based on supply and demand dynamics, currency prices, and key commodity prices, as well as fiscal and structural measures.

After the CPI release and surrounding analysis, traders can bring in technical analysis to their approach, by examining if price is reacting to key support and resistance levels defined by indicators such as Fibonacci retracements or moving averages. These indicators may help to give some insight into the short-term strength of the move, for more informed trading decisions.

However, as with other news releases, timing is everything. It may, therefore, be unwise to open a position shortly before an announcement, as forex spreads may widen substantially immediately before and after the report.

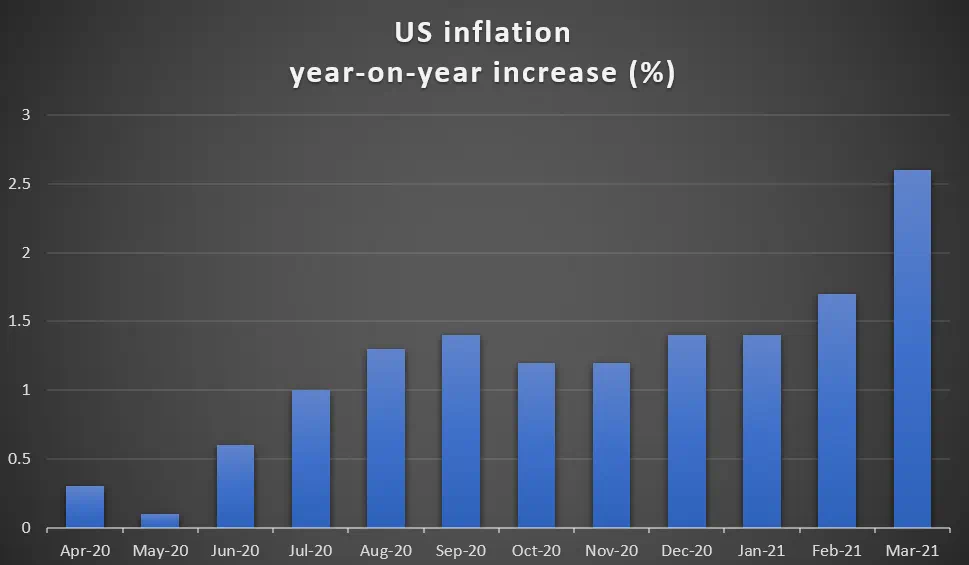

In the below chart US inflation statistics are shown as a percentage of change since the same point 12 months ago. So for the latest March figure, consumer prices were 2.6% higher than at the same point the previous year. Source: Tradingeconomics.com/US Bureau of Labor Statistics.

The US Dollar Index (USDX), which shows the performance of USD against a basket of other currencies, can be a useful way of exploring the effects of CPI data. If the latest release is divorced from analysts’ expectations, traders may watch for USDX to move accordingly.

On the latest March CPI figures released in April, USD briefly spiked as the mark was slightly above analyst expectations. However, as it became clearer that interest rate hikes were likely off the agenda for 2021, the USDX fell, a slump aided by languishing US treasury yields.

CPI takeaways for forex traders

- CPI is a major indicator used for determining rate of inflation

- The measure helps central banks to maintain price stability

- Significant forex swings can occur when releases don’t align with analysts’ expectations

- Time your entries carefully so as not to get caught by widening spreads

- Consider using other economic indicators in conjunction

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.

Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

The products and services available to you at FOREX.com will depend on your location and on which of its regulated entities holds your account.

FOREX.com is a trading name of GAIN Global Markets Inc. which is authorized and regulated by the Cayman Islands Monetary Authority under the Securities Investment Business Law of the Cayman Islands (as revised) with License number 25033.

FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET.

GAIN Global Markets Inc. has its principal place of business at 30 Independence Blvd, Suite 300 (3rd floor), Warren, NJ 07059, USA., and is a wholly-owned subsidiary of StoneX Group Inc.

© FOREX.COM 2024