Multiple drivers weigh on equity sentiment across the Asian region

Over the past 48 hours several driving forces have weighed on Asian equities. Reports that tensions between the US and China had resurfaced following a vote in Washington resulted in the effective ban on China Telecom Corp from operating in the US. The South China Moring Post also fanned fears that Chinese companies may be delisted from US exchanges within a year to further fan fears of a fallout.

Furthermore, China’s reform commission (NDRC) told some property firms to “optimise” offshore debt structures as Beijing moves to minimise damage from the Evergrande default. And Chinese property developer Modern Land become the latest company to default on a bond payment, weighing broadly on property shares across China.

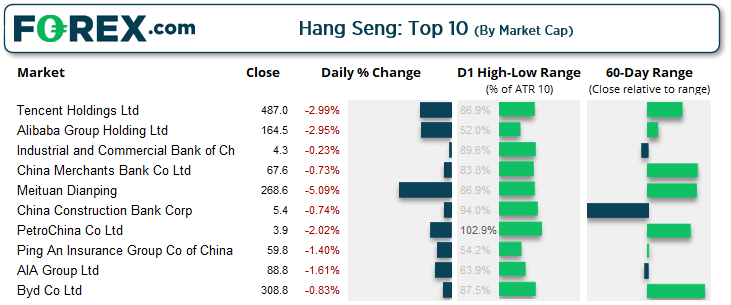

Tencent was the second worst performer yesterday

Yet developments in Hong Kong saw the Hang Seng index break out of a 5-day consolidation, to the downside. Hong Kong’s leader Carrie Lam announced on Tuesday that they will tighten border restrictions and remove quarantine exemptions, to bring their rules “more in line with the mainland” (China). This is despite there being no COVID-19 outbreak in over two months and concerns being raised by the business community of the impact it will have on the economy.

Lam said the move was required in order to enjoy quarantine free travel with China. This is frustrating to business leaders who are watching financial rivals such as Singapore, Tokyo, London and New York Reopen.

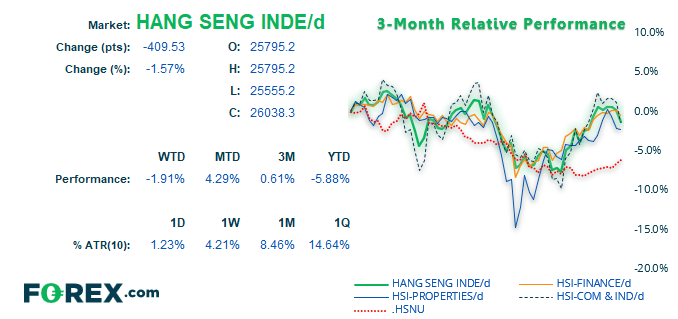

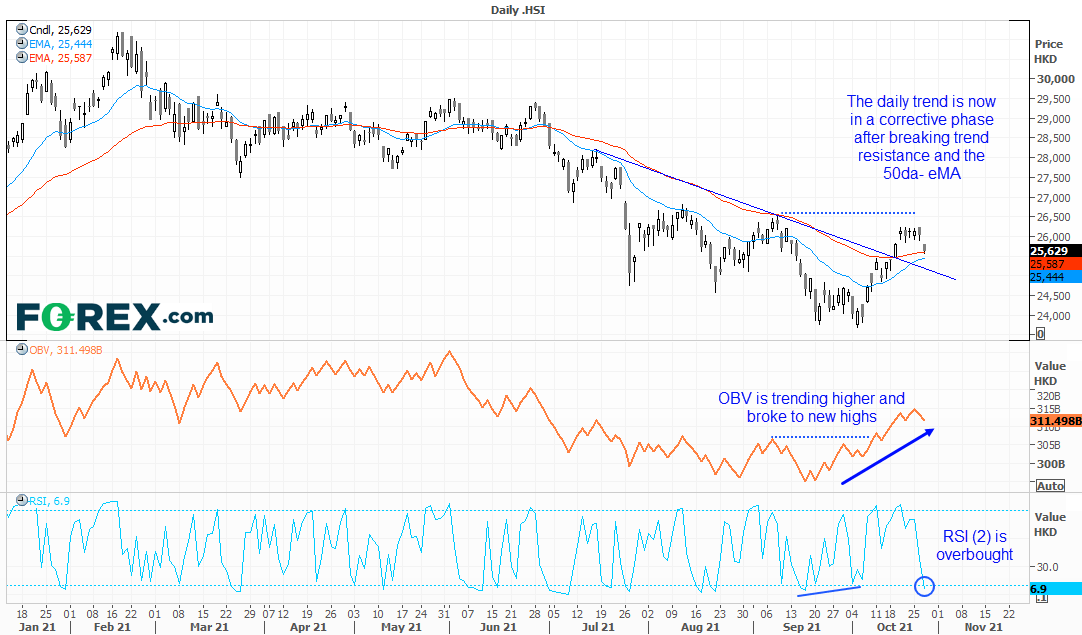

HSI remains bullish on the daily but in a corrective phase

The Hang Seng fell -1.6% by the close during its worst session in 3-weeks. All top-10 stocks by market-cap were also in the red with Tencent (0700) and Alibaba (9988) dragging the index lower and are currently down -4.4% and -5.7% this week respectively. This means the index is clearly within a countertrend move after its 10% rally from October’s low.

However, the daily trend remains bullish above 24,880 which means prices could fall another -3% and retain its bullish structure. Should sentiment remain fragile and USD/HKD continue to rise, then we suspect the Hang Seng will also move lower over the near-term.

However, something to keep in mind is that OBV (On Balance Volume) has been trending higher since September, which shows us that bulls have been more active than bears over this period. So, whilst we see near-term risks to the downside, we continue to suspect its current decline is corrective in nature so will seek evidence of a corrective low above 24,880, or the broken trendline.

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.