- Hang Seng and China A50 futures printed outside daily candles on Friday

- Both bounced from known levels, hinting the reversal may have been technical in nature

- China Loan prime rates almost certain to be cut later in the session

Overview

Hang Seng and China A50 futures delivered obvious bullish reversal patterns on Friday, hinting the unwind from the recent highs may have run its course. While some may say the rebound was driven by stronger-than-expected Chinese economic data released during the session, both moves started from known levels, suggesting it may have been technical in nature.

Hang Seng long setup

Looking at Hang Seng futures first, the outside daily candle is a classic reversal pattern, sending the price back above 20725, a minor level that acted as both support and resistance earlier this month. A pickup in traded volumes on the day only enhances the bullish signal.

Those considering longs could buy around these levels or wait for a possible pullback towards 20725, allowing for a stop to be placed below Monday’s session low of 20670 for protection.

On the topside, resistance may be encountered around the downtrend dating back to the highs of October 10. It’s currently found around 20940. If that were to be broken, it may open the door for a push towards 21663, a minor level that provided both support and resistance in early October. Beyond that, we’re talking the double top of 23334.

While it’s only early days, it looks like the price has entered a falling wedge, hinting that if we do see a breakout it may be on the topside.

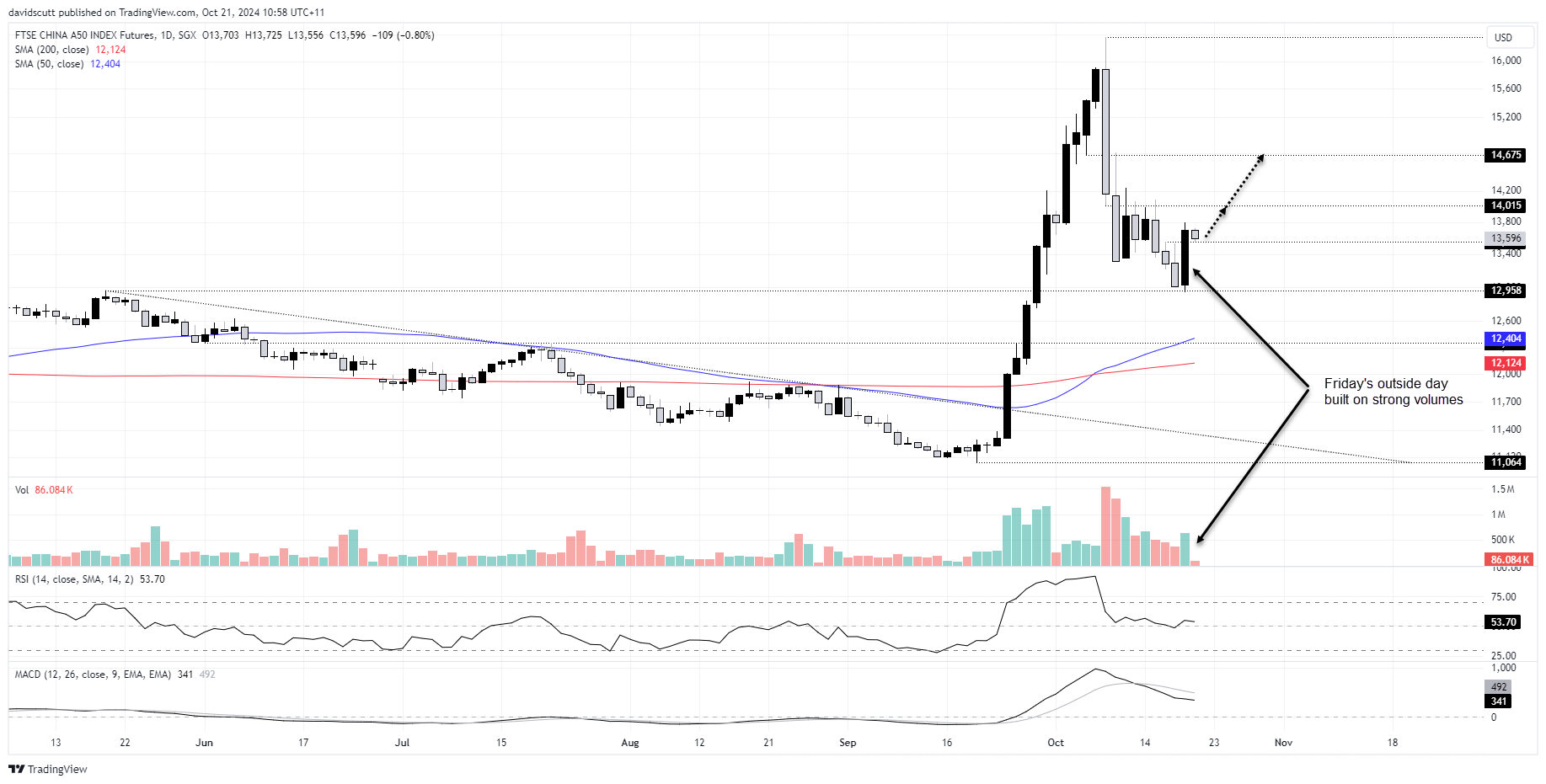

China A50 bounces hard from former resistance

The technical picture is much the same for China A50 futures traded in Singapore with Friday’s candle also an outside day built on strong volumes. The reversal has seen the price push and hold above 13557, providing a long setup for those seeking upside.

Longs could be initiated here or towards 13557 with a tight stop below for protection. If Friday’s high of 13795 can be overcome, look for a potential retest of 14015, a level where rallies were reversed constantly earlier in the month.

China Loan Prime Rates (LPR) likely to be cut

Later Monday, the People’s Bank of China (PBOC) is likely to cut loan prime rates for one and five-year terms by 20 basis points to 3.15% and 3.65% respectively, adding to monetary policy easing already delivered. Even though the announcement is expected, it may add to bullish sentiment in the near-term.

Loan Prime Rates (LPR) is the interest rate banks offer their best customers, acting as the benchmark for lending rates across the country. Set by a panel of banks, it directly impacts borrowing costs and plays a key role in the transmission of monetary policy in China.

-- Written by David Scutt

Follow David on Twitter @scutty