Gold and silver have been unable to decouple from the selling pressure we have seen in other key commodity prices in recent days, including crude oil and copper. Thanks to consistently weak manufacturing data from around the world, demand concerns are the forefront of investors’ minds. They have so far resisted the temptations of picking up silver’s dip back below the $30 handle, following the metal’s big breakout in the last couple of months. However, the long-term silver outlook remains bullish, and I am expecting the short-term selling pressure to ease soon.

Silver hit by profit-taking

So, gold and silver prices haven’t made a great start to the week following their modest losses the week before. This morning’s losses coincided with the dollar index bouncing off the 104.00 support level ahead of a busy week for macro data and central bank action. In recent days, precious metals have struggled to maintain their gains, and Friday's much-anticipated Core PCE data did not alleviate concerns about the "higher for longer" interest rate narrative. Without significant new bullish catalysts, metals traders have been content to take profits after a strong year in the sector. Nonetheless, the overall outlook remains positive. After some consolidation, I expect the bull trend to continue, especially as silver tests liquidity just below the technically significant $30 level.

Before discussing the week’s key macro highlights and demand concerns as highlighted by the crude oil sell-off, let’s first take a look at the charts of silver.

Silver, gold outlook: Metals still remain in dip-buying mode

It is likely that many traders who missed the recent surge in gold and silver prices are now watching for opportunities to buy during price dips. Precious metals bulls argue that with prices no longer excessively high, the upward trend could continue, especially given underlying factors such as ongoing central bank gold purchases and the role of precious metals as an inflation hedge. After years of excessive inflation, fiat currencies have significantly depreciated, leading some investors to see precious metals as a reliable protection against inflation.

Silver outlook: Technical factors and levels to watch

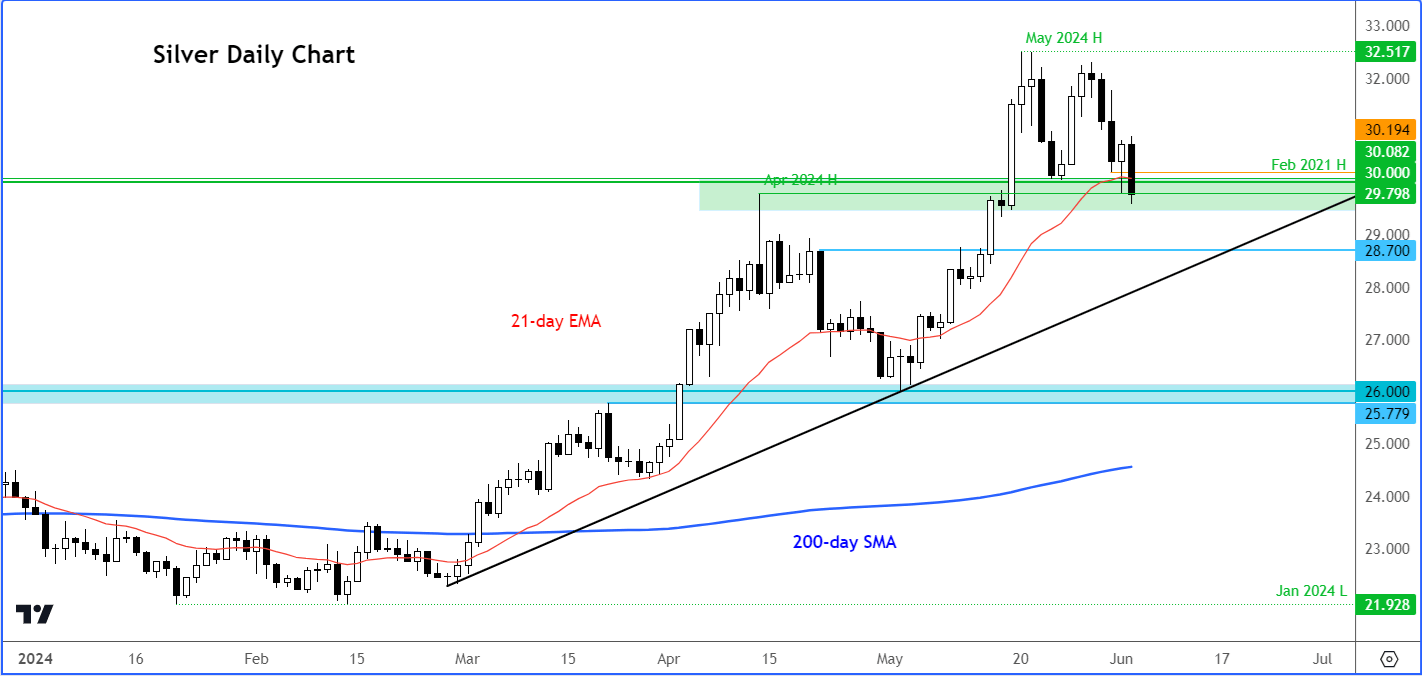

Silver dipped below $30 an ounce early this morning before rebounding towards this key psychological and technical level. It's crucial to watch silver's behaviour here. A daily close above $30 will please the bulls and sustain the bullish trend seen this year, while a close below $30 could trigger some further short-term weakness before the rally potentially resumes.

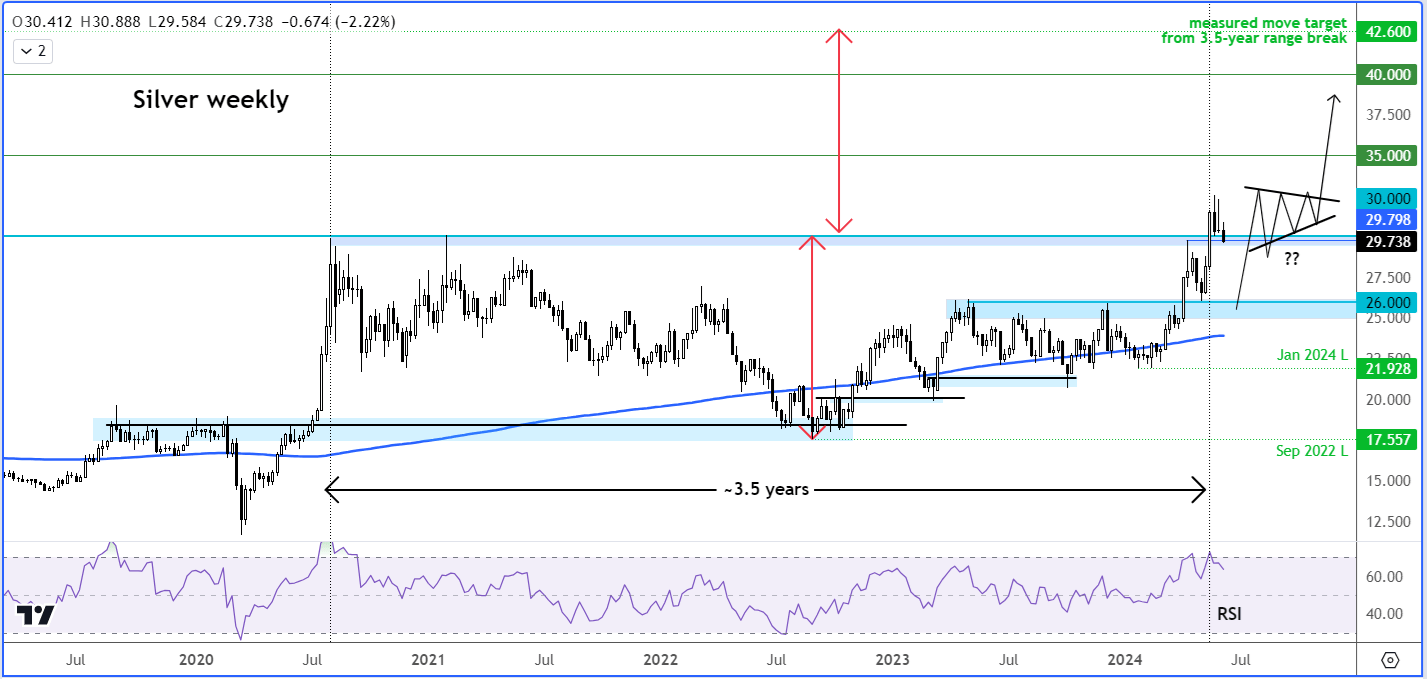

The long-term trend remains bullish regardless of short-term price movements, following a significant breakout a couple of months ago that ended 3.5 years of consolidation with prices moving higher. Therefore, any further weakening is likely to be just a short-term pullback before the existing trend resumes.

Here's a long-term weekly chart, showing a potential path towards the range breakout measured move target of around $42.60:

Source: TradingView.com

On the lower time frames, I'm looking for prices to establish a short-term bullish structure above $30. This could be a break above a continuation pattern like a triangle or a bull flag, similar to the breakout in early May that led to gains throughout the month.

Source: TradingView.com

In summary, the path of least resistance for silver remains upward despite recent struggles. Even if silver closes below $30 on a daily basis, the long-term bullish structure suggests that the upward trend could resume later. This would simply require more patience from the bulls.

Silver and Crude extend losses: Fifth down day for black gold

Silver may have rolled over a little today but spare a though for crude oil. The so-called black gold is failing to find any strong buying activity, even if it has dropped for the third consecutive week and fifth day in a row. The sell-off gathered pace on oil on Monday after weaker-than-expected US factory data intensified demand concerns, already underscored by the OPEC+ decision to extend its output cuts on Sunday. Revised ISM manufacturing PMI data for April revealed US factory activity was in contraction after spending just one month in the expansion threshold of 50.0 and above. The pace of the slump deteriorated further in May, which was unexpected. What’s more, we saw construction spending fall unexpectedly by 0.1% m/m when a small rise was expected.

Key macro highlights of the week: ECB and NFP

The upcoming week is packed with significant data releases. The US economic calendar includes the ISM Services PMI, ADP private payrolls, and jobless claims data. However, the main focus is on Friday, June 7, when the May jobs report will be published. Today's highlight is the JOLTS Job Openings, which could impact the dollar. The forecast is 8.40 million, down from 8.49 million the previous month, indicating a potential softening of the labour market.

The Federal Reserve has indicated it may wait until the end of summer before considering interest rate cuts. Friday's jobs report and wage data, along with other key US data this week, will provide further insights. However, after weak factory numbers on Monday, there are increasing calls for an earlier rate cut. A series of below-forecast US data could bolster metals and weaken the US dollar.

Meanwhile, on Thursday, June 6, the European Central Bank is expected to deliver its first rate cut of the year. The key question is how many more will follow, if any. High wage pressures and improving macroeconomic data in the Eurozone present a significant challenge for the ECB ahead of its rate decision. Despite this, a 25-bps rate cut may proceed, which could positively impact metals by reducing the appeal of bonds from a yield perspective.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R