Key Events

- Gold pulled back 60 points after falling short of the critical $2800 mark.

- Silver is retesting the significant May 2024 high support at $32.50.

- A tight US presidential race is only 5 days away.

- Middle East conflicts diverge from ceasefire deals.

- US Non-Farm Payrolls and Fed rate anticipation.

As we approach the US elections, balance employment and inflation risks to the Fed’s easing cycle, and weigh geopolitical factors, momentum on safe-haven assets appears overstretched.

Clarity with the coming US non-farm payroll indicator, US elections, and FOMC meeting may ease off uncertainty risks from the gold chart, leaving the geo tensions in the background.

The key question now is whether this recent pullback in both precious metals is enough to recharge momentum for a continuation of the primary trend. Volatility can be expected following the non-farm payroll results today, as the markets are ready to price in the FOMC meeting tone for next week following the US election volatility.

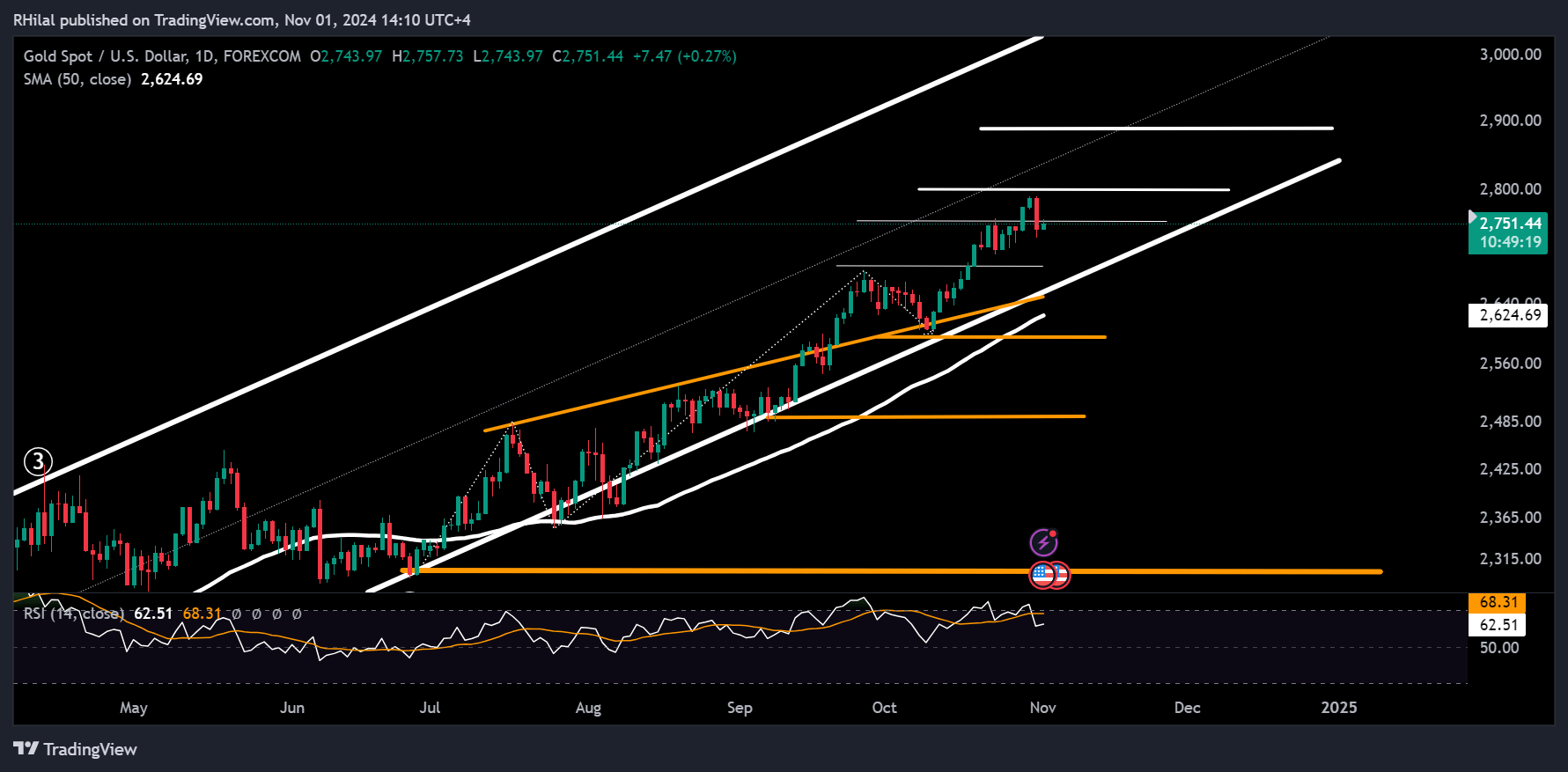

Gold Outlook: Daily Time Frame – Log Scale

Source: Tradingview

The recent 60-point pullback in gold from the $2790 high created a daily bearish engulfing candlestick pattern, accompanied by an RSI dip below its moving average. However, considering ongoing fundamental and geopolitical uncertainties, the potential for an uptrend remains viable above $2800, with possible extensions towards $2890 and $3050.

On the downside, a break below the recent low of $2730 could extend declines to support levels at $2710 and $2685.

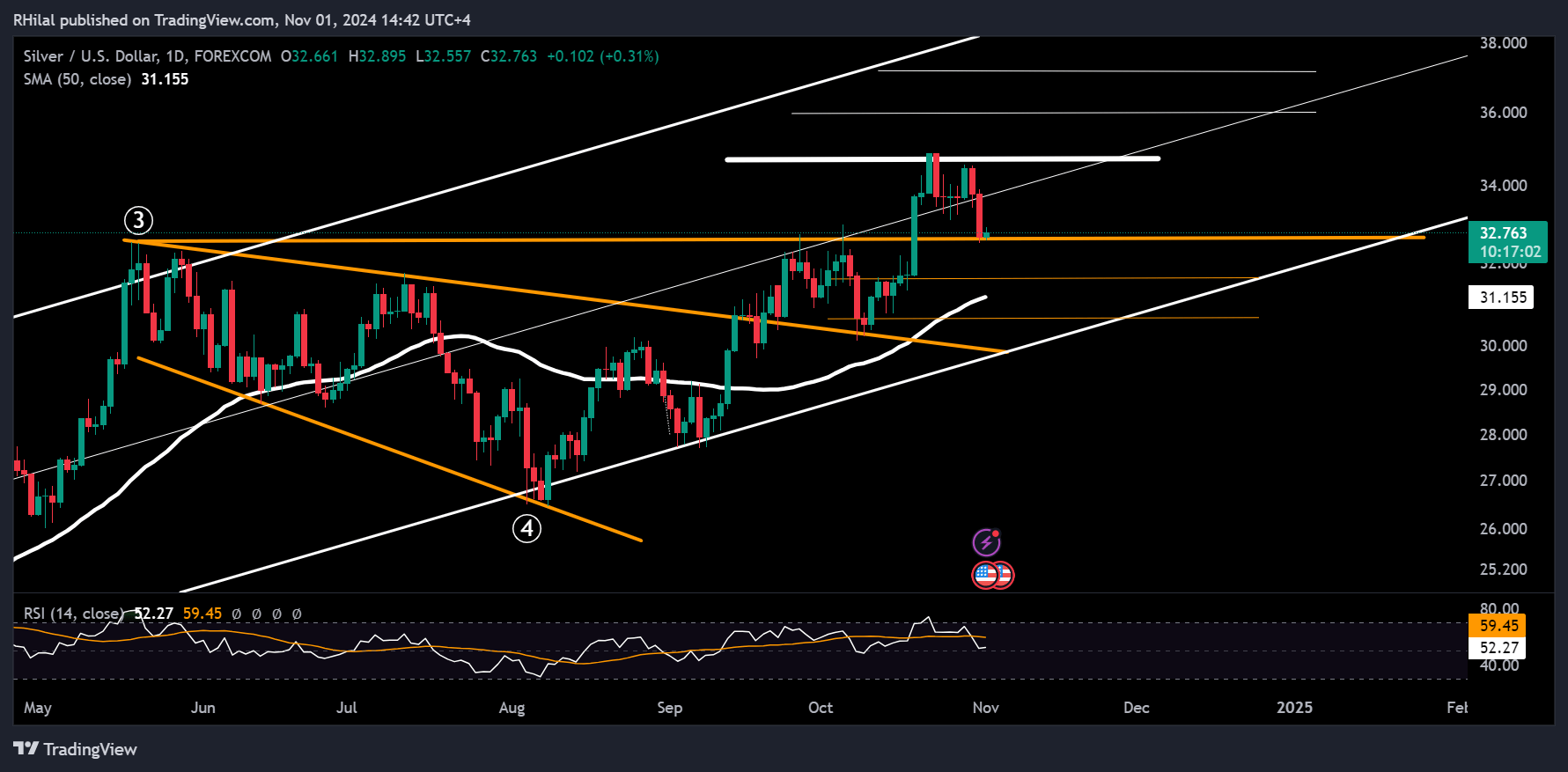

Silver Outlook: Daily Time Frame – Log Scale

Source: Tradingview

Unlike the gold chart, silver is reflecting potential bullish continuation signals, aligning with the $32.50 support level (May 2024 high). This includes the RSI holding above its neutral 50 level, and a pullback to the 0.272 Fibonacci retracement level of the uptrend from the August 2024 low of $26.45 to the October 2024 high of $34.87.

A decisive close below $32.50 could extend the pullback to $31.50 and $30.70. On the upside, a close above $35 would support a bullish continuation toward $36 and $37 respectively.

— Written by Razan Hilal, CMT – on X: @Rh_waves