Gold Technical Outlook: XAU/USD Short-term Trade Levels

- Gold rebounds off near-term trend support- attempting third daily advance

- XAU/USD vulnerable to larger correction while below yearly high-day close

- Resistance 1980s, 2004, 2040/50 (key)– support 1943/50, 1912/18 (critical), 1877

Gold prices are plunging with XAU/USD down more than 6% off the monthly / yearly highs. The decline has broken below the objective May open / opening-range lows and keeps the near-term risk weighted to the downside in the days ahead. That said, price is coming up on some major levels and the battle lines are drawn for the bears. These are the updated targets and invalidation levels that matter on the XAU/USD short-term technical charts.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold technical setup and more. Join live on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Daily

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold short-term price outlook we noted that, “A multi-week rally into confluent uptrend resistance has faltered amid ongoing momentum divergence and threatens a deeper setback in gold prices.” A final attempt at a topside breach into the open of the month failed with a break back below monthly-open support (1995) this week fueling the setback we were looking for. The decline is now approaching the first of two-major support zones we are tracking for possible price inflection.

Gold Price Chart – XAU/USD 240min

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Notes: A closer look at gold price action shows XAU/USD trading within the confines of a newly identified descending pitchfork formation extending of the yearly highs. Initial support rests with the 50% retracement of the yearly range / February high-close at 1943/50 backed by 1910/18- a region defined by the 61.8% Fibonacci retracement, the February high-day close and the 2021 high-day close (look for a larger reaction there IF reached). Note that a break / close below this threshold would threaten a much steeper correction towards 1877 and beyond.

Look for initial resistance along the median-line (currently ~1980s) backed by the April 14th reversal-close at 2004. Broader bearish invalidation now set to the April high-day close / 2022 high-day close at 2040/50.

Bottom line: Gold prices are in correction with a break of the objective May opening-range shifting the focus towards a late-month low. From a trading standpoint, look to reduce short-exposure / lower protective stops on a stretch towards these down-trend support slopes – rallies should be limited to 2004 IF price is indeed heading lower. We’ll be on the lookout for possible downside exhaustion in the weeks ahead. Review my latest Gold weekly technical forecast for a longer-term look at the XAU/USD trade levels.

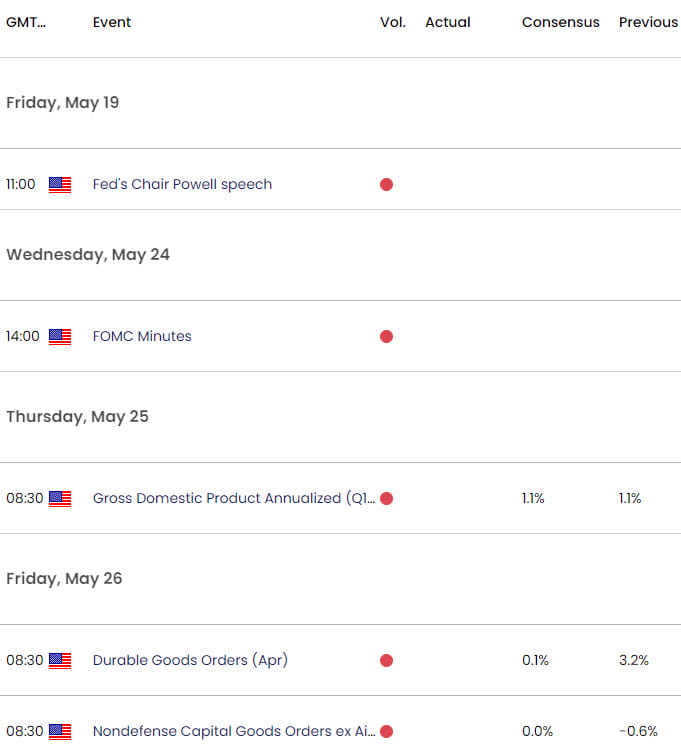

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Short-term Technical Charts

- Japanese Yen Short-Term Outlook: USD/JPY Ripper Eyes May / 2023 Highs

- Canadian Dollar short-term outlook: USD/CAD moment of truth at yearly support

- British Pound short-term outlook: GBP/USD breakout faces BoE

- Euro short-term outlook: EUR/USD resistance on Fed- ECB, NFP on tap

- US Dollar short-term outlook: USD battle-lines drawn ahead of Fed

- Australian Dollar short-term outlook: AUD/USD bears emerge

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com

Follow Michael on Twitter @MBForex