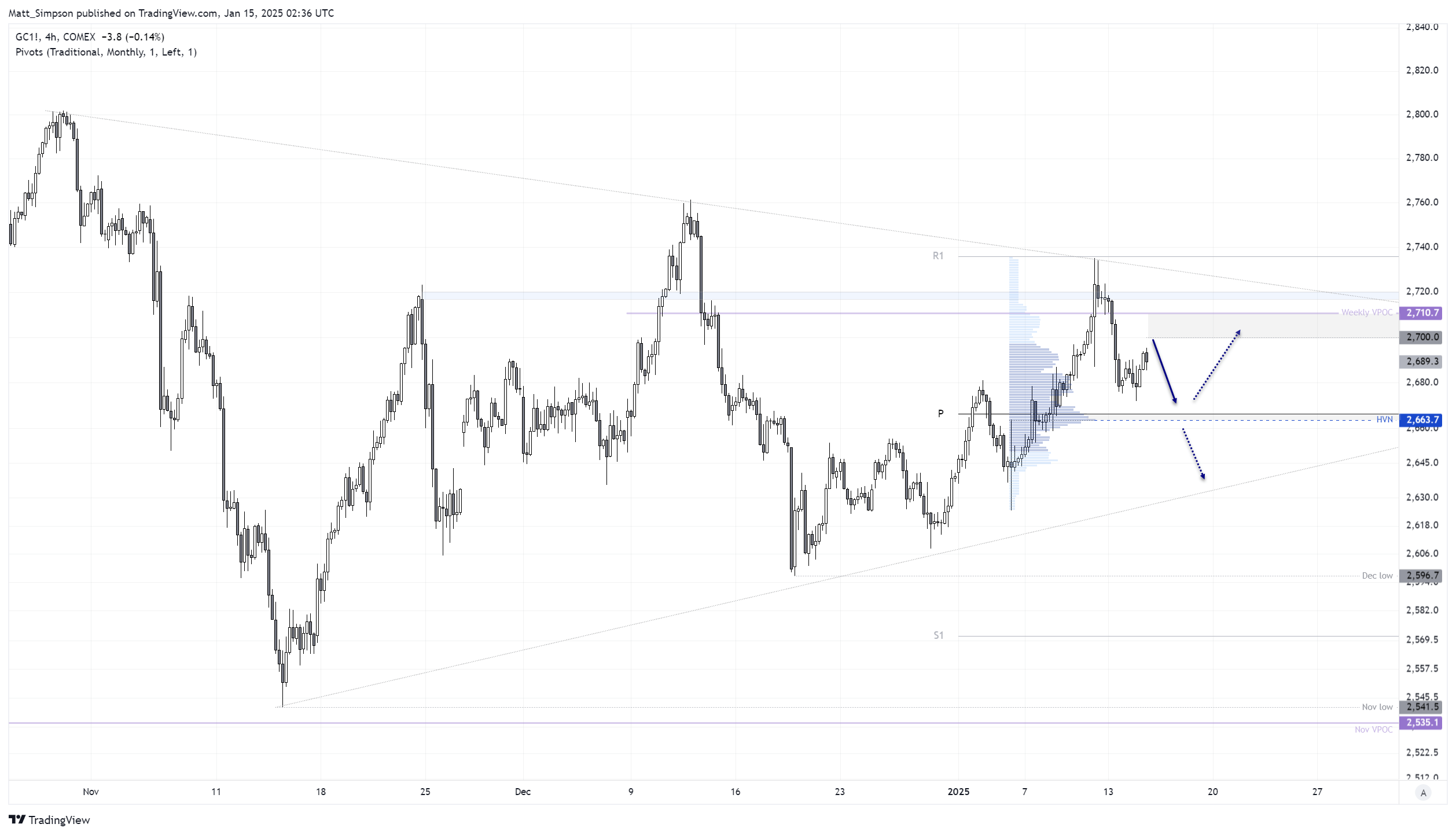

Last week I warned that gold’s gains appeared dubious, and that they could sucker-punch bulls. And it seems they did. While the low-liquidity rally continued a touch higher than I had in mind, momentum most certainly turned lower on Monday with a bearish engulfing candle. Not only did it respect trend resistance from the record high, but the engulfing candle formed around 2720 resistance and the weekly VPOC (volume point of control) I had originally pencilled in as a potential reversal point.

I therefore suspect we could see prices recycle lower within the ascending triangle. But I am also on guard for a downside break and retest of the November low.

Before we get all-out bearish, there are many supportive feature for gold, a market which seems far more likely to print new record highs this year than not. It remains in a strong uptrend on the weekly chart, which is bobbing nicely along the 20-week EMA. A small symmetrical triangle or pennant appears to be in the making and last week’s bullish candle was accompanied with strong volumes. Fundamentals also remain strong.

- The uncertainty around a Trump Presidency is likely to see gold attract safe-haven flows

- Central bank buying remains strong According to gold.org

- ETF inflows pushed assets under management to a record high of US$271 billion

- While physical gold trading gold volumes were down -24% in December, they were up 39% overall for the year

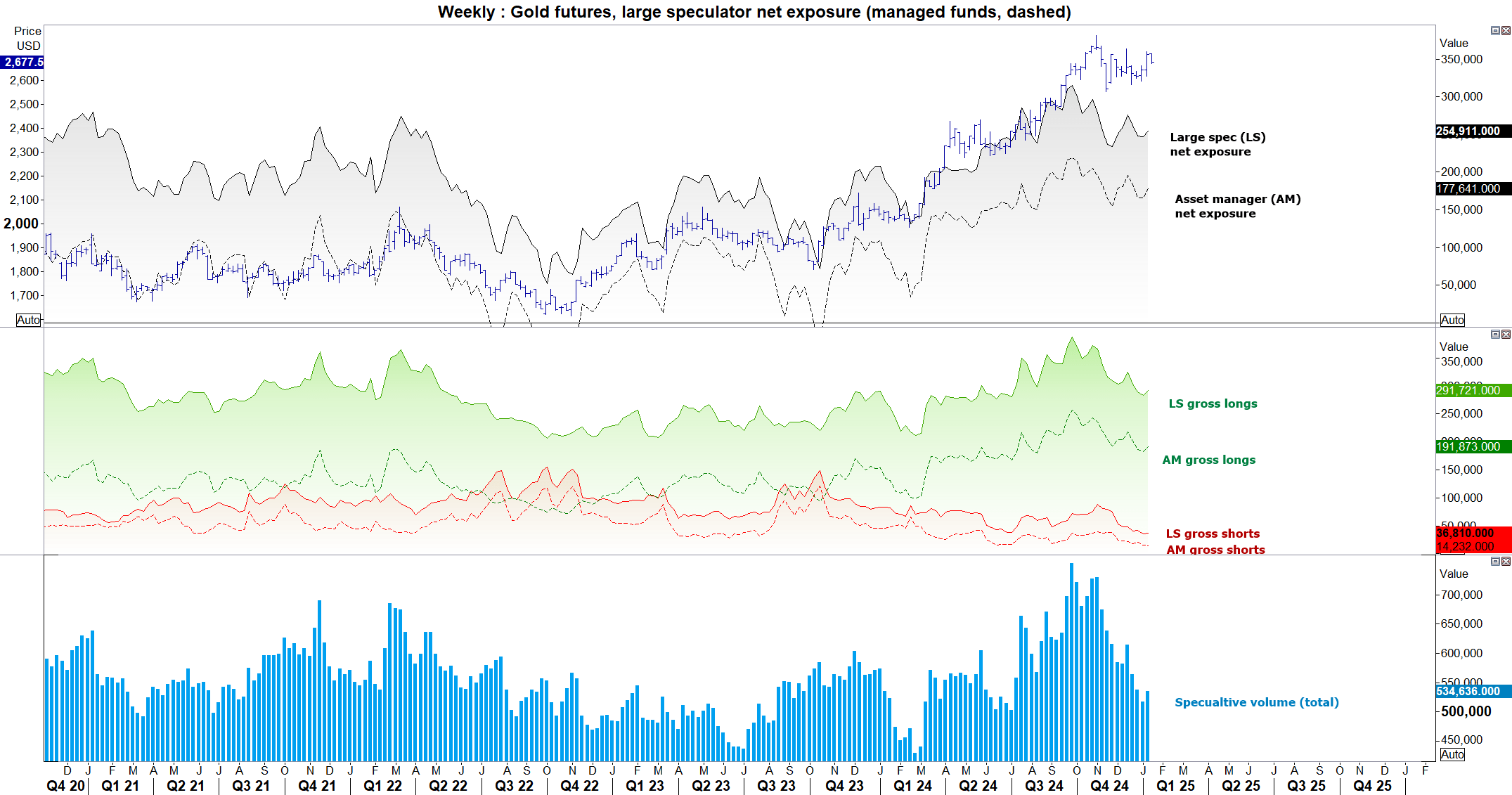

Gold futures market positioning – COT report

Futures market positioning also any retracement may be on the small side. Large speculators and managed funds remain heavily net-long but without being at a sentiment extreme, and both sets of traders increased their gross-long exposure which pushed net-long exposure higher. Speculative volume (volumes for both traders combined) also increased for the first week in three while gross-short exposure remains low.

Gold futures technical analysis

The decline from the monthly R1 (2735.8) and trend resistance appears to have come in one wave, which suggest at least one more leg lower. A mild bounce from the cycle low is in motion, and the bias is to fade into moves up to 2700 in anticipation of a move down to the monthly pivot point (2666.5).

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge