Gold Technical Forecast: XAU/USD Weekly Trade Levels

- Gold price poised to mark three-week rally- now testing major resistance at record high

- XAU/USD immediate rally may be vulnerable- weekly close critical

- Resistance 2643/71 (key), 2743, 2804 – Support 2622, 2517/24, 2450 (key)

Gold prices are poised to mark a third consecutive-weekly advance with XAU/USD surging to fresh record highs today in US trade. The rally is now testing a critical resistance zone we’ve been tracking for months, and the focus is on possible price inflection here- failure to mark a weekly close above this threshold may risk exhaustion for the bulls. Battle lines drawn on the XAU/USD weekly technical chart into the close of the month.

Review my latest Weekly Strategy Webinar for an in-depth breakdown of this gold setup and more. Join live on Monday’s at 8:30am EST.Gold Price Chart – XAU/USD Weekly

Chart Prepared by Michael Boutros, Sr. Technical Strategist; XAU/USD on TradingView

Technical Outlook: In last month’s Gold Weekly Price Forecast we noted that XAU/USD had, “broken above a major technical hurdle with weekly momentum still deep in overbought territory. From a trading standpoint, look to reduce portions of long-exposure / raise protective stops on a rally toward the upper parallels (2643/71)- losses should be limited to 2450 IF price is heading higher on this stretch.” Gold surged more than 4% over the past two-weeks with price now testing this critical resistance zone- looking for possible inflection here into the close of the month with the immediate advance vulnerable while below.

A weekly close above 2643/71 is needed to keep the immediate rally viable with such scenario likely to fuel another accelerated advance. Confluent resistance objectives eyed at the 200% extension of the 2022 advance at 2743 and the 2.618% extension of the 2022 decline at 2804- both levels of interest for possible topside exhaustion / price inflection IF reached.

Weekly-open support rests at 2622 and is backed by 2517/24- a region defined by the 1.618% Fibonacci extension of the October advance and the measured inverse head-and-shoulders objective of the 2022 advance. Note that numerous slopes converge on this threshold and pullbacks would need to be limited to this level for the September breakout to remain in play. Broader bullish invalidation now raised to the objective May high at 2450.

Bottom line: Gold is testing a critical resistance zone today / this week and the focus is on a reaction off this key threshold with the bulls vulnerable while below. From a trading standpoint, a good zone to reduce long-exposure / raise protective stops- losses should be limited to the 2517 IF gold is heading higher on this stretch with a close above 2671 needed to keep the immediate advance viable / fuel the next leg in price.

Keep in mind we get the release of key US inflation data tomorrow with the August Core Personal Consumption Expenditure (PCE) on tap. Watch the weekly close here and stay nimble into the monthly cross.

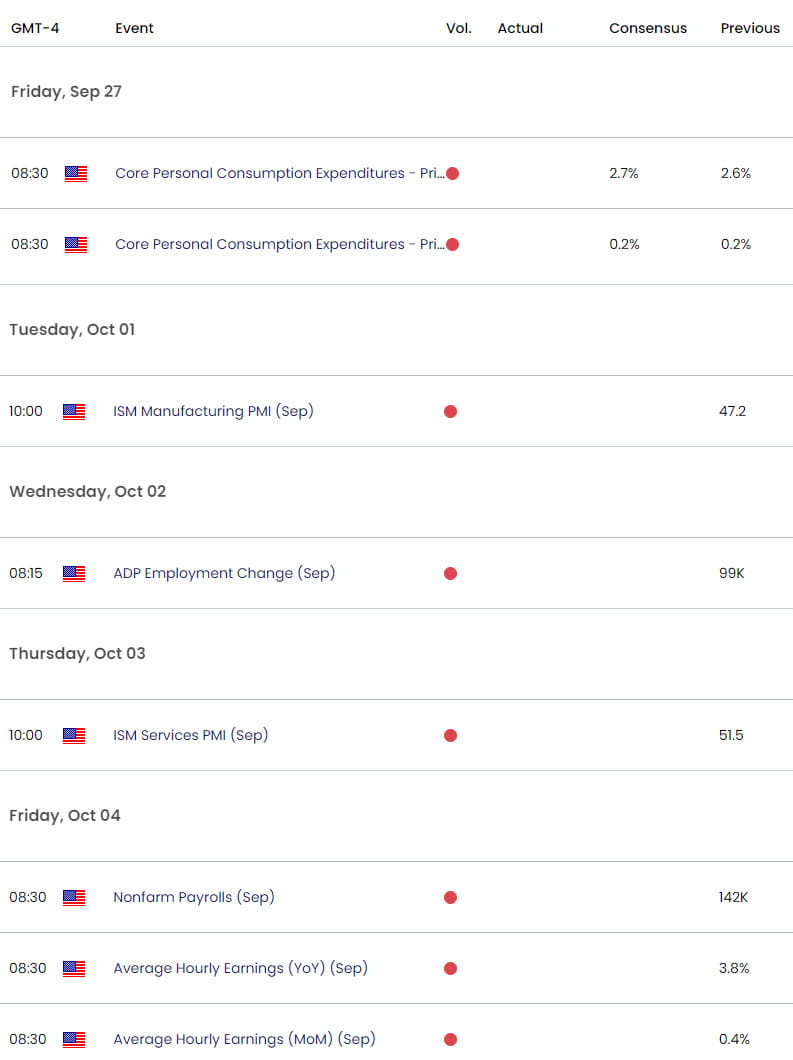

Key US Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

--- Written by Michael Boutros, Sr Technical Strategist

Follow Michael on X @MBForex