Gold technical forecast: XAU/USD weekly trade levels

- Gold prices rally to record high on FOMC – closes week more than 3% off the highs

- XAU/USD testing uptrend on building divergence- risk for correction

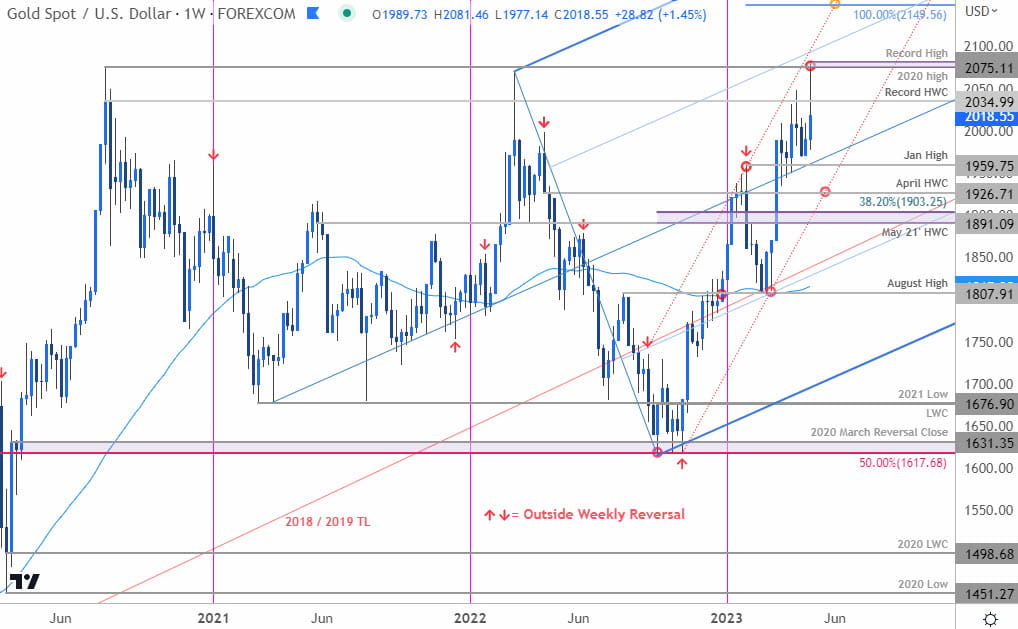

- Gold resistance 2035, 2075/81, 2149 – support 1959, 1926 (key), 1891-1903

Gold prices rocketed to a fresh record high this week, but the advance quickly fizzled with XAU/USD closing more than 3% off the highs. While the broader outlook remains constructive, building divergence into technical resistance once again highlights the threat of corrective price action within the uptrend. These are the updated targets and invalidation levels that matter on the XAU/USD weekly technical chart.

Discuss this gold setup and more in the Weekly Strategy Webinars on Monday’s at 8:30am EST.

Gold Price Chart – XAU/USD Weekly

Chart Prepared by Michael Boutros, Technical Strategist; XAU/USD on TradingViews

Technical Outlook: In last month’s Gold Weekly Price Forecast we note that XAU/USD was trading just below the yearly high-week close and that, “A topside breach / weekly close above 2004 is needed to fuel another test of the record high-week close at 2035 and the record high at 2075- look for a larger reaction there IF reached.” Prices ripped higher this week on the heels of the FOMC rate decision with Gold briefly ripping to a fresh record high (registered at 2081) before pulling back sharply into the close of the week.

The move suggests another failed attempt to mount the record high with a close back below the record 2020 high-close at 2035 once again threatening topside exhaustion in XAU/USD. A newly identified ascending pitchfork extending off the 2021 & 2022 lows (blue) seems to be defining this advance rather well with initial support eyed at the median-line. Lateral support rests at the objective January high at 1959 backed by the April high-week reversal close at 1926- losses should be limited to this threshold IF price is heading higher on this stretch. Broader bullish invalidation now raised to the May high-week close / 38.2% Fibonacci retracement at 1891-1903.

Initial resistance steady at 2035 with a breach / close above 2075/81 needed to mark resumption of the broader uptrend towards the 75% parallel (currently ~2100) and the 100% extension of the 2022 advance at 2149.

Bottom line: Gold is testing resistance at the record highs on building momentum divergence. The last time we tested these highs price closed 1.93% & 3.8% in 2020 & 2022 respectively- both ultimately fueled declines of more than 19% and while the broader outlook remains constructive, the immediate advance may be vulnerable after this last attempt.

From a trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses should be limited to the 2022 channel line IF price is heading higher on this stretch with a weekly close above 2075 needed to mark resumption. Review my latest Gold short-term technical outlook for a closer look at the near-term XAU/USD technical trade levels.

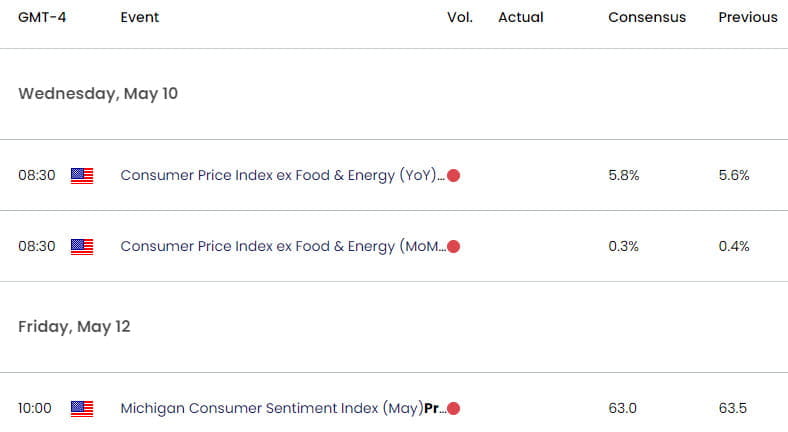

Key Economic Data Releases

Economic Calendar - latest economic developments and upcoming event risk.

Active Weekly Technical Charts

- British Pound (GBP/USD)

- Crude Oil (WTI)

- Euro (EUR/USD)

- Canadian Dollar (USD/CAD)

- Japanese Yen (USD/JPY)

- Australian Dollar (AUD/USD)

- US Dollar (DXY)

- S&P 500 (SPX500)

--- Written by Michael Boutros, Sr Technical Strategist with FOREX.com