- Gold outlook remains bearish amid rising dollar and yields

- Can Dollar Index extend rally to 10 weeks?

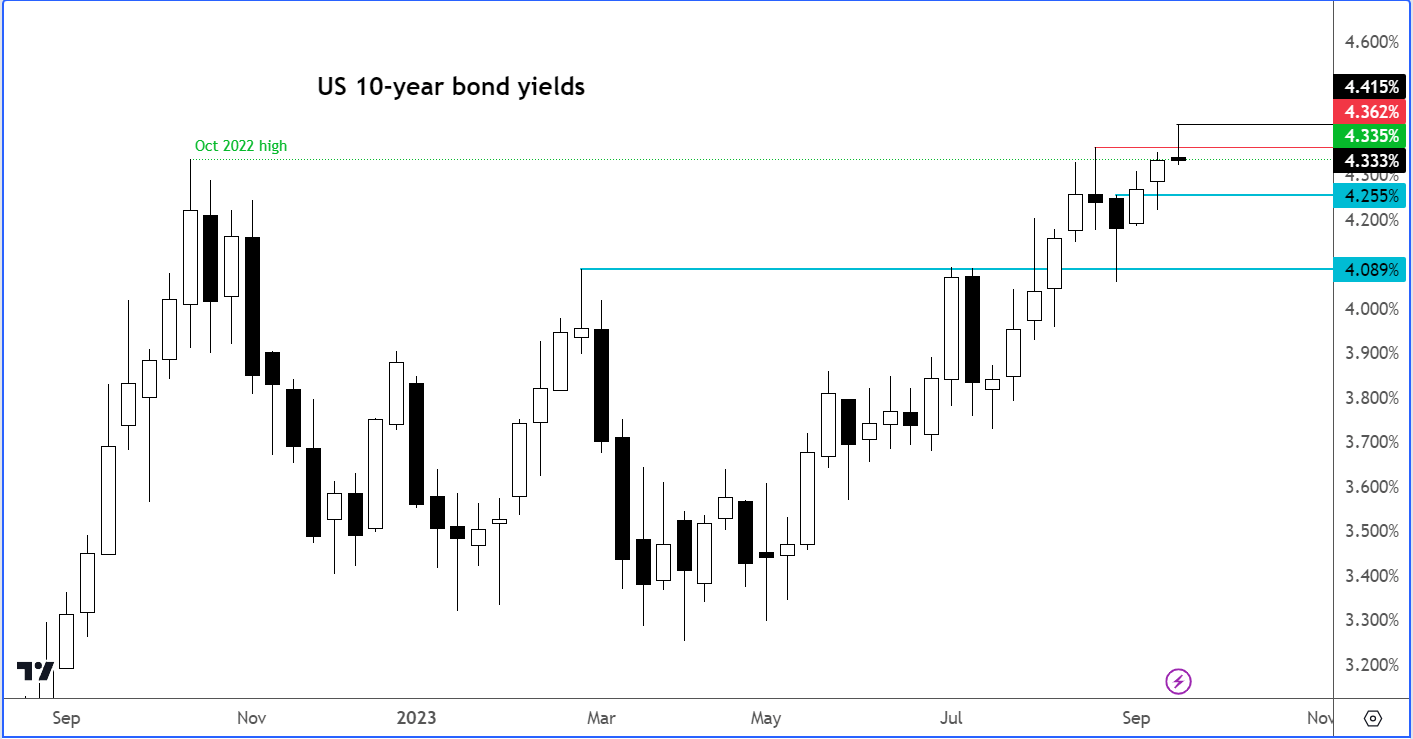

- Keep an eye on bonds as FOMC decision looms

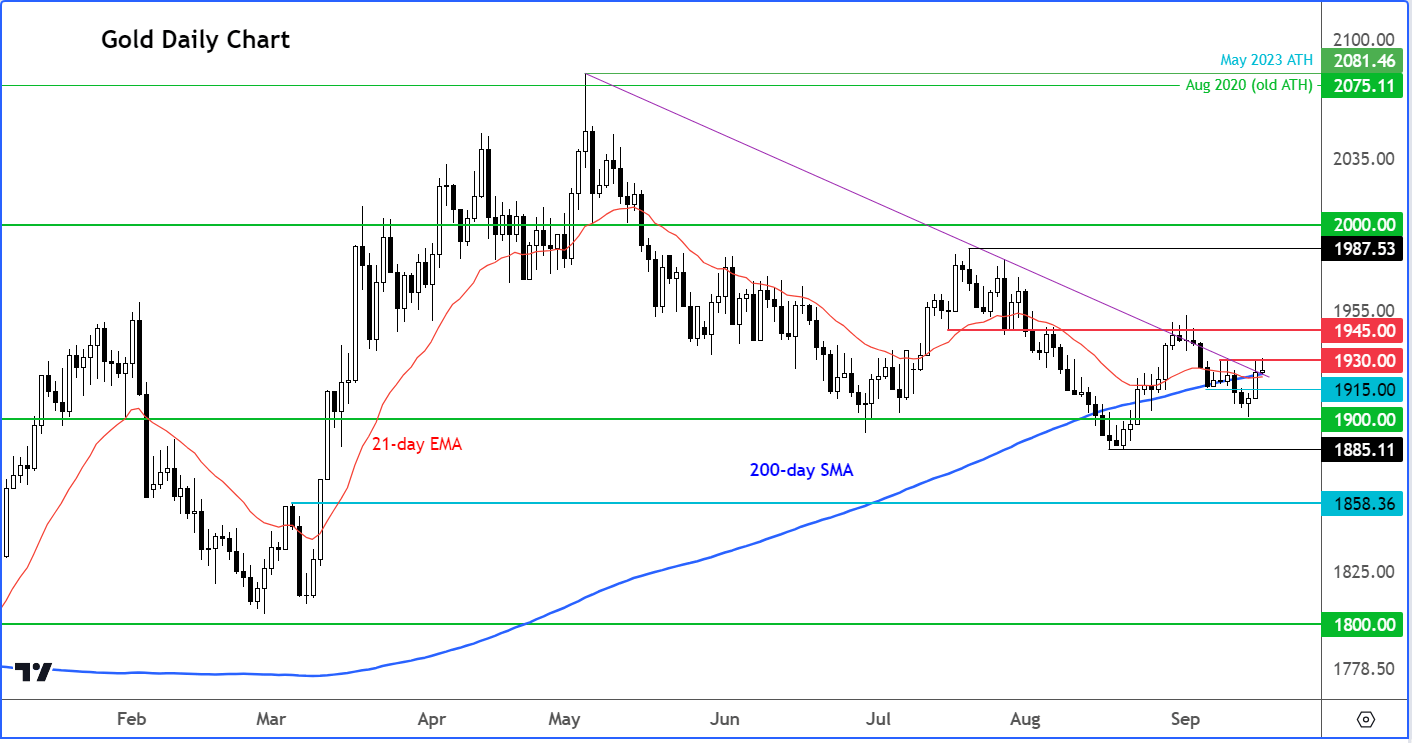

- Gold outlook: long-term bullish, but short-term remains bearish

Gold was able to climb in the last two days of last week despite the US dollar and bond yields pushing higher. The precious metal gained ground on Friday as stocks reversed their earlier gains to close lower before falling further today. In other words, the metal has been supported by haven flows in the last few sessions. Gold was attempting to gain further ground today, but unsurprisingly was struggling to do so. Gold investors were wary of the dollar, which remained strong, and the benchmark US 10-year bond yields, which broke out briefly to hit levels not seen since 2007. For the opportunity cost of holding gold to fall, yields will need to go down and fast. Otherwise, there is a good chance the precious metal will head lower instead.

Can Dollar Index extend rally to 10 weeks?

The US dollar took its time last week, but a dovish ECB hike meant the EUR/USD would slump and this would push the Dollar Index (DXY) higher to ensure of another weekly close in the positive territory. While the start of Monday’s session saw the DXY pare some of its gains, as the likes of the EUR/USD and GBP/USD bounced back on profit-taking, while the USD/CAD fell below 1.35 handle briefly on the back of strong Canadian CPI and rising oil prices, there were no clear indications of a top for the dollar index just yet. Indeed, the GBP/USD and EUR/USD were coming off their earlier highs, pushing the DXY into the positive territory for the day.

Will the dollar be able to rise for the 10th consecutive week on a closing basis? I certainly wouldn’t bet against it. For one thing, US data continues to surprise to the upside, which should keep the Fed in a hawkish mode. For another, a growing number of major central banks, such as the ECB, are pausing, or about to pause, their interest rate tightening, owing to weakness in foreign data and signs of disinflation around the world.

That said, central banks in the UK, Switzerland, Sweden and Norway, as well as Turkey and Brazil, will all be making their own policy decisions this week, and all are expected to hike. The impact of these central bank decisions, apart from the BoE, on the dollar index will be limited, however, given that the DXY is heavily influenced by the EUR (57.6% weighting) and JPY (13.6%) whereas the SEK (4.2%) and CHF (3.6%) have weightings of less than 8% combined. While the GBP (11.9%) also has a big influence on the DXY, I reckon sterling is going to do what the euro did last week and drop. For we expect a dovish rate hike by the BoE this week.

Keep an eye on bonds as FOMC decision looms

Last week saw US 10-year Treasury yields close north of 4.30% for the first time since 2007. Yields on the 10-year Treasurys can easily rise further if the Fed turns out to be more hawkish than expected, especially if they signal fewer rate cuts in 2024 than priced in. Should that happen, then gold could break $1900 support level.

Now the Fed will be making its decision on Wednesday and not many people are expecting any dovish surprises, even if no rate hikes are expected at this meeting. Strong US inflation numbers and surprising strength in some other key parts of the world’s largest economy have given rise to speculation that the Fed’s tightening cycle may not be over just yet. Traders will be looking for clues with regards to the next meeting. If there’s a strong inclination towards a final hike before the year is out, then this should support the dollar on any short-term dips, given that the market is currently pricing in a 70% chance of another pause in

So, keep a close eye on the policy statement and the latest dot plots, and hear what Powell says at the FOMC press conference. The Fed may indicate that one more hike is likely before the year is out – thanks to a slower disinflation process that has undoubtedly been boosted by a stronger US consumer and higher inflation expectations. The FOMC may upwardly revise the 2024 median plot to point to fewer rate cuts than the 100 bps it had projected previously. If so, this would further discourage bearish bets on the dollar, keeping the pressure on the gold in the short-term outlook.

Gold outlook: Bullish long-term

That being said, there is no doubt that gold remains an attractive long-term investment in my mind. It is just that there is increased risk of a short-term correction due to the reasons mentioned. In the slightly longer-term outlook, we should see renewed strength come back to gold as central banks start loosening their monetary policies again. The other bullish argument for gold is that it is a haven asset. With fiat currencies have been devalued around the world due to high inflation, gold, often viewed as a good inflation hedge, should remain supported – which is why we saw a new record high earlier this year.

Gold short-term outlook bearish

Although it didn’t quite get to $1900 last week before bouncing back noticeably, gold below its bearish trend line and within the “lower lows” series. So, the bearish trend is not over just yet. The bulls have been trying to reclaim the technically important 200-day moving average over the past two sessions, but for as long as the previous high at $1953 remains intact, the bears wouldn’t be too bothered. All told, a break below $1900 still looks like a strong possibility. If that happens, the next downside target for the bears will be liquidity below the August low of $1885 next.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R