- Gold outlook has been boosted on haven flows recently

- But rising bond yields and dollar pose threat to gold’s rally

- Gold technical analysis: Metal enters key area

Gold and silver continued their fine form on Tuesday, with the yellow metal adding another 1.8% to its recent gains. At nearly $1960, gold is now at its best level since late August. But is the good run of form about to end?

Gold outlook has been boosted on haven flows recently

So far, gold has found support on the back of haven flows due to the situation in the Middle East. But with the dollar maintaining its bullish trend and bond yields on the rise again, the opportunity cost of holding gold continues to rise. Therefore, it is not going to take much to slam gold back down. Perhaps if there’s a ceasefire between Israel and Hamas, then that could be the trigger. Judging by the way gold has rallied, it looks like investors are pricing in a sharp escalation in crisis in the region. If, hopefully, that doesn’t happen, then gold is at risk of reversing sharply lower.

Gold technical analysis

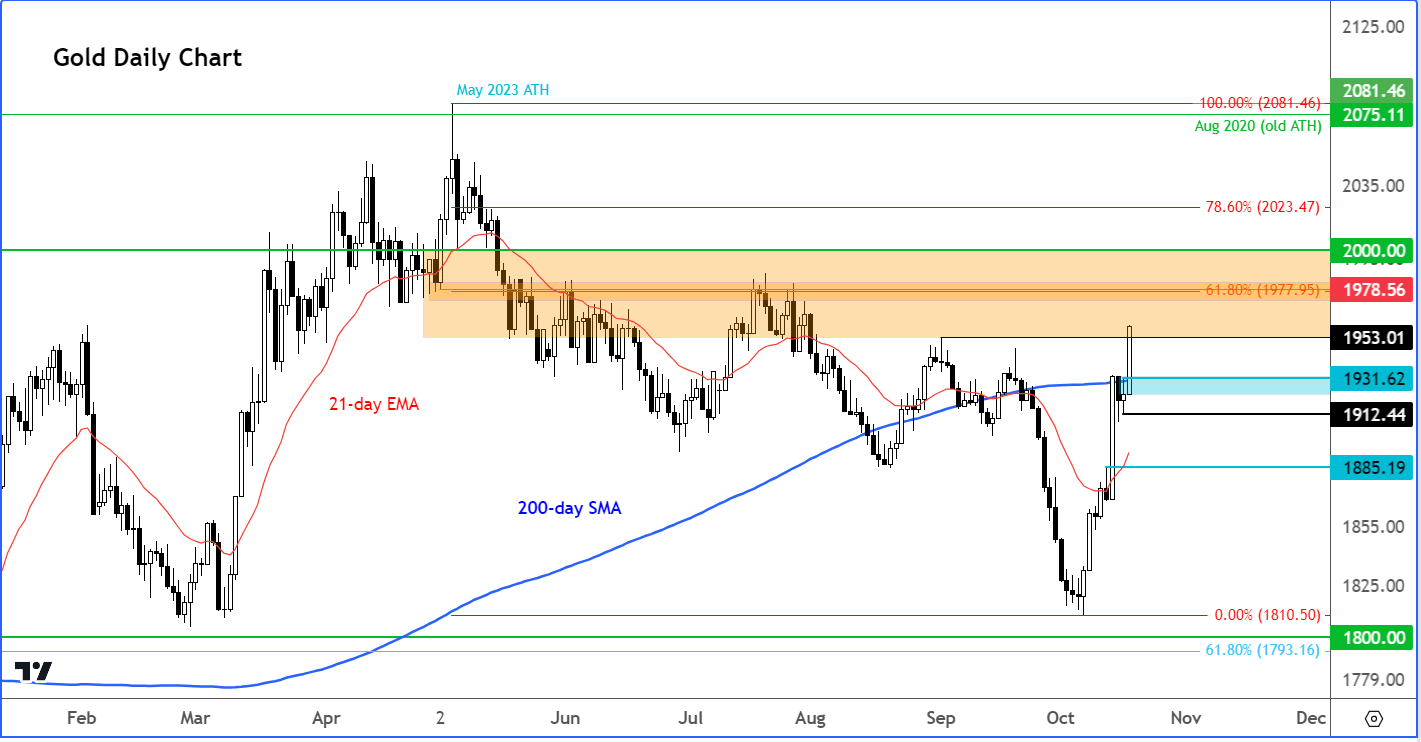

From a technical standpoint, while, clearly, the current bullish trend looks impressive, I am just wary of the fact that the metal is now looking a little ‘overbought’ in the short-term outlook. With gold breaking lots of short-term resistance levels of late, this has further aided the recent recovery, so what I would like to see now is a period of consolidation and some give-back, just to see whether the buyers will step in to defend broken resistance levels or not.

Interestingly, gold has reached a potential resistance zone now, around $1960 to $1980ish. Here, the metal struggled for significant periods during the summer months. So, let’s see if the sellers return here or we just slice through this zone like butter. Key support now is the base of today’s breakout around $1930ish where we also have the 200-day average converging. A closing break below this area would be bearish, in my view.

Source: TradingView.com

So, going forward, gold may at least slow down in its path, as the dollar and bond yields might outweigh the impact of haven demand.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R