Gold has looked healthier. Having put in a resilient performance in August, grinding higher in what was a traditionally difficult environment, the outlook has turned nasty in recent days, at least when priced in US dollar terms, breaking the uptrend established on August 21 along with the 50-day moving average. It may do the same with the 200-day MA in the near-term, threatening to close below it for the first time in 2023, ushering in the possibility of further losses ahead.

Gold undermined by higher real bond yields

The drivers behind gold’s pullback are well documents. Benchmark US 10-year real bond yields have moved back to 2%, within touching distance of fresh multi-decade highs. You can that on the chart below which shows the differential in yield between nominal and inflation-protected US Treasuries for the same duration. When real yields are this elevated, it undermines the appeal of gold given it does not provide income for investors.

Source: Refinitiv

USD strength the other key factor

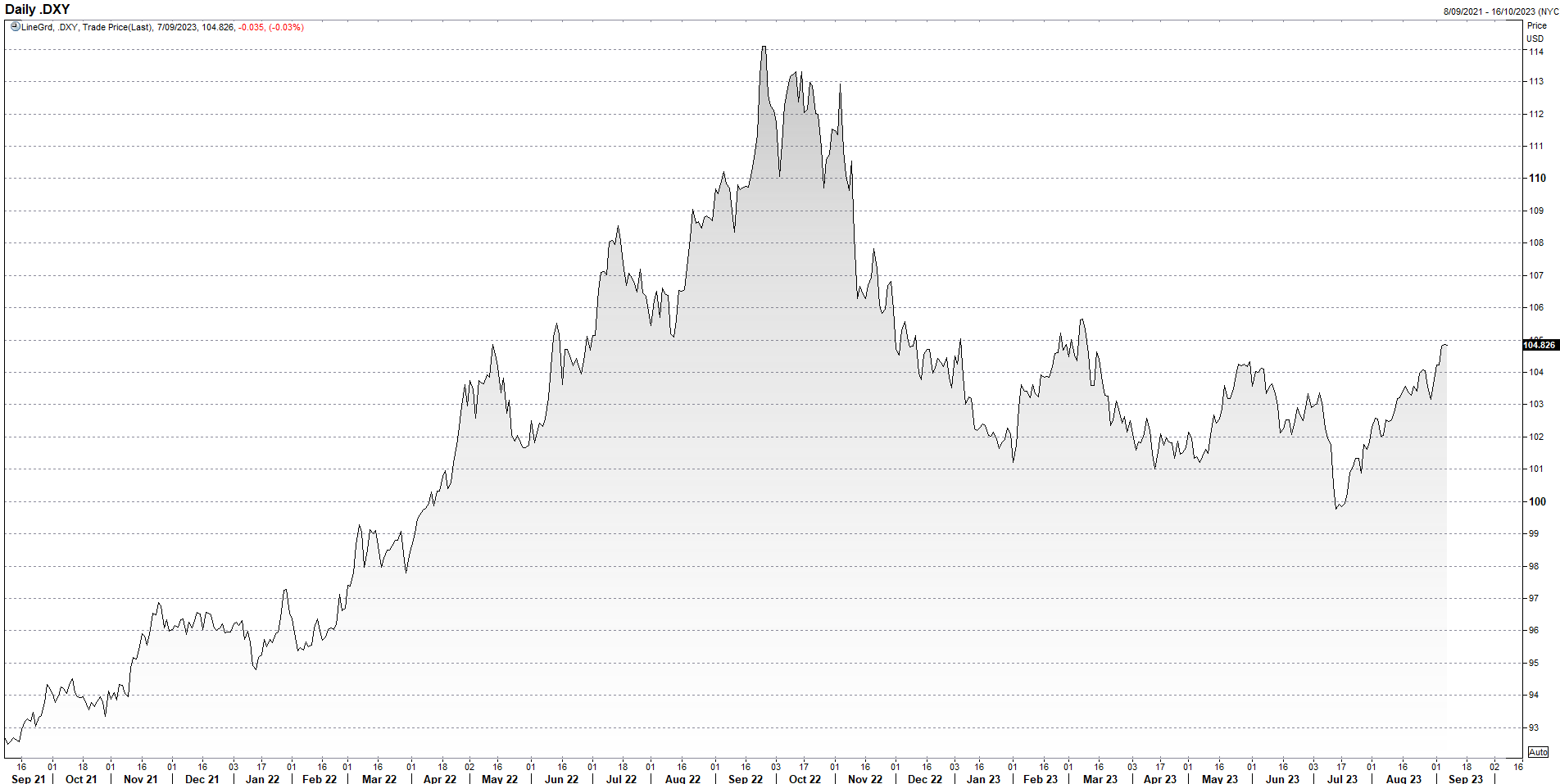

The other big factor is stronger US dollar which has discovered renewed upside momentum recently against almost every currency worldwide, be they G10, EM or in frontier markets. Here’s US dollar index (DXY) which has pushed to six-month highs, largely reflecting unrelenting weakness in the Japanese yen and, more recently, the euro. As the two largest weighting in DXY, their continued underperformance is driving the USD higher, weighing on gold which most investors value against the world’s benchmark currency.

While there are other drivers of price, if you’re taking a directional view on gold, you’re having to evaluate how the US dollar and bond yields will evolve. Right now, the momentum for both is higher.

Source: Refinitiv

On the charts, a break below the 200-day MA may lead to further downside pressure, continuing the series of lower highs seen on the daily since March. On the downside, resistance looms at $1885/oz and again at $1860/oz. On the topside, minor resistance is likely to be found above $1930/oz.

-- Written by David Scutt

Follow David on Twitter @scutty