Gold was down for the fifth consecutive session on Thursday, extending its weekly losses to 5% following last week’s 2% drop. The metal has pulled back around 9% from its latest all-time high hit at the end of October. The drop has certainly helped to work off gold’s severely overbought technical conditions on many time frames. Whether or not this turns out to be a major top, or a temporary pullback ahead of $3K, remains to be seen. But until we see a bullish reversal stick, the short-term gold forecast remains bearish – even if the downside could be limited from here on. But for now, the ongoing hawkish repricing of US rates after Trump's emphatic victory is keeping US dollar and yields underpinned, and buck-denominated gold undermined.

Gold forecast: Why has XAU fallen so much?

Gold’s ongoing weakness is a reflection of two major themes. First, it is the potential for US monetary policy to remain quite restrictive in 2025 under Trump, than would have otherwise been the case. With the US 10-year yield approaching 4.5% amid the hawkish repricing of US rates in 2025, the opportunity cost of holding low- and zero-yielding assets have been on the rise. Gold, which doesn’t pay any interest or dividends, has been among these assets, particularly because it was severely overbought. The second reason why gold is losing out is because investors are pricing out geopolitical risks. The US election uncertainty is now out of the way, which in itself means one less reason for holding the safe haven asset. But more to the point, with Trump wining quite comfortably in the end, this has given markets hope that the conflicts in the Middle East and between Russia and Ukraine could end when Trump starts his presidency next year.

PPI and Powell speech coming up

In as far as today’s macro calendar is concerned, we have a couple of important data releases including US PPI data and initial Jobless claims, along with speech from the Fed chair Powell. It is likely we could see gold prices react to these events.

After all, the PPI data could be a key driver for bond yields, as they closely relate to the core CPE, which is the Fed’s preferred inflation gauge. Economists are expecting a slight uptick in headline PPI from 0.0% to 0.2% month-over-month, while the core measure is seen steady at 0.2% in October.

Meanwhile, Powell will likely face questions about the latest inflation data and the potential effects of protectionist policies under Trump, on the central’s monetary policy in 2025. Gold could benefit if Powell avoids directly linking potential policy shifts to the Fed’s decisions, as this could dampen US rate expectations. As things stand, the market is cautiously pricing in just 50 basis points of easing by mid-2025 – a marked revision from before the US election. The market, though, has a tendency of making its own mind up, and any dovish Powell remarks might fall on deaf ears.

Technical gold forecast: XAU/USD key levels to watch

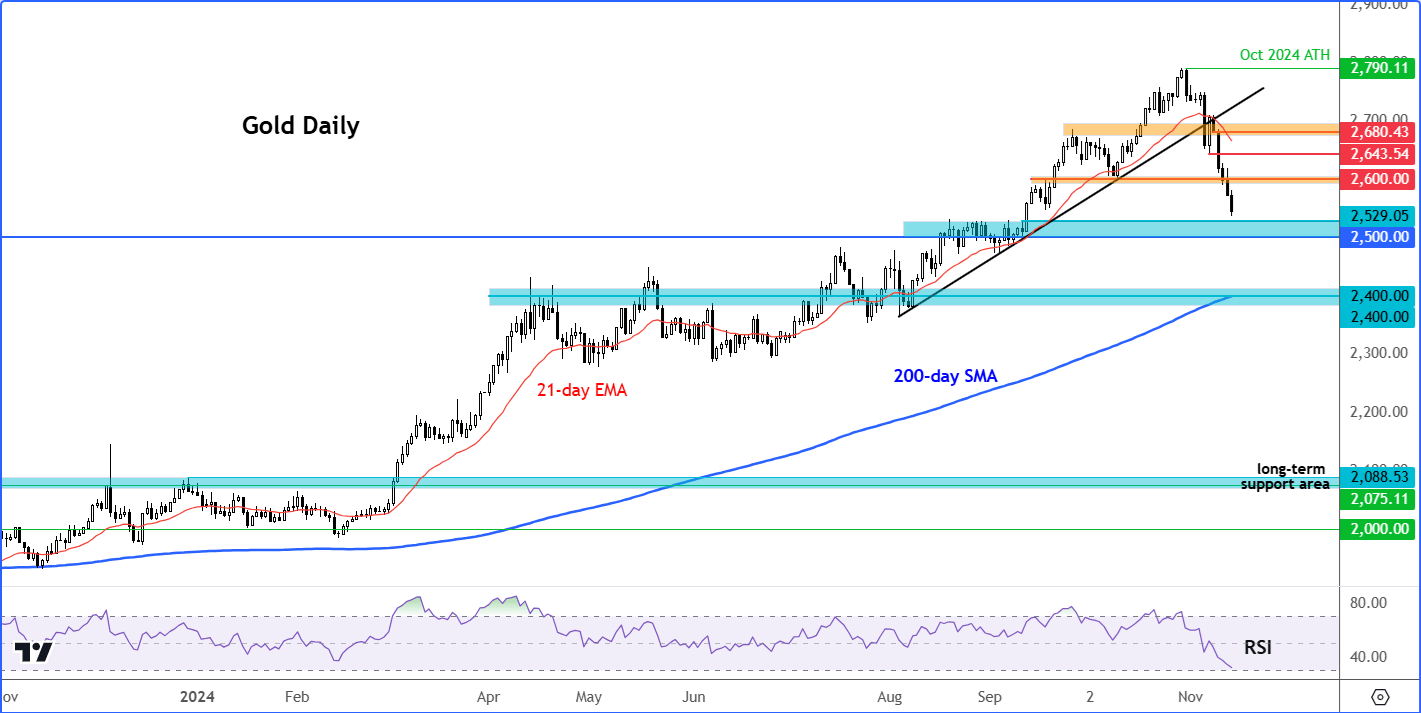

Source: TradingView.com

Gold is now nearing potential support around $2500 to $2530 and is no longer technically overbought on multiple time frames except the monthly. So, the potential for at least a short-term bounce is now there. But with several prior support levels broken down, the XAUUSD forecast and upside could be limited to around $2600 in the near-term outlook. This level was one of those broken support levels mentioned and is where the backside of the broken trend line comes into play. It needs to reclaim this trend line and level in order to discourage the bears from punishing the metal further.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R