Gold was higher in the first half of Wednesday’s session, as the US dollar gave back some of its gains from Tuesday. Metals and FX markets are now now likely to remain in a holding pattern until the Fed’s rate decision, which is set for 19:00 BST (14:00 ET) with Powell’s press conference taking place 30 minutes later. While we have seen a slightly stronger headline US retail sales and industrial production data in the previous session, these did not lead to any changes market’s pricing of the size of the rate cut, currently favouring a 50-basis point cut with a 65% probability. Therefore, gold could drop in case the Fed opts for 25 basis point cut today, which I think might be the case. As well as by the rate cut itself, the gold forecast will be influenced by the language the Fed chooses in today’s policy statement, press conference and the dot plots.

Gold forecast: What will the Fed decide?

Despite hotter inflation data from last week, attention has now shifted toward economic growth and the cooling labour market, prompting a dovish turn by the Federal Reserve. With the odds of a 25 or 50 basis point rate cut equally balanced, the US dollar has weakened, and this has kept gold supported. Gold investors are likely to remain cautious until the Fed announces its decision. The short-erm direction of gold will depend on how surprising the rate decision is, so traders aiming to reduce risk may prefer to wait for Fed Chair Powell's press conference, where he could hint at accelerating the pace of future rate cuts. Therefore, with a potential 25 bp cut, gold may initially fall on the back of the rate decision itself, but where it goes thereafter will depend on how dovish the Fed is with their dot plots and the forward guidance Powell may provide at his FOMC press conference.

Uncertainty remains high regarding the size of the rate cut. Last week's stronger-than-expected US core CPI and PPI inflation data led to speculation about a dovish shift. However, the rates market has since moved toward pricing in a 50-basis point cut, with a 60-65% probability, up from around 35% last week. If the Fed opts for a smaller 25 basis point cut, it will now surprise the market, likely causing a brief rally in the dollar—though this could be short-lived if Powell adopts a more dovish tone during his press conference.

Gold technical analysis and trade ideas

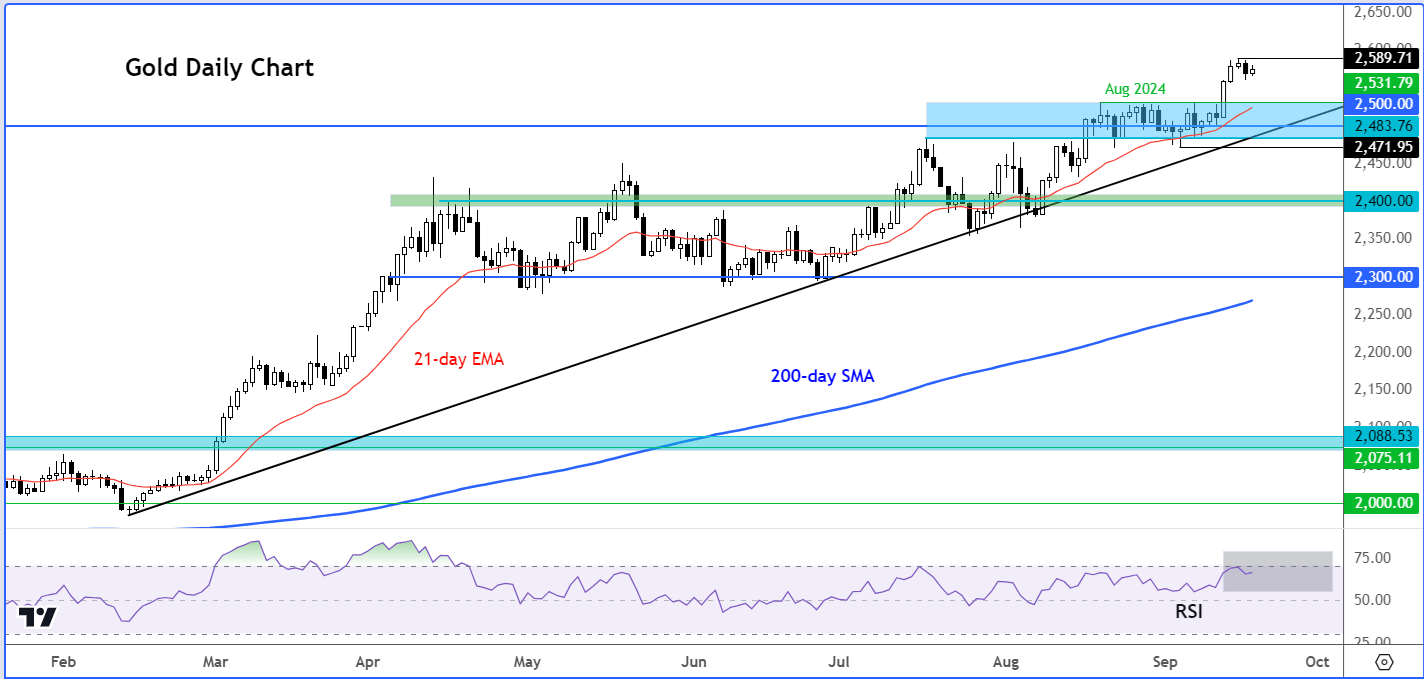

Source: TradingView.com

The underlying trend for gold price is undoubtedly bullish and will remain that way until we see a lower low form. However, the RSI indicator suggests gold is overbought and could ease back on profit-taking anyway, soon. If it does so, we will be looking for support to come in around $2530 initially, followed by $2500 and finally $2480ish. The line in the sand is now at $2471, marking the most recent low prior to the latest rally. If this level breaks, we will drop our short-term bullish gold forecast. On the upside, liquidity above this week’s record high of $2589 is the first objective, followed by the next round handle of $2600.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R