Key Events

- US Elections and Fed Rate Decision

- BRICS Summit

- Technical Analysis: XAUUSD

US Elections and Fed Rate Decision

The US elections are two weeks away, and so is the next Fed rate meeting. The uncertainty surrounding the election results, foreign relations, and their impact on the US economy is driving demand for gold.

Inflation remains a challenge to the expected monetary easing cycle, and with both political parties presenting differing stances on taxation and tariffs, investors are hedging their portfolios with gold until more clarity emerges.

BRICS Summit

The BRICS alliance (Brazil, Russia, India, China, South Africa), now including the UAE, Iran, Egypt, and Ethiopia, with Saudi Arabia invited, is poised to create significant geopolitical shifts.

Representing over 40% of global oil production and 29% of world GDP, BRICS decisions to establish a new monetary system independent of the US Dollar could weaken global demand for the dollar, further strengthening gold’s position as the ultimate hedge.

Technical Analysis

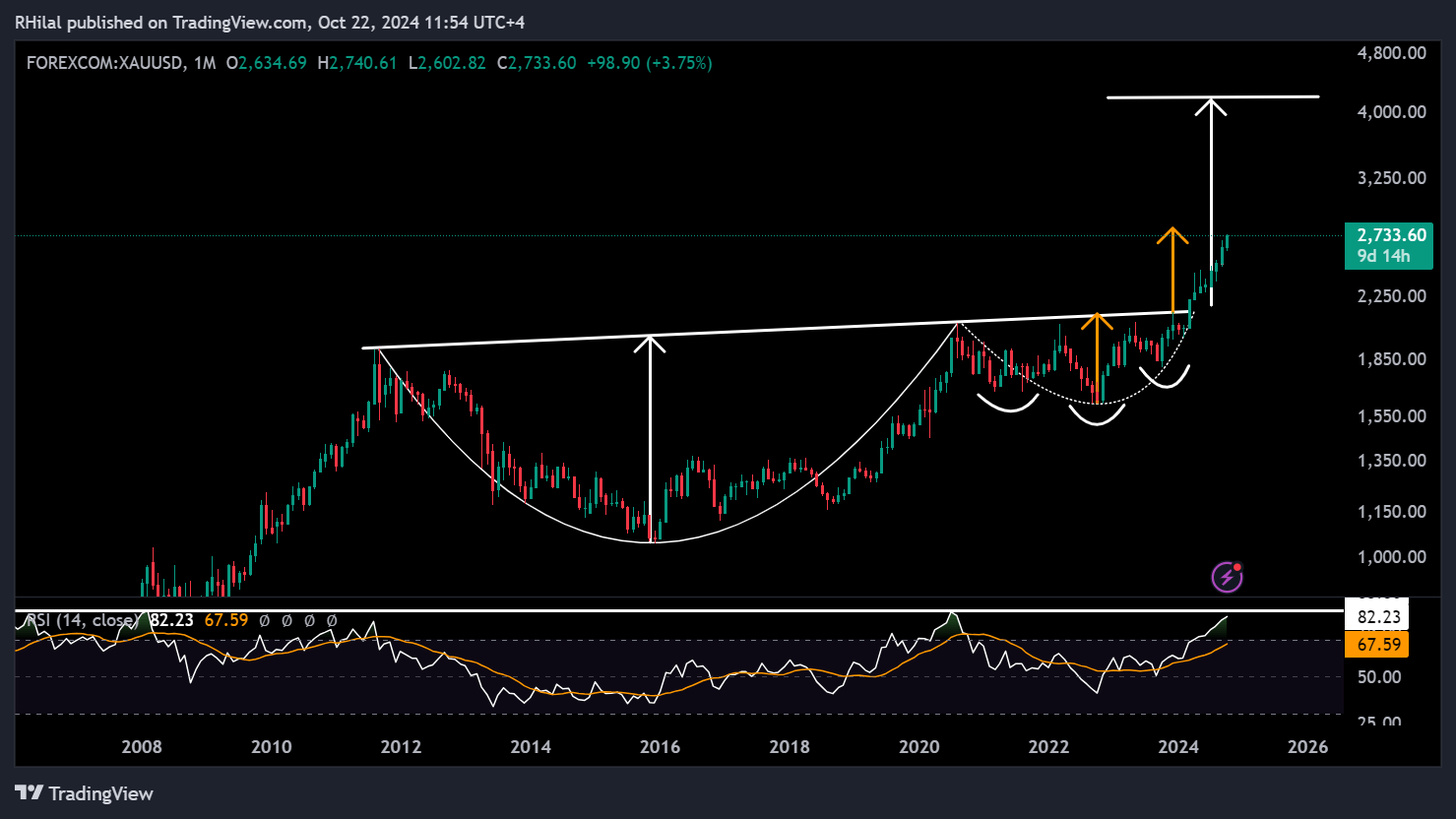

Gold Forecast: Monthly Time Frame – Log Scale

Source: Tradingview

Between 2011 and 2024 gold has followed a cup and handle price pattern:

- 2011 – 2020: cup pattern suggesting a potential breakout towards the $4,000-mark

- 2020 – 2024: handle formation with an inverted head and shoulders pattern, indicating a breakout towards 2760 – 2800.

Current price levels are approaching the inverted head and shoulders target, with a potential range extending between $2800 and $3,050.

Downside risks can be expected given the possible need for the trend to recharge with a pullback before proceeding with its primary uptrend.

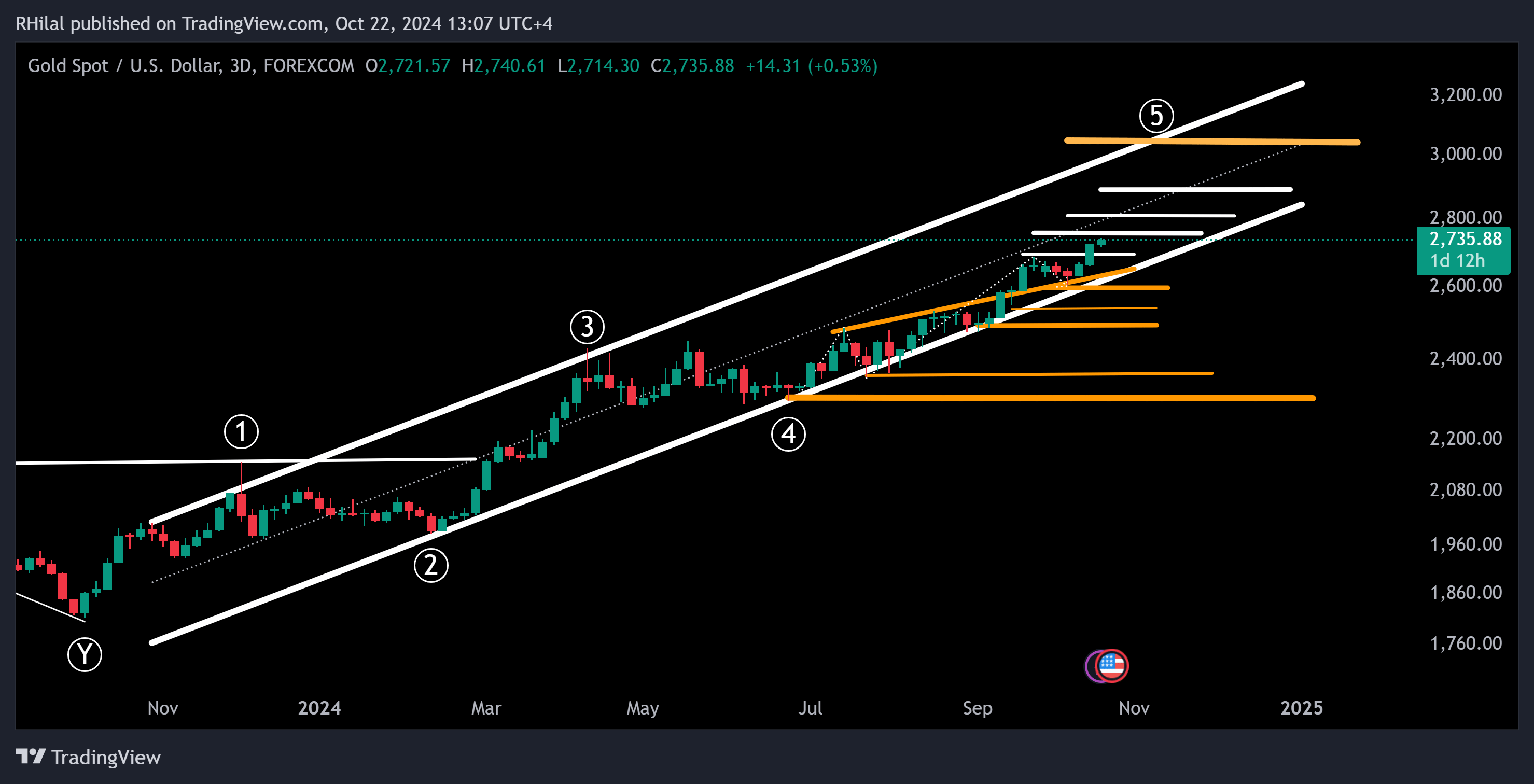

Gold Forecast: 3 Day Time Frame – Log Scale

Source: Tradingview

From a 3-day time frame perspective, the Relative Strength Index (RSI) indicator is in overbought territory, previously seen at the $2,430 high in April, signaling a possible pullback.

Bullish Scenario:

A strong close above $2,760 could push prices further to $2,800, $2,890, and eventually $3,050.

Bearish Scenario:

If momentum weakens at current highs, support levels around $2,680 and $2,600 could hold potential pullbacks. Should bearish momentum build further, a deeper drop could target $2,530 and $2,480, potentially initiating a longer-term bearish correction.

--- Written by Razan Hilal, CMT – on X: @Rh_waves