- Gold delivered strong gains in October (its third best month this year)

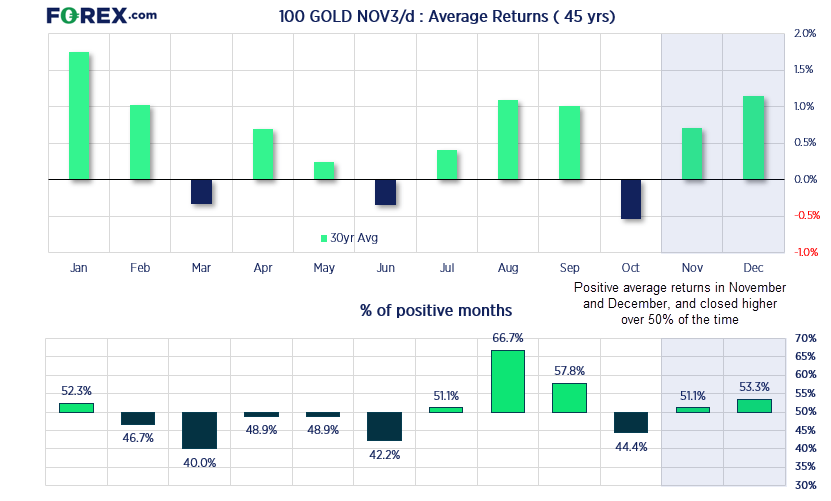

- Seasonality is on gold’s side for November and December, and is now within striking distance of its record high

- But a record high may not be a slam dunk, given the $2075 area has triggered three multi-month retracements since 2020

- Momentum is turning lower for gold on the daily chart, and shows the potential for a move to at least the $2050 area

Gold enjoyed its best month in seven in October, with its 7.3% rise forming a clear bullish engulfing candle and was its third best month of the year. Whether it can extend its rally and make a run for a new record high remains to be seen, but we have seen gold failed around the $2075 highs three times since 2020. What would be so different this time?

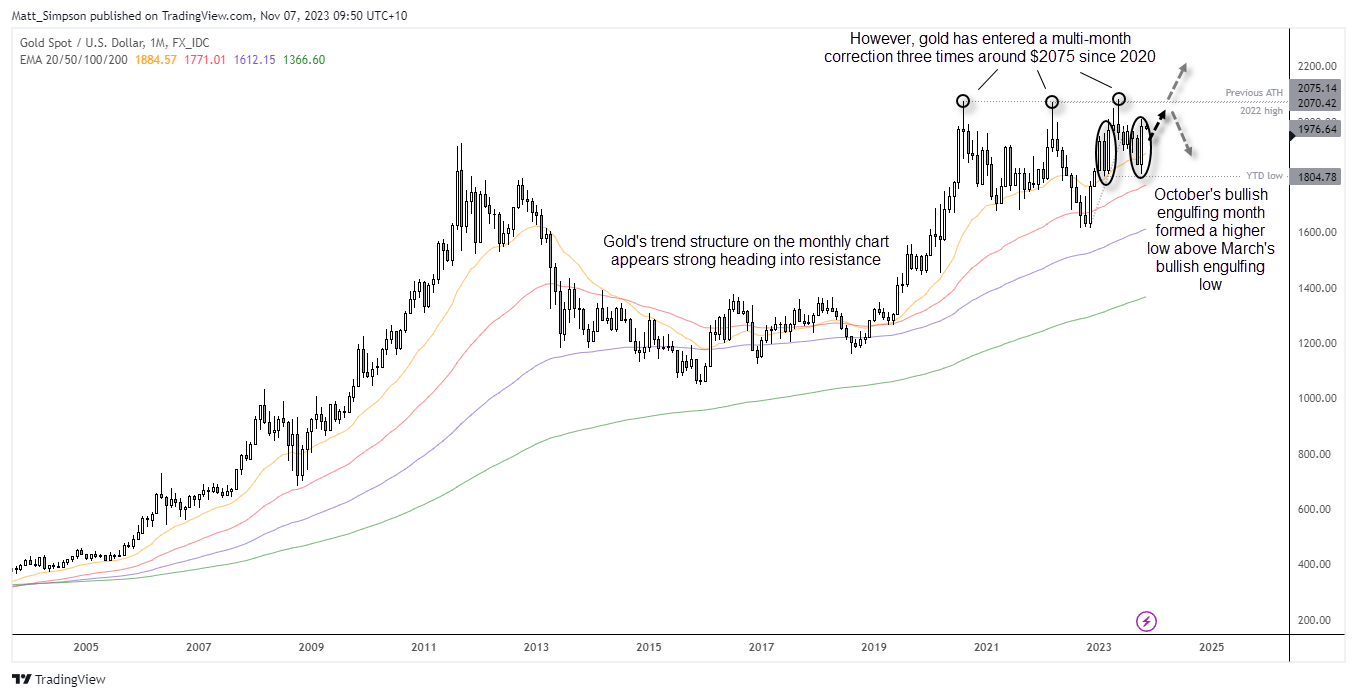

Gold technical analysis (monthly chart):

Well, we could argue that the structure on the monthly chart appears to be more bullish. October’s bullish engulfing low held above the bullish engulfing candle formed in March (a higher low) and momentum is now accelerating into resistance. Seasonality is also on its side, with November and December posting average positive gains over the past 45 years, slightly more than 50% of the time.

Yet the significance of these highs cannot be understated, given each rally to the $2075 area resulted with a multi-month retracement. But for gold to stand any chance of breaking sustainably above the previous high, we’d need to see the US dollar and yields move sharply lower. And that may require a refreshingly dovish Fed to be driven by another round of weaker US employment figures. It certainly is not impossible, but unless US data comes in weaker on aggregate then it seems plausible the Fed may want to push back against dovish market pricing, if inflation remains elevated.

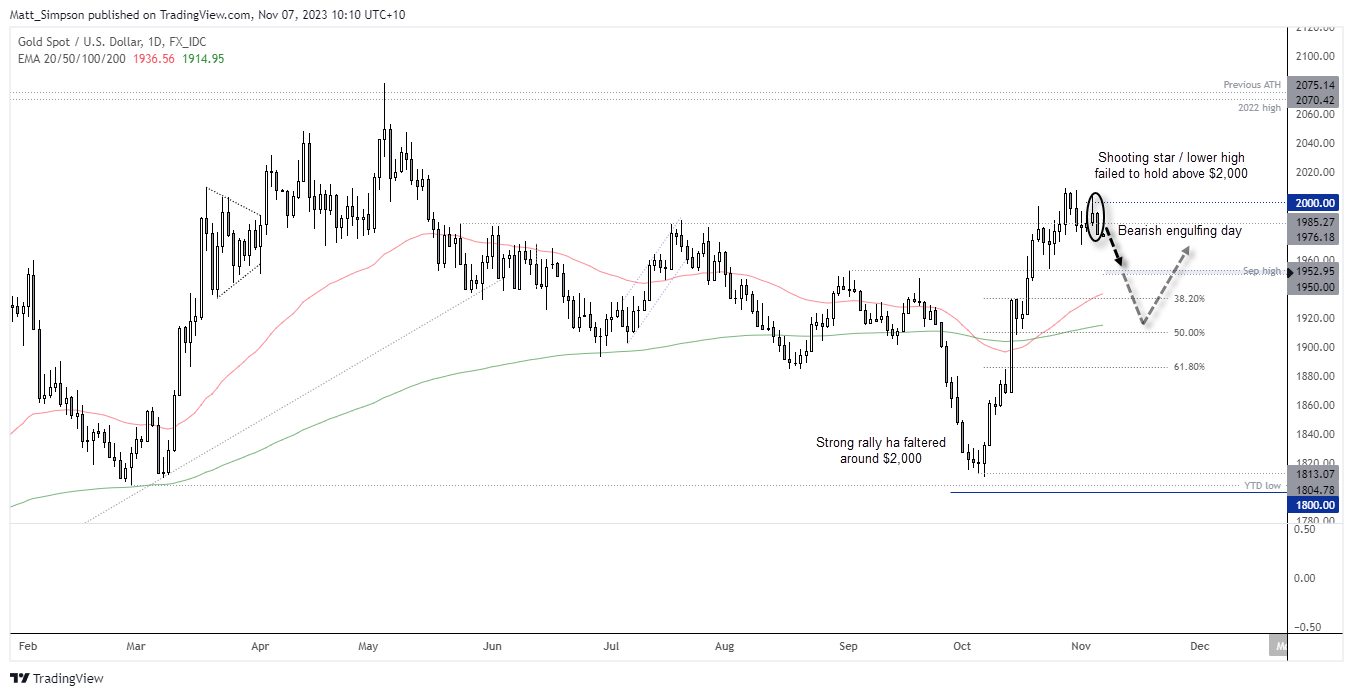

Gold technical analysis (daily chart)

Whilst we wait to see if gold can make a break for a new record high, I suspect gold is due a retracement lower on the daily chart. Gold prices surged nearly 11% over 15 days, and whilst it achieved a daily and weekly close above $2000, prices have since eased and momentum is trying to turn lower. A shooting star candle formed on Friday after failing to hold above $2000, which itself was a lower high and followed by yesterday’s bearish engulfing day.

A move towards the September high / 1950 handle seems plausible from a technical perspective, at which point I’d want to reassess its potential to form a swing low. But even a pullback to $1950 is quite shallow relative to its preceding move, meaning the 50 and 200-day EMAs come into focus (near the 38.2% and 50% retracement levels) should prices break beneath $1950.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge