Gold Explodes To 5-Year High Post-FOMC

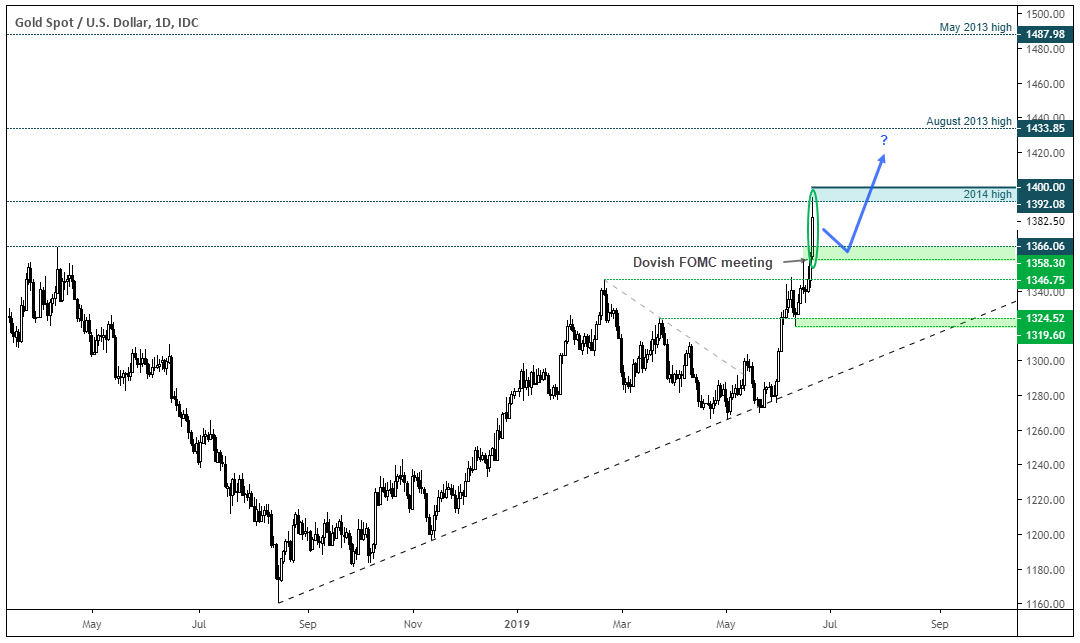

During a busy session for Asia and no less than three dovish central banks, gold exploded to a 5-year high and stopped just shy of $1400. With an increasingly bullish trend structure on the monthly charts, we remain bullish after prices have had a chance to pause for breath.

The Fed had confirmed their dovish stance nearer the end of the US session, with nearly half of the voting FOMC members expecting two cuts this year. Shortly after, RBA’s Philip Lowe hit the wires to hammer home their dovish views and all but confirm another cut is on the horizon. And, let’s not forget that RBA teased the notion of QE in their June minutes, adding that “Lower interest rates were not the only policy option available to assist in lowering the rate of unemployment”. Not wanting to miss out, BOJ reiterated their ultra-easy policy and expect to keep ‘extremely low rates at least through spring 2020’. Given the backdrop of trade wars and deteriorating economic data, the pressure if building for BOJ to stimulate the economy further. And, of course this is all after Draghi shot down the Euro with potential for ECB to ease further, earlier this week.

Put together, the demand for gold has shot through the roof and pushed the yellow metal to an intraday 5-year high.

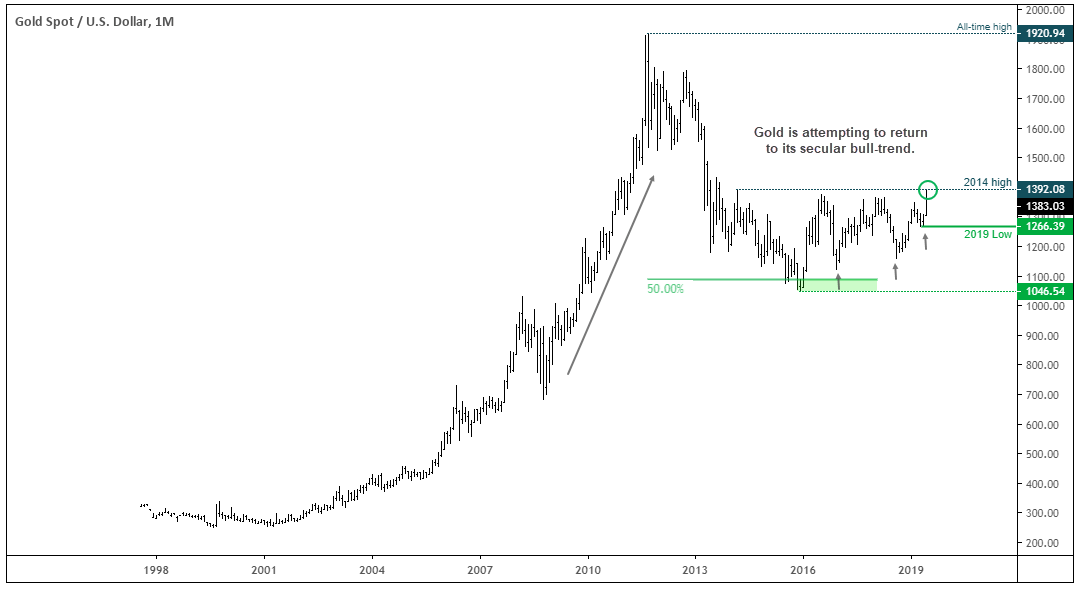

Starting with the bigger picture, we can see on the monthly chart that the fall from the all-time high stopped around the 50% retracement level, before grinding higher since the 2016 low. However, a series of higher lows have formed to show demand picking up into the 2014 high. Whilst this timeframe I too large to trade for many, the bigger picture suggests gold is trying to return to its secular bull-trend.

Switching to the daily chart shows the spike higher which momentarily touched a 5-year high. Given the strong fundamentals driving gold, we expect the trend to breakout in due course. However, gold appears technically over stretched over the near-term, especially since today’s high stopped just short of $1400 and has retreated below the 2014 high.

- Given the strong resistance below $1400, we’d like to see prices pause for breath and build a new level of support, on lower volatility.

- Ideally a retracement will form above the $1358.30 - $1366 zone before its next leg high.

- If it can clear $1400, the August and May 013 highs come into focus around $1433 and $1487 respectively.

Related Analysis:

FOMC Recap: Fed Doves Play Catchup With Markets

Gold poised for breakout as central banks depress yields

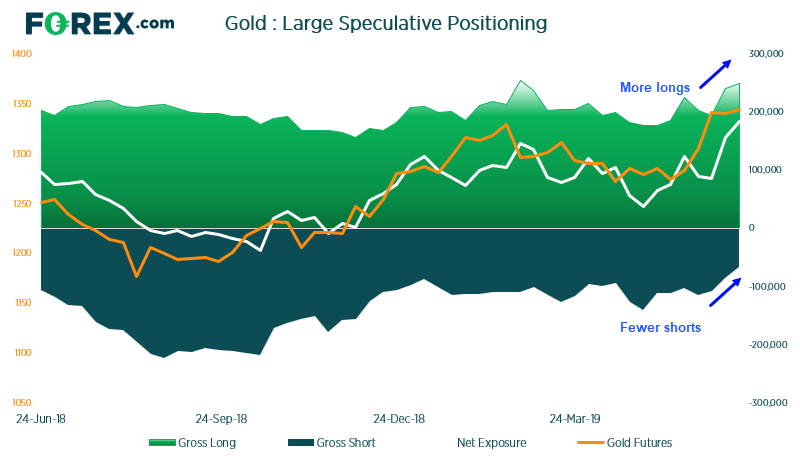

Weekly COT Report: Gold’s Net Long Exposure Hits A 14-Month High

A Glimmer Of Light For Gold