- Gold has pushed higher recently despite higher US bond yields and stronger US dollar

- Focus next week likely to return to softening US inflationary pressures

- That may pressure USD which normally provides tailwinds for gold

Gold: there’s not a lot not to like

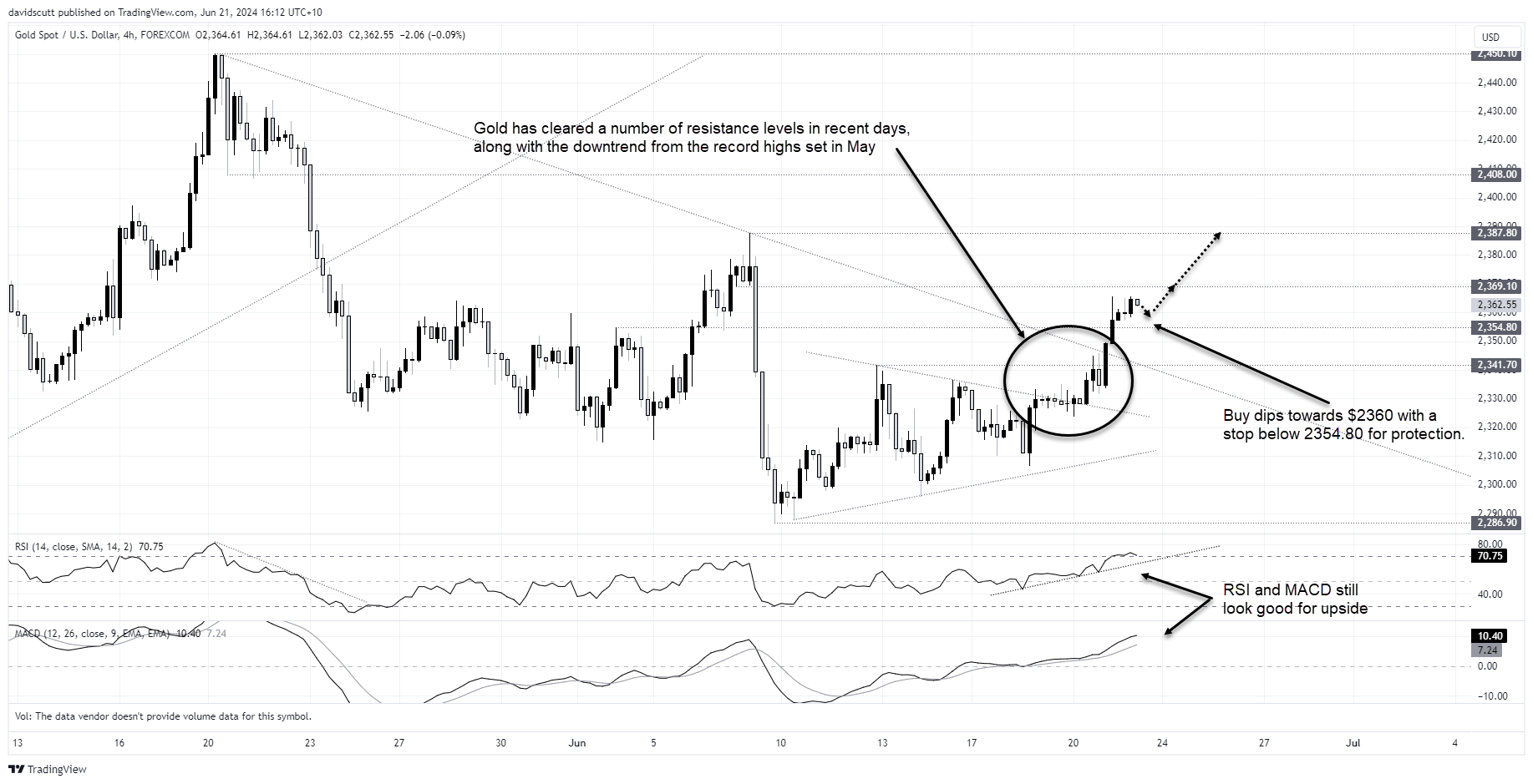

Gold has been on a nice run recently, breaking out of the pennant it had been coiling in before doing away with the downtrend dating back to the highs set in May. Considering the drift higher in US bond yields, along with a stronger US dollar, the move has been doubly impressive. Even on Friday, when most base and precious metals are weaker in Asia, gold continues to grind higher, consolidating on the bullish break earlier in the week. There’s not a lot not to like.

US disinflation returns to radar

Given evidence of renewed disinflationary forces in the United States, and the increasingly soft US economic data accompanying it, there’s a decent chance the US dollar and Treasury yields may come under pressure next week if the Fed’s preferred inflation measure, the core PCE deflator, mirrors weakness in other measures seen earlier in the month.

If such a scenario were to eventuate, it would normally provide to tailwinds for gold. Considering the constructive price action and how the narrative on US inflation is likely to evolve in the coming days, the case for adding long gold exposure looks decent in the near-term.

Long gold setup

Turning to the charts, and mirroring the bullish price action this week, momentum on the 4H timeframe remains to the upside with MACD and RSI signaling building strength. While the latter sits in overbought territory, it’s not at the level that warns of an imminent risk of a snapback in price. Nor is price overbought on longer timeframes.

Given $2354.80 acted as support and resistance in early June when gold was last around these levels, it comes across as a decent level to build a bullish trade around.

Initiating longs around $2360 targeting the June high of $2387.80 is one potential setup, allowing for a tight stop to be placed below $2354.80 for protection. $2369.10 is a level where some resistance may be encountered given it acted as support briefly in the first week of June.

-- Written by David Scutt

Follow David on Twitter @scutty