Gold is back in favour. The prospect of looser monetary policy, a weaker dollar and elevated geopolitical tensions in the Middle East has put the gold bulls firmly back in control. Gold touched $1400 for the first time since 2013 on Friday. The question is can is last?

This week the Federal Reserve shifted towards a more dovish stance, opening the door to interest rate cuts should the economy require it. This weakened the dollar making gold cheaper for holders of other currencies, boosting its appeal.

The Fed joined the ECB and the RBA who had already adopted a more dovish stance by signalling that they are prepared to do more to support their ailing economies as headwinds build. Non-yielding gold performs well in low interest rate environments as the opportunity cost of holding a non-interest paying asset declines.

In addition to more dovish central banks, gold is getting a boost from its safe haven status. Elevated tensions in the Middle East following the downing of a US drone as seen flows increase into the precious metal.

This trio of factors is keeping gold at six-year highs. For as long as these factors remain relevant, we expect gold to remain buoyant. Gold bugs will want to see US data printing on the softer side. The CME FedWatch tool shows the market pricing in a 100% probability of a rate cut in July. The next big risk for gold could be if the Fed fails to deliver in July.

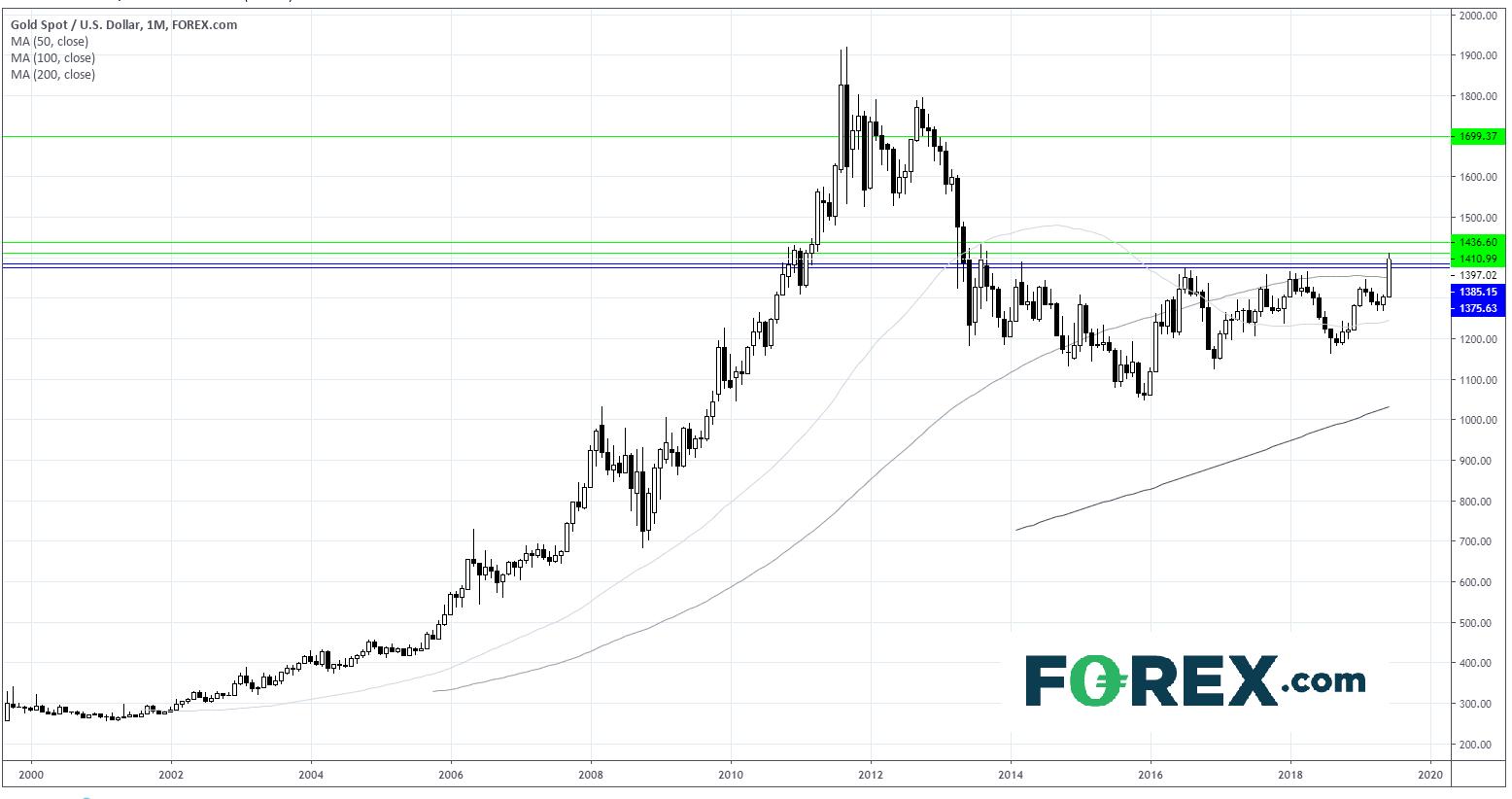

Gold levels to watch:

Gold surged to a high of $1414.95 in early trade, it has since eased back to support at $1400. Given the almost 5% surge in the price of gold this week, we could expect to see consolidation here before any further big moves. That said should gold manage a move above $1435, the road then to $1700 looks relatively straight forward.

Latest market news

December 20, 2024 04:14 PM

December 20, 2024 02:45 PM

December 19, 2024 10:26 PM

December 19, 2024 05:22 PM

December 19, 2024 02:23 PM

December 19, 2024 01:56 PM