Gold, Bitcoin Key Points

- Both Gold and Bitcoin extended their near-term bullish momentum to hit record highs today.

- Some analysts speculate Gold and Bitcoin are rallying on the prospect of lower interest rates in the future to keep sovereign debt loads manageable.

- Regardless, both Gold and Bitcoin remain “buy the dips” trades until proven otherwise.

Gold, Bitcoin Fundamental Analysis

March 5th, 2024 is a day that may well be etched into “fiat currency skeptic” history books.

Both Gold, the currency alternative with thousands of years of history as an alternative “store of value,” and Bitcoin, the proverbial “New Kid on the Block” when it comes to non-fiat currencies, hit all-time record highs this morning. Crucially, both these moves are occurring against a backdrop of relatively high interest rates (4.5%+ across the developed world).

Any time you have a huge market move, there are inevitably going to be multiple catalysts. From elevated risk appetite to sticky inflation to record debt levels to ongoing geopolitical tensions in the Middle East and Eastern Europe, there are plenty of reasons that traders are seeking out alternative to traditional fiat currencies in the current environment.

When it comes to gold, my colleague Fawad Razaqzada nailed it earlier today: “Gold’s rally has been fueled by speculation surrounding a potential shift in Federal Reserve policy and lingering geopolitical uncertainties that have bolstered demand for the precious metal, seen as a haven asset. There have also been some concerns about a possible downturn in equity markets, especially in the technology sector following the recent eye-watering gains.”

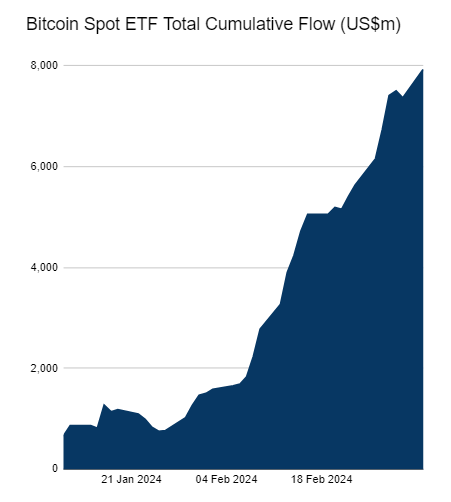

For Bitcoin, excitement about the upcoming quadrennial “halvening” of the cryptocurrency’s new supply and relentless inflows into US ETFs ($8B in less than 8 weeks) are driving the entire crypto space higher:

Source: Farside Investors

From a bigger picture perspective, some analysts are speculating that the market is “sniffing out” the fact that the US and other developed countries will be unable to maintain high interest rates for long given their record debt loads. In that view, the only way to alleviate the long-term fiscal concerns is through default or a “stealth default” through inflating away the debt. I’m personally skeptical of this view, but with the world’s most prominent alternative “currencies” hitting record highs within hours of each other, it’s certainly worth watching.

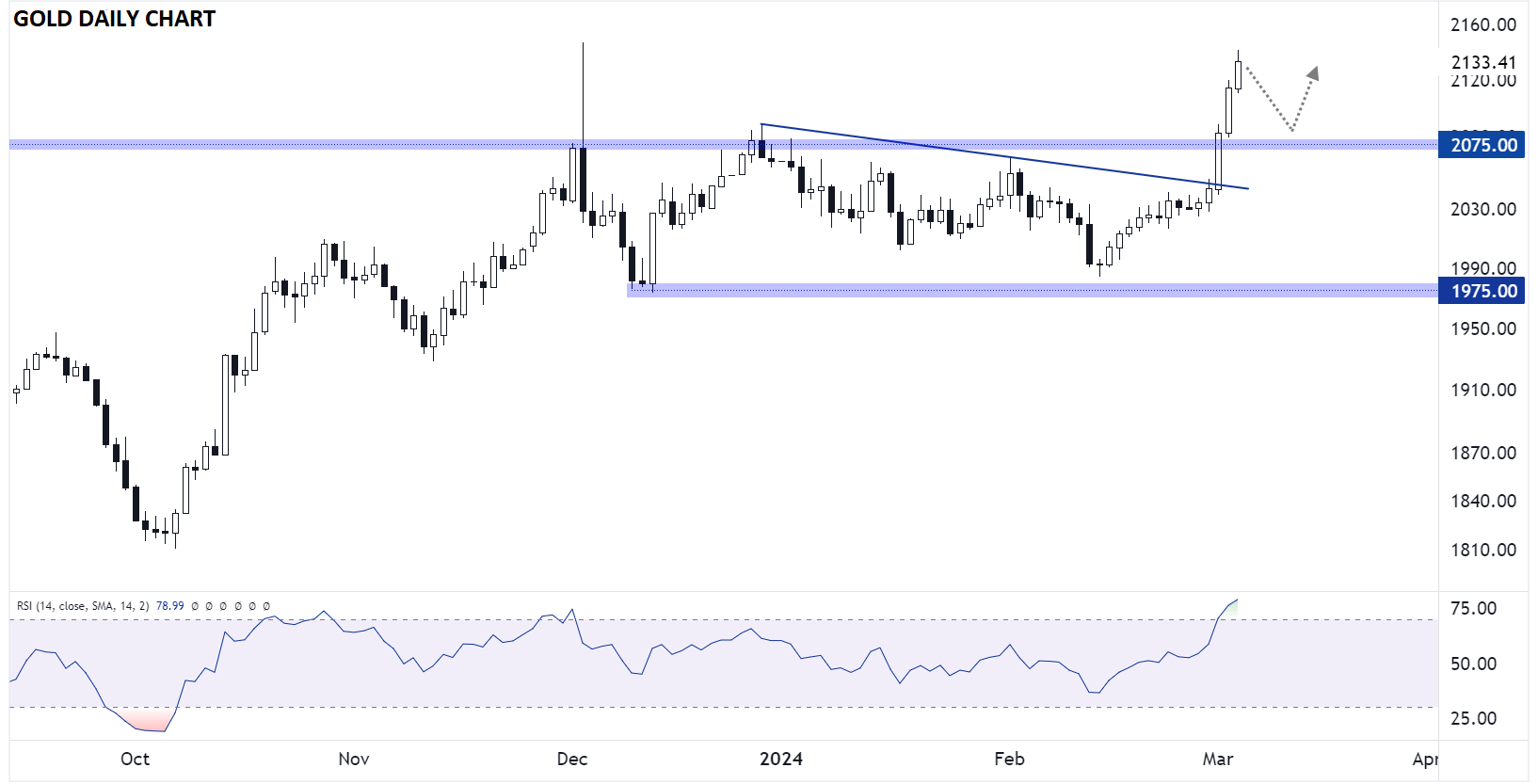

Gold Technical Analysis – XAU/USD Daily Chart

Source: TradingView, StoneX

After spending three and a half months consolidating in the $1975-$2075, Gold finally broke out to set a new weekly closing high last week. As the chart above shows, that momentum has carried over into this week, with the yellow metal reaching as high as $2,140 intraday. Technically speaking, the momentum remains clearly at the back of the bulls, though with prices well into overbought territory, a near-term dip back toward previous-resistance-turned-support at $2075 cannot be ruled out. As long as the precious metal remains above that level though, the path of least resistance will remain to the topside.

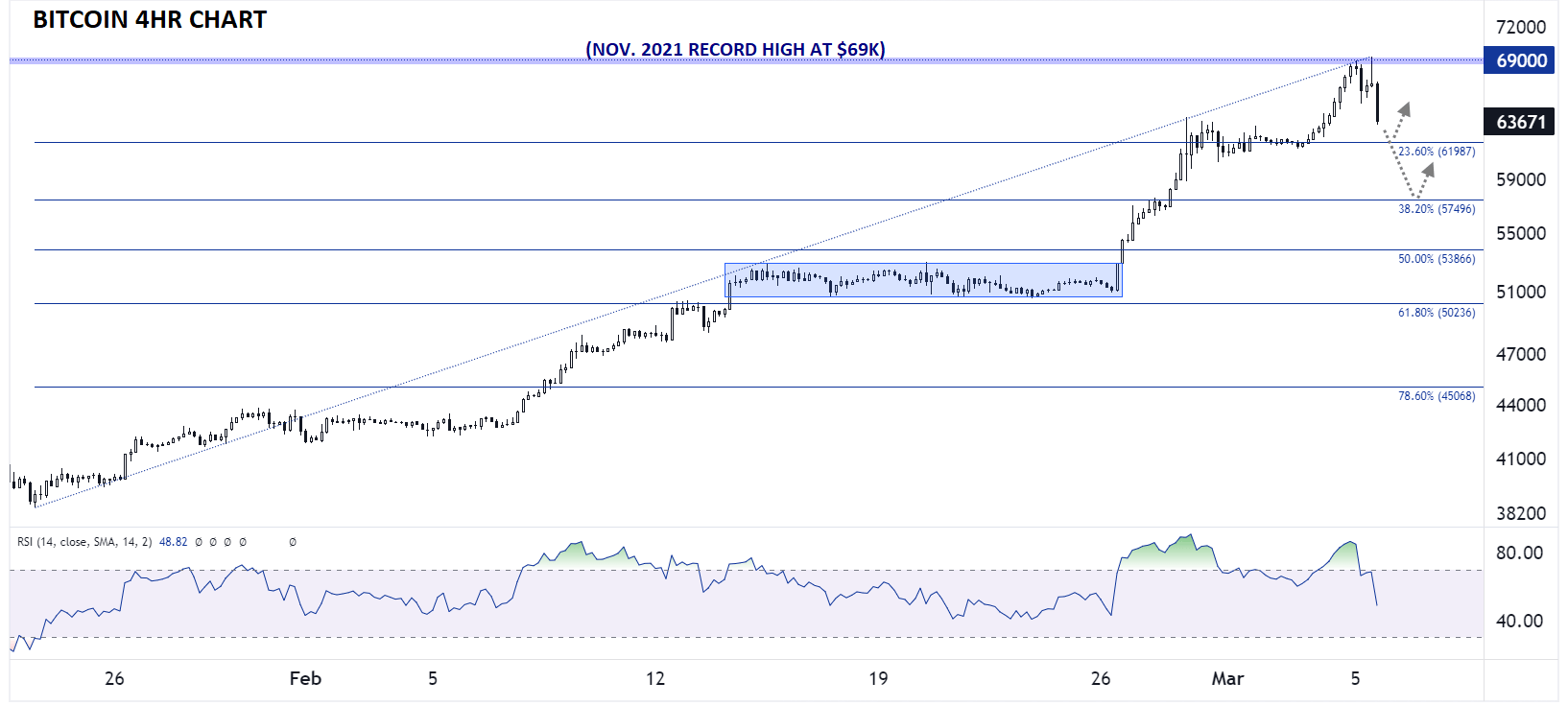

Bitcoin Technical Analysis – BTC/USD Daily Chart

Source: TradingView, StoneX

Despite the bullish catalysts highlighted above, Bitcoin has seen intraday selling pressure emerge after tagging a record high above $69K. As the chart above shows, Bitcoin is extremely extended on the 4-hour chart, so a deeper retracement would be logical, with the first support levels to watch coming around $62K (23.6% of the 6-week rally) and $57.5K (38.2%).

As with Gold however, the longer-term bias remains in favor of the bulls, so swing traders may look at any near-term dips as opportunities to join the established uptrend at a better price.

-- Written by Matt Weller, Global Head of Research

Follow Matt on Twitter: @MWellerFX