Another week, another record high for net-short exposure to the US 2-year bond. And as yields have risen since the data was collected last Tuesday, I suspect we’ll be looking at another new record when the next report is released on Friday. So whilst positioning is clearly at an extreme and at risk of a nasty reversal at some point, we’re yet to see that materialise on prices.

Clearly, higher yields have benefitted the US dollar which helped the US dollar index rise for a sixth week. Although such sequences are quite rare so we’d expect a bearish week at some point, which could help the likes of AUD/USD and gold hold above key trendlines (as seen below).

This content will only appear on Forex websites!

Read our guide on how to interpret the weekly COT report

This content will only appear on Forex websites!

Read our guide on how to interpret the weekly COT report

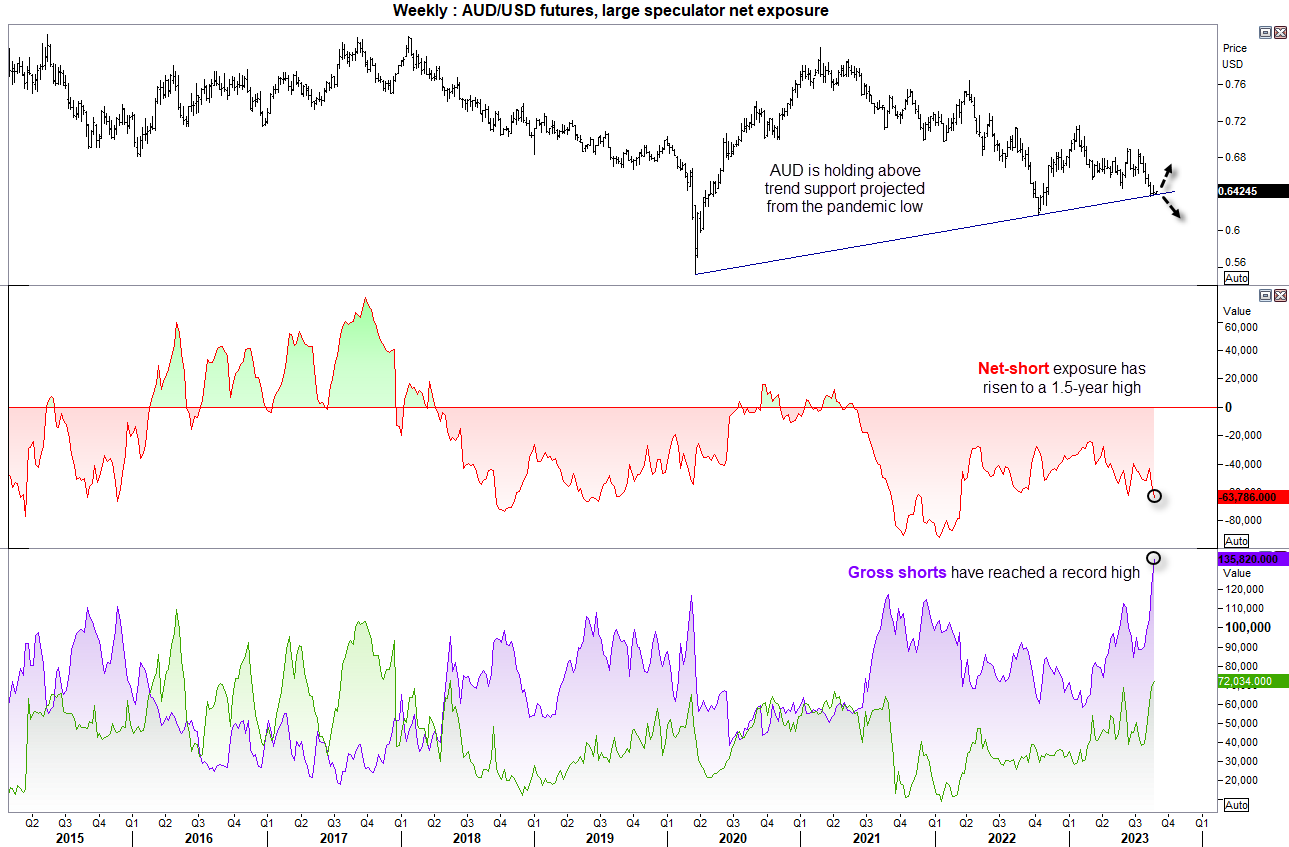

Australian dollar futures (AUD/USD) – Commitment of traders (COT):

AUD/USD bears have come out in full force with large speculators sending gross short exposure to a record high. Interestingly, gross longs have also risen and now sit at a 5-year and 3-month high, but bears clearly have the stronger following. This has sent net-short exposure to a 76 week high. And whilst net-short exposure may not be at an extreme, gross-short exposure may well be. And if prices continue to hold above trend support projected from the pandemic low, bears may be forced to cover and trigger the bullish rally they’re hoping to avoid. And with the Fed hinting at another rate hike, it could shake some AUD bears out of their shorts of Australian inflation data comes in hotter than expected on Wednesday.

Gold futures (GC) - Commitment of traders (COT):

Sentiment towards gold futures remained fragile, although gold has resisted the urge to break beneath 1900 support. However, large speculators were their least bearish in just under six months whilst managed funds were on the cusp of flipping to net-short exposure for the first time since November. However, prices rallied over 1.3% on Wednesday, the day after data for this report was collected – and prices have remained elevated despite a hawkish speech from Jerome Powell at the Jackson Hole symposium on Friday. And if gold struggles to trade lower from here, I suspect bears will be questioning their positions and may be forced to close and help fuel a rally.

Dow Jones Industrial futures (DJ) - Commitment of traders (COT):

Dow Jones futures enjoyed a very brief spell with net-long exposure among large speculators. Three weeks, to be exact. Yet they flipped to net-short exposure the week before last and expanded their bearish exposure last week. Asset managers were also on the cusp of flipping to net-short exposure, with both groups of traders increasing gross shorts and trimming gross longs. The question now is whether we’ll see the market rally from trend support and force bears to cover, bears are already positioned correctly for an anticipated break of trend support.