Precious metals have benefited from rising oil prices fanning inflation worries and French elections uncertainty providing added haven demand for gold and silver. A weakening US dollar this week has further aided the gold and silver recovery. Investors are looking forward to the release of some important US data ahead of US Independence Day break on Thursday. Today’s data dump includes the ADP private payrolls, unemployment claims, factory orders and ISM services PMI. Friday will see the release of the June payrolls data. Judging by a weaker US dollar (outside of the USD/JPY pair), it looks like investors are expecting this week’s data to be overall on the weaker side. In any case, our bullish gold and silver forecast remain unchanged.

Gold forecast: XAU/USD could shine brightly again after recent consolidation

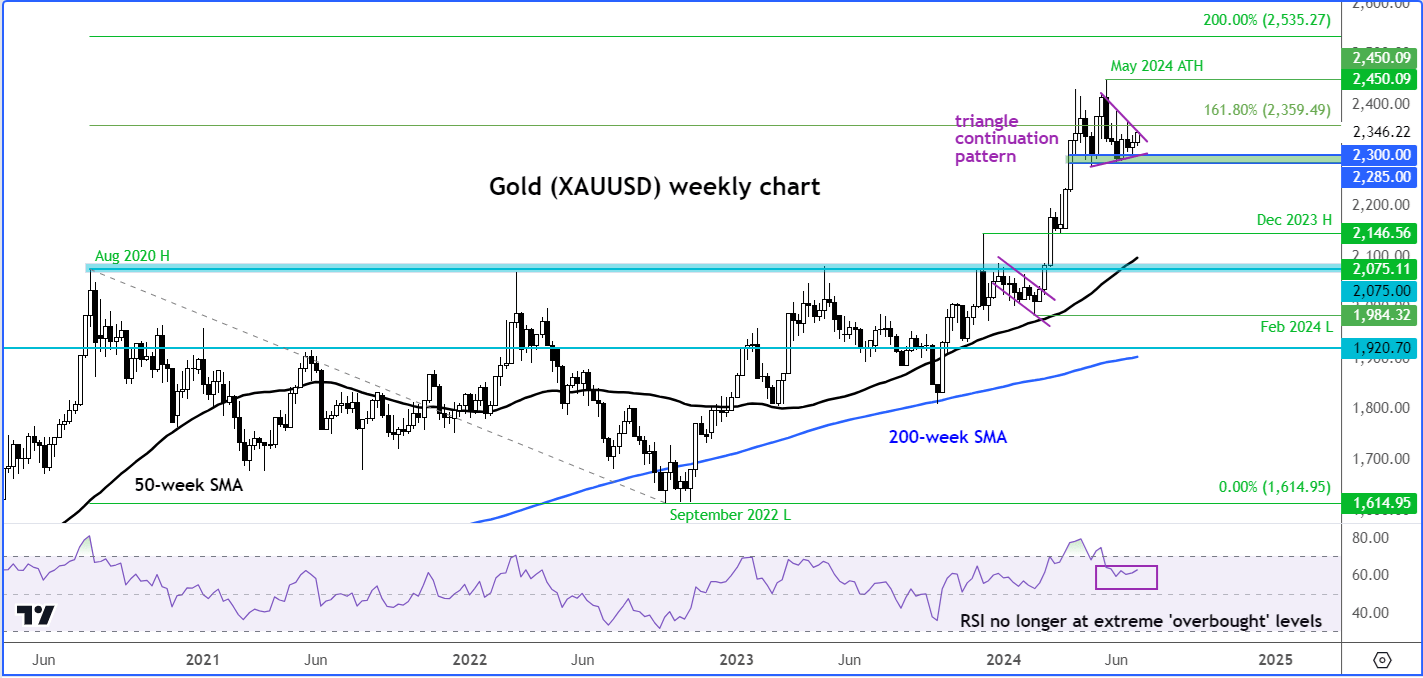

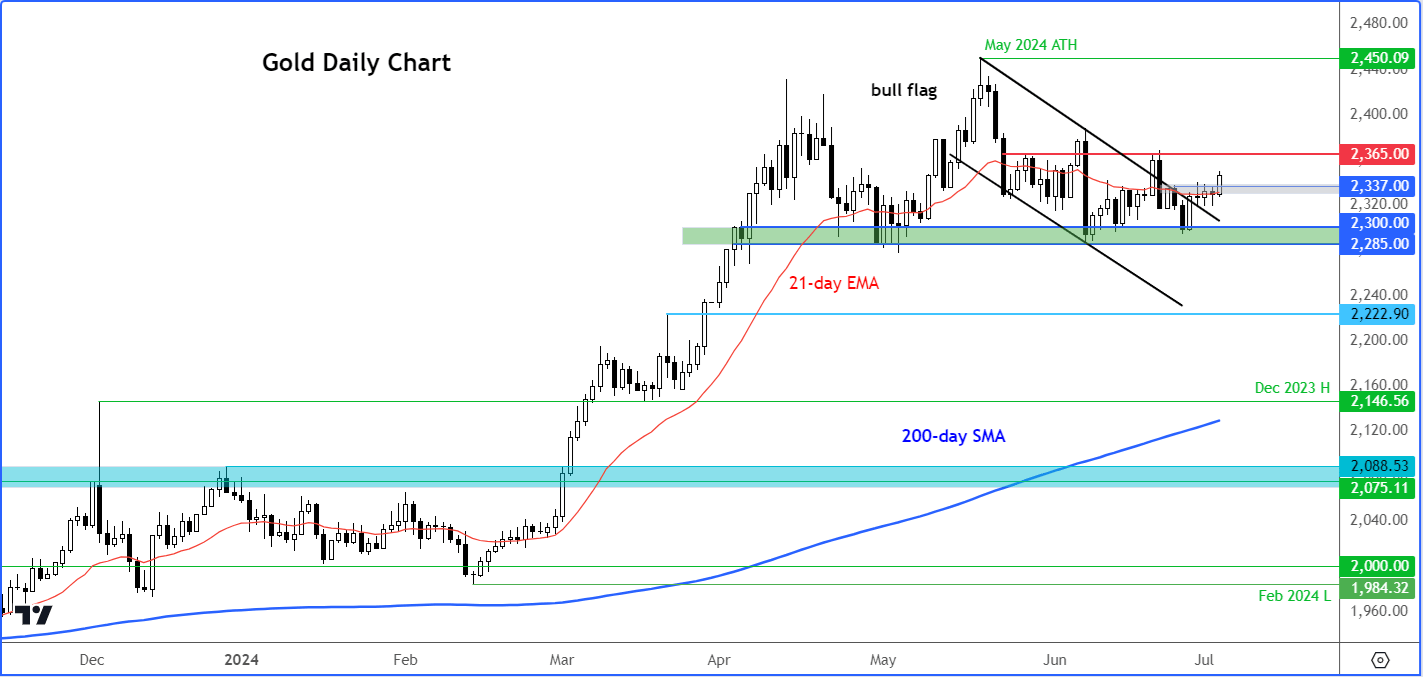

Gold and silver have moved in the positive territory on the week, keeping the long-term charts looking bullish. Throughout June, gold traded within a narrow $100-range, peaking just above $2387 and bottoming just below $2287. This was the first month since February without any new record highs, following a series of all-time highs in the period between March and May. The consolidation paused the rally, but no significant reversal patterns emerged to concern bullish investors. After a quieter June, the bullish trend might resume this month. The charts certainty point that way for both gold and more so silver.

The higher highs and higher lows remain intact despite recent concerns about waning momentum on gold. The metal hit a new all-time high in May before going into a multi-week consolidation phase. The consolidation has eased the 'overbought' conditions in the Relative Strength Index (RSI) on the weekly and monthly charts, primarily through time rather than price action, indicating a bullish sign.

While on the lower time frames you might be able to spot a potential head and shoulders reversal formation, on the weekly gold chart this is not very visible and instead one could argue it is starting to break out of a symmetrical continuation pattern. In any case, gold hasn't broken key support and what would be the neckline of that potential H&S pattern around the $2300 area yet.

So, I reckon gold another bullish breakout may be on the cards. The bears will need to exert significant pressure to reverse the long-term bullish trend, which, until now, they have failed to do.

Gold has broken $2340ish resistance level, which may now turn into support on a potential retest from above. Its next potential resistance level comes in at $2365. A move above this level would further fuel the bulls' confidence that it has resumed its trend and that a new all-time high could be achieved soon.

BUT, if the breakout fails, and gold goes on to break the $2300 support instead, then only in that case will I drop my short-term bullish view on gold. In that potential scenario, we may see some my base case scenario.

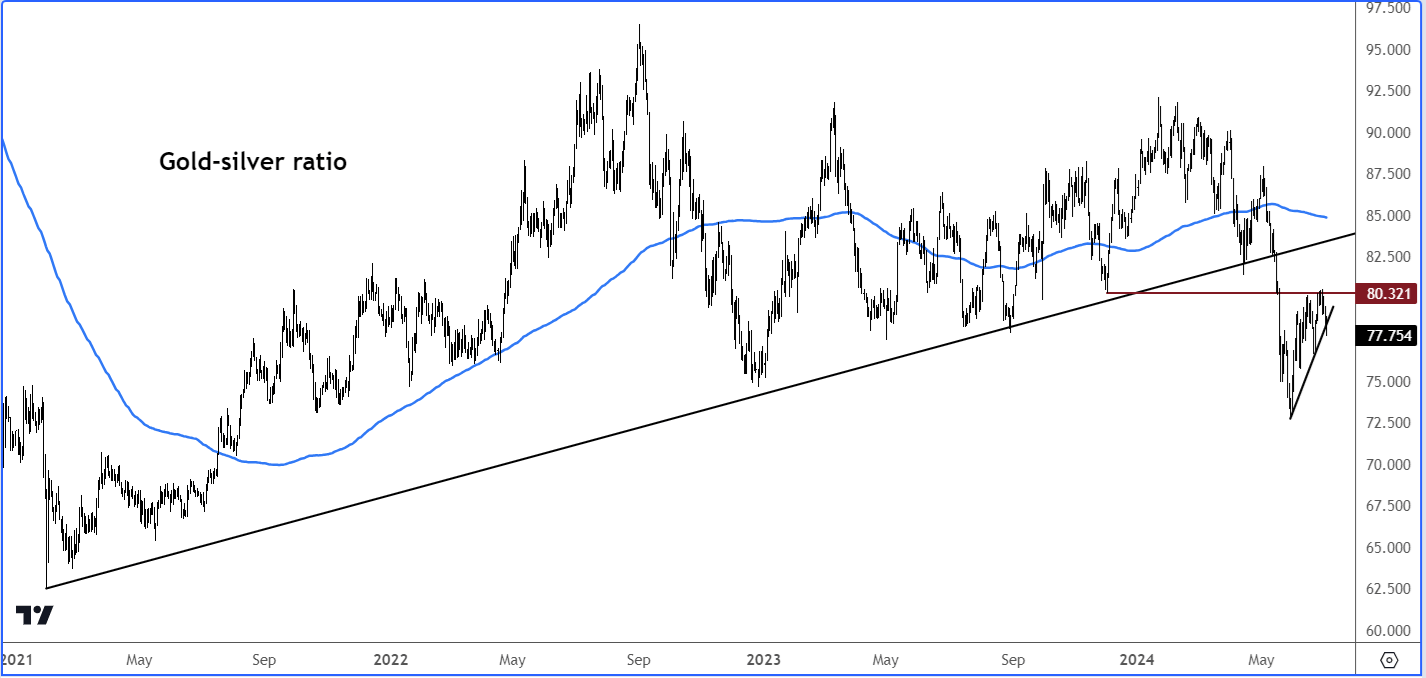

Gold-silver ratio breaks down: What does this tell us about precious metals?

The gold-silver ratio reached a significant resistance area between 80.30 and 80.55 and has reacted accordingly there, falling after the re-testing this area from underneath. This follows a major breakdown below a multi-year bullish trend line in early May. The ratio has held resistance, suggesting that silver might outperform gold again. Alternatively, it could indicate that both metals are in a correction phase, with gold declining more rapidly than silver. However, given the bullish trends observed this year, I lean towards a bullish outlook for precious metals. In other words, the breakdown in the ratio underlines my bullish silver forecast more than gold.

Silver forecast: XAG/USD technical analysis

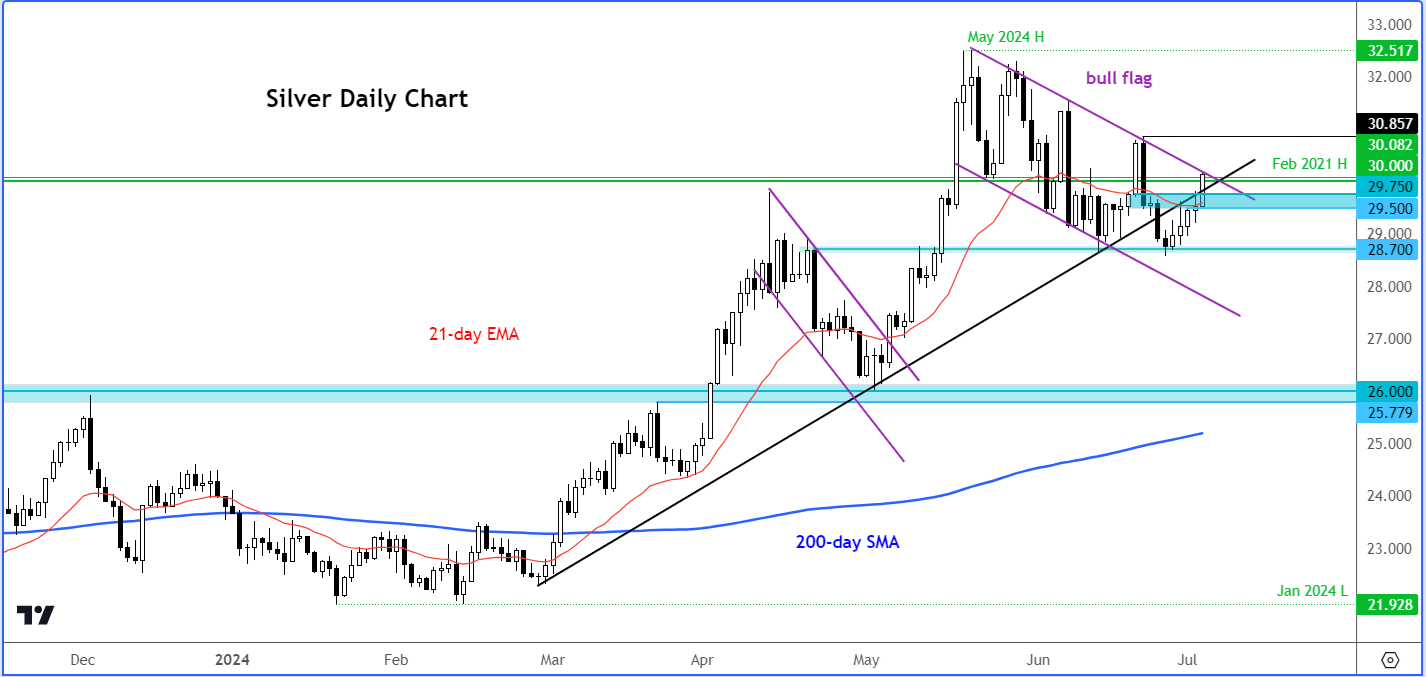

At the time of writing, silver was up 2% on the session, testing the resistance trend of its bull flag pattern around $30.15 to $30.20 area.

Until this week’s recovery, silver had been trending lower in recent weeks, testing a major support area around $28.70 to $29.00. It looks like support held here and it has consequently reclaimed the broken bullish trend line. In the process, it has broken back above resistance in the $29.50 to $29.75 range, an area which now needs to hold as support should we see a dip from around the resistance trend of the bull flag pattern.

What the bulls will want to see next is a clean break out of the bull flag pattern to indicate silver has resumed its long-term bullish trend. While today’s price action is bullish, by no means is silver completely out of the woods just yet. However, the positive technical signs we have observed means that the bullish silver forecast is intact.

Source for all charts in this article: TradingView.com

-- Content created by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R