GBP/USD Talking Points:

- I looked into GBP/USD on Wednesday just as the pair moved down for a test around the 1.3000 psychological level. That led to a sizable bounce that continues into the end of the week, with the weekly bar showing as ‘green’ at this point after that rally helped to erase prior-week losses.

- As shared in the Tuesday webinar, GBP/USD remains one of the more attractive venues for USD-weakness scenarios, in my opinion. Given the potential for greater carry unwind in USD/JPY, that pair can also remain attractive for such themes.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

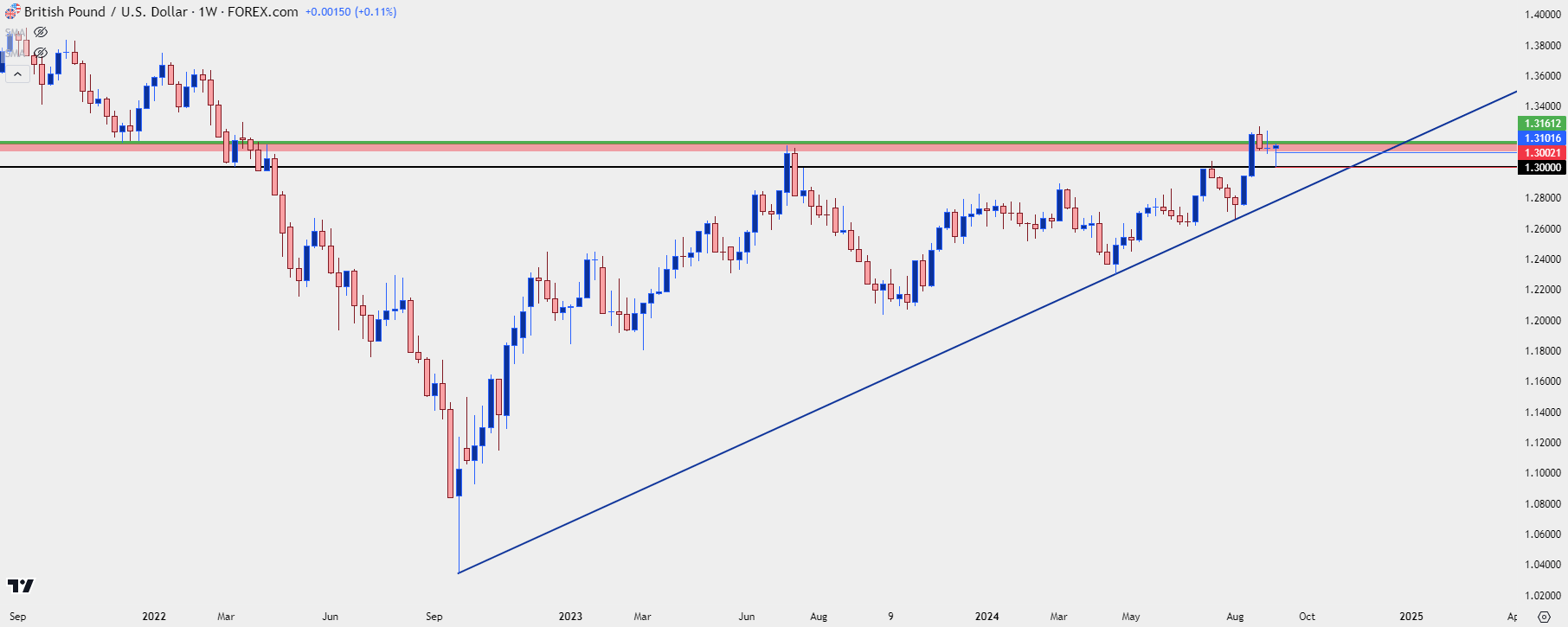

I’m a big fan of weekly bars as they help me to get a greater view of the big picture. And for the past couple of weeks, that picture was struggle in GBP/USD as the pair had previously vaulted to a fresh two-year-high on the back of USD-weakness.

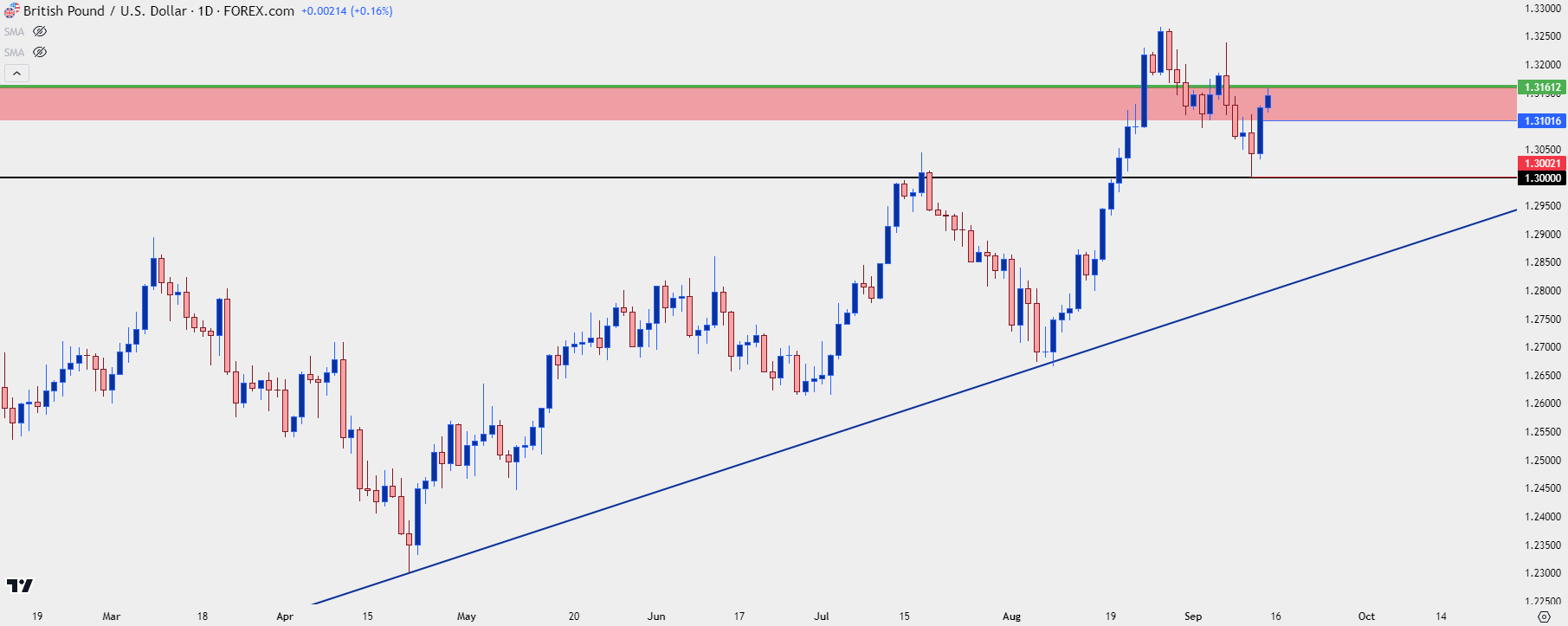

I looked into this in the Tuesday webinar and as I said then, I was expecting a big test around the 1.3000 level. Gauging buyer behavior at that point seemed like a big deal to me at the time and as we saw on Wednesday, bulls stepped in just two pips shy of the big figure, leading to a strong topside rally. The 1.3000-1.3058 zone that I had referenced as possible resistance was chewed through by buyers yesterday and that push has continued so far on Friday.

GBP/USD Daily Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

At this point there’s a bit of time until the weekly bar completes but GBP/USD has the potential to finish the week with a hammer formation, often approached with aim of a bullish turn following an intra-bar reversal theme.

The 1.3000 price is key as this was resistance in July before a pullback drew price down for a trendline support test. So there’s a case of support at prior resistance at that big figure, along with what’s been a strong early response to that level.

The key here will be continued weakness in the US Dollar as we move into next week’s FOMC rate decision and I’m of the same mind as I was on Tuesday, where GBP/USD can remain as one of the more attractive venues for continued USD-weakness.

GBP/USD Weekly Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

--- written by James Stanley, Senior Strategist