Key Events

- UK CPI y/y drops to 1.7%, below BOE’s 2% target

- Gold rises above 2670 for the third time in history

- BOE Monetary Policy Report Hearings (Thursday)

- US Retail Sales (Thursday)

- UK Retail Sales (Friday)

Pound Outlook

With UK CPI coming in at 1.7%, well below both the central bank’s target of 2% and the projected 1.9%, the GBP/USD fell below the 1.30 mark. This decline is significant as it coincides with the trendline connecting consecutive lower highs from July 2014 to June 2021 and the upper boundary of its 15-year consolidation range, which was broken in August 2024.

Global inflation headlines are fluctuating between persistent inflation and faster-than-expected declines, prompting markets to increasingly price in more aggressive dovish policies from central banks.

Gold Outlook

As global conflicts intensify, the precious metal’s positive correlation with uncertainty continues to drive its price higher. Investors are seeking protection from both economic and geopolitical instability, as concerns about the health of the global economy and monetary policies linger.

Technical Analysis

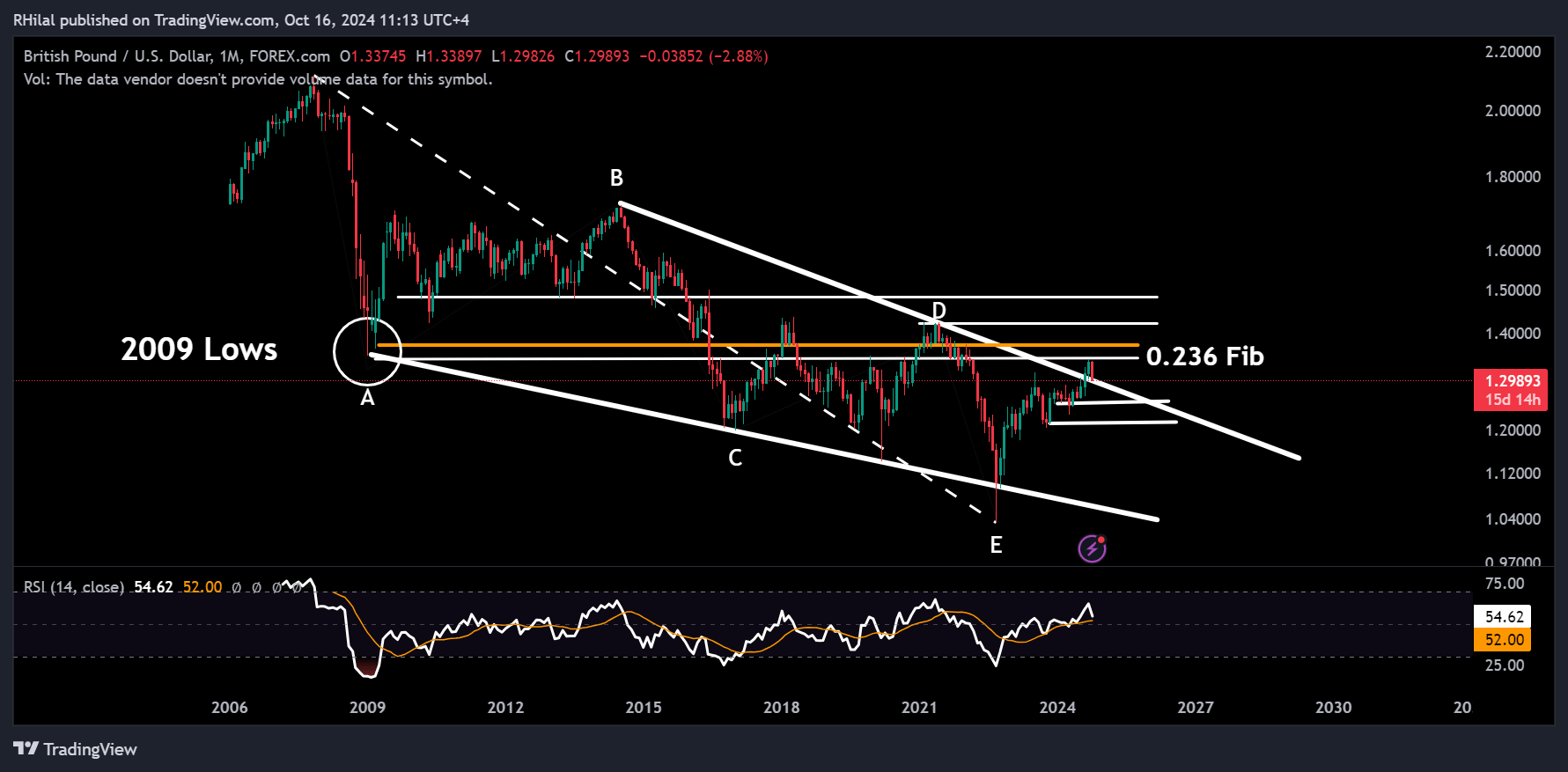

GBPUSD Forecast: Monthly Time Frame – Log Scale

Source: Tradingview

From a monthly time frame perspective, the GBPUSD’s latest drop is retesting the upper border of its 15-year consolidation and the 1.29 support zone. A drop below this level could extend the decline toward the 1.26 and 1.21 support areas, bringing the pair back into bearish territory.

From the upside, should the current border be respected, and as the daily relative strength index indicator (RSI) rebounds from the oversold zone, resistance levels 1.31, 1.33, and 1.3430 are next in line prior to the trend continuation towards level 1.37.

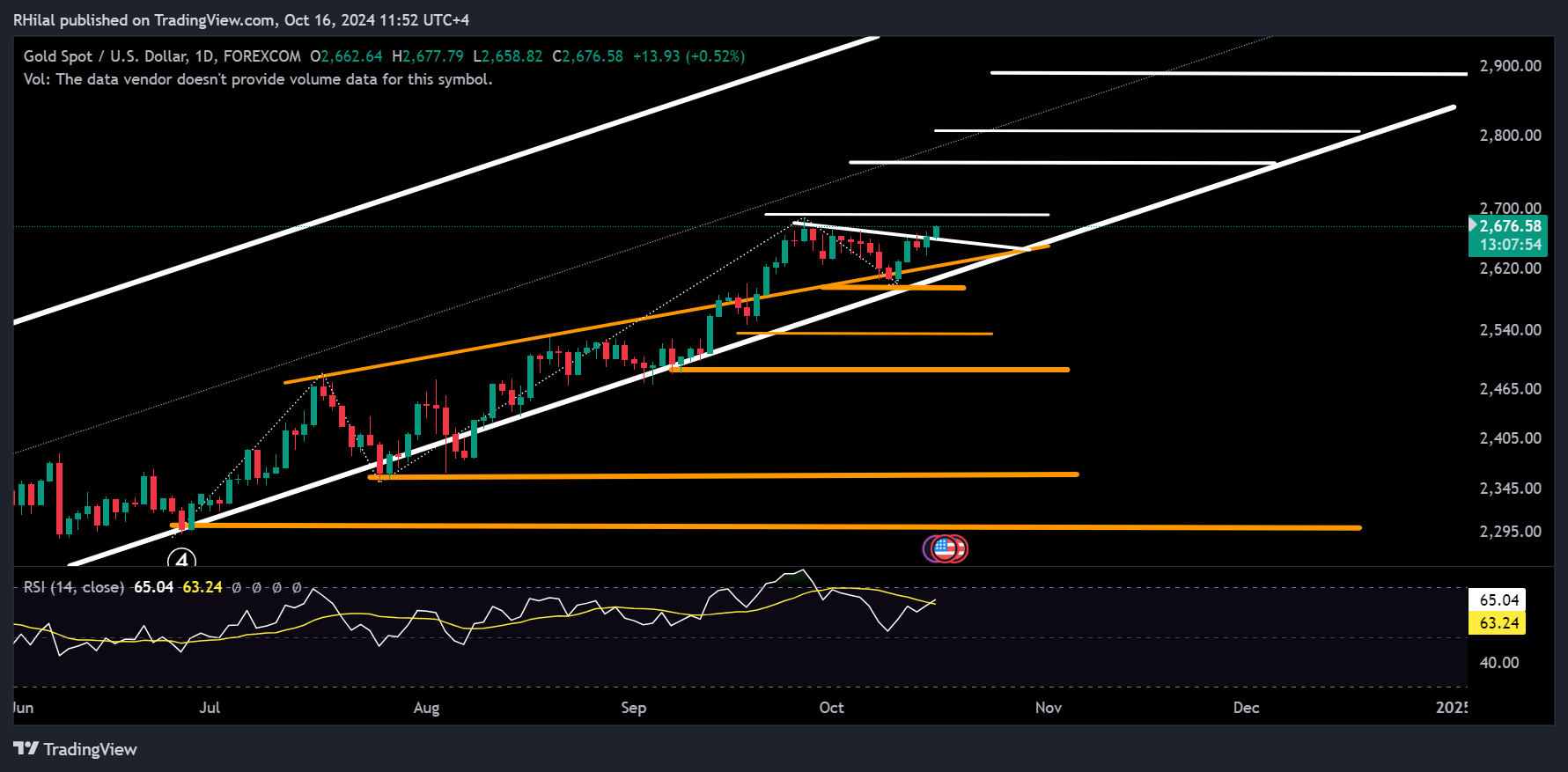

Gold Forecast: Daily Time Frame – Log Scale

Source: Tradingview

Gold is eyeing a return to its all-time high amid escalating geopolitical tensions, including:

- A recent bombing on the road between North and South Korea

- Rising military drills and tensions between China and Taiwan

- Conflicts in the Middle East involving Israel, Palestine, Lebanon, Syria, Yemen, and Iran

- The ongoing Russia-Ukraine war

From a political perspective, the US elections add further uncertainty, while from an economic standpoint, recent inflation data reflects faster-than-expected declines, which could influence monetary policy adjustments.

Bullish Scenario: A close above 2700 could extend gold's rally toward 2760, 2800, 2890, and potentially 3000.

Bearish Scenario: Failing to break new highs, gold may find support at 2600-2580, 2530, and 2490 before potentially deeper corrections occur within its primary trend.

--- Written by Razan Hilal, CMT – on X: @Rh_waves