- GBPUSD Forecast: bearish momentum prevails as the pair touches new weekly lows, retesting the 1.2470 support

- DXY rebounds to new weekly highs, surging above 105.60

- Dovish sentiment dominates ahead of BOE decision

With doves in the lead, GBPUSD is poised to challenge the previously mentioned 1.2470 support level in GBPUSD Analysis: Economic Optimism Meets Dovish BOE Outlook after breaching the 1.2530 level. On another note, the U.S Dollar Index marked a significant shadow on Friday which set its trend on a strong bull track this week, adding bearish pressures on the GBPUSD pair.

With the mentioned dynamics, the British Pound Index is analyzed below along with the updated GBPUSD chart

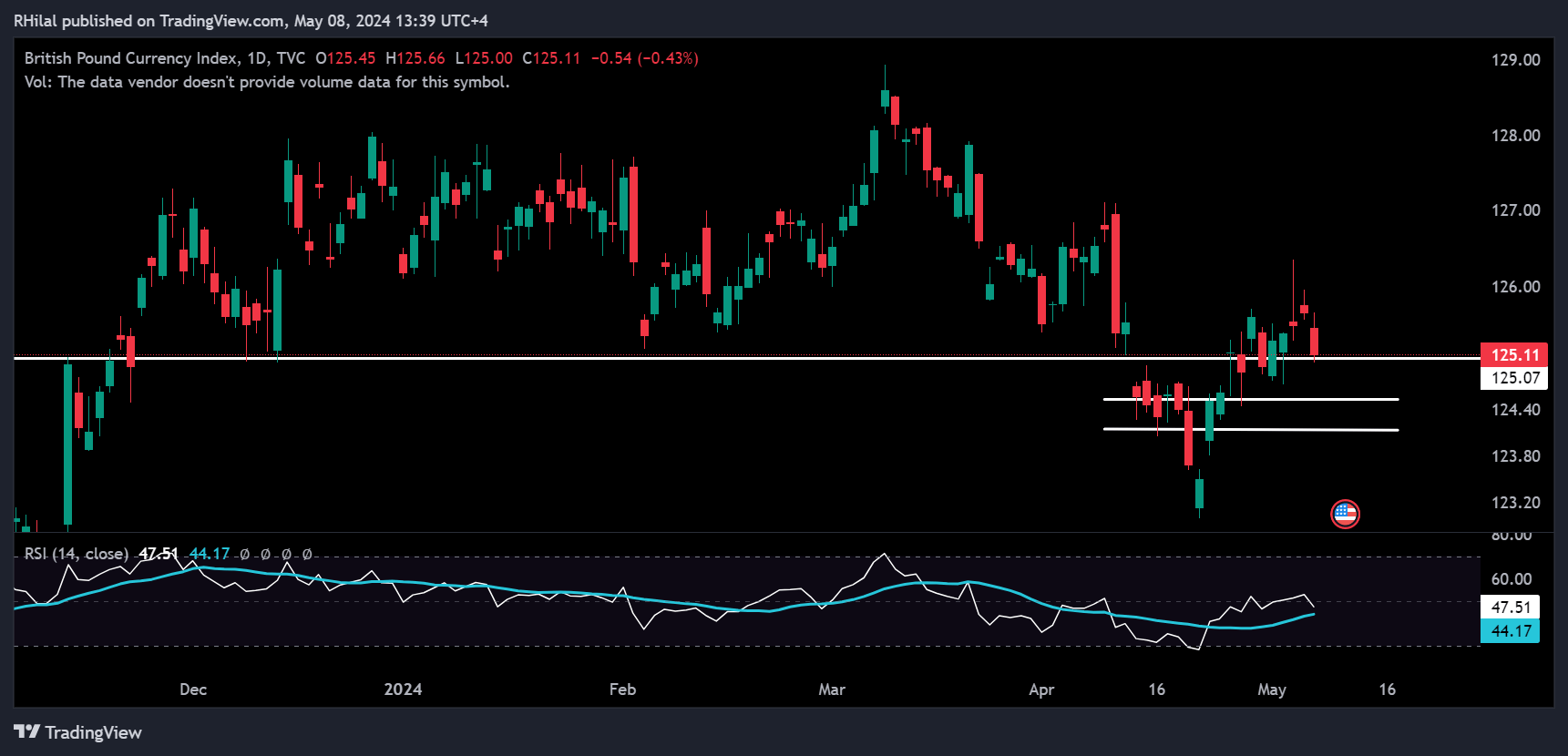

GBPUSD Forecast: BXY – Daily Time Frame – Logarithmic Scale

The British Pound Currency Index is currently retesting its significant support zone near 125, an area respected since December 2023. Additional bearish breakouts would deepen the bearish sentiment, potentially finding support near the mid-124 zone. Moreover, the relative strength index is hovering just below the neutral 50 level, indicating a tilt towards neutral to bearish sentiment in the current chart analysis.

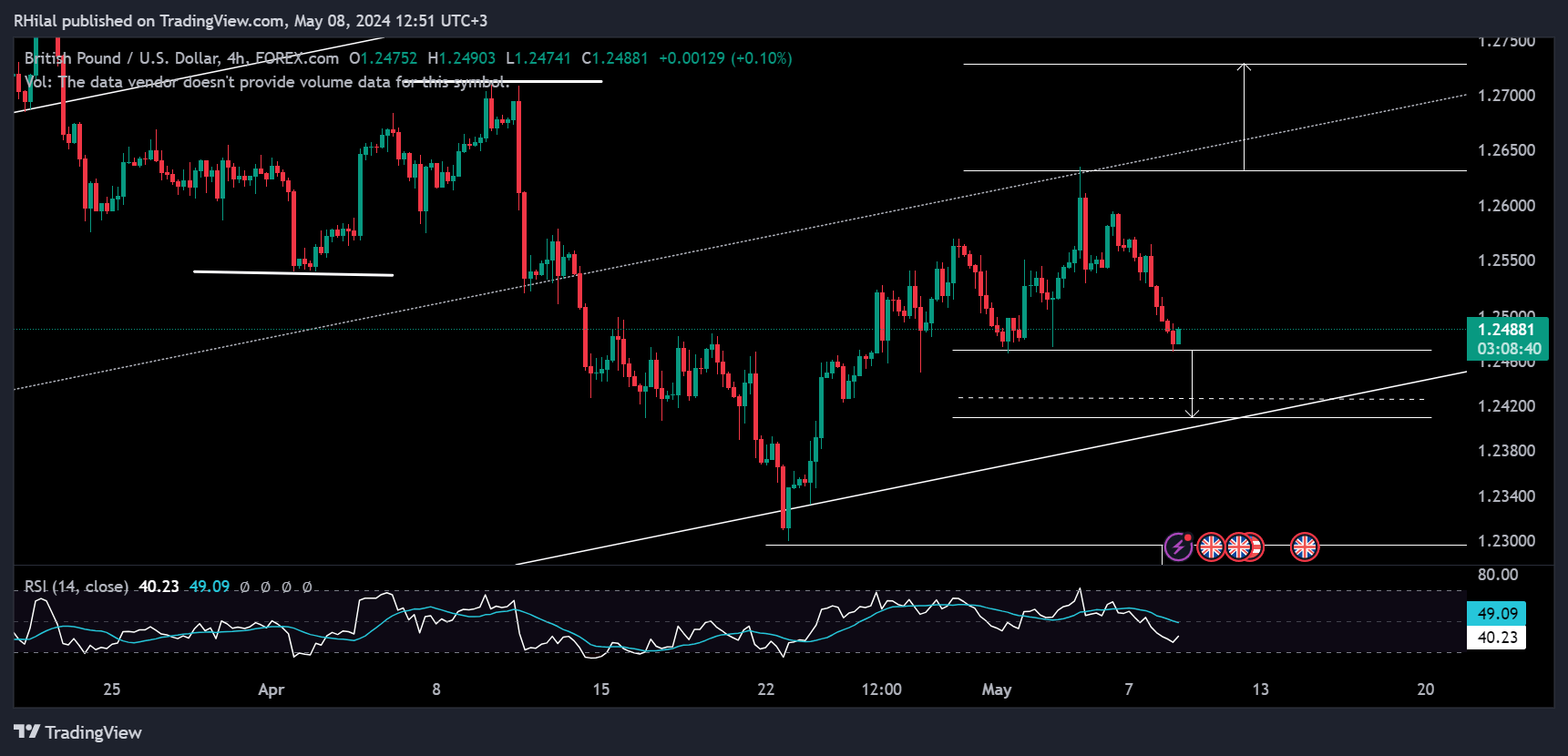

GBPUSD Forecast: 4Hour Time Frame – Logarithmic Scale

Dropping to the previously mentioned 1.2470 support, the GBPUSD is showing signs of a slight bullish rebound. The potential level to hold any further down break lies near 1.2430, representing the 0.618 retracement of the previous uptrend, along with the previously mentioned 1.24 level.

As markets typically anticipate leading policies prior to their release, bearish trends can be assessed with caution prior to the BOE policy and report.