Traders remain obsessed with central bank policies, and quite rightly so. Expectations of Fed policy has dominated sentiment for quite some time, but over the past week or two we’re getting stronger signals that key central banks are willing to step out of the Fed’s shadows and begin easing before the Fed. Which is a relief, as the Fed now seem unlikely to cut rates at all this year, let alone soon.

ECB members have been busy drumming up support for a June cut, with some touting more than one this year. And that has been backed up by ECB President Lagarde herself, prompting the majority of economists to expect at least two cuts this year, beginning in June. And now traders are more confident that the BOE will cut twice this year from August.

And it is these developments that sent GBP/USD to a 5-month low on Monday and EUR/USD to its own 5-month low last week.

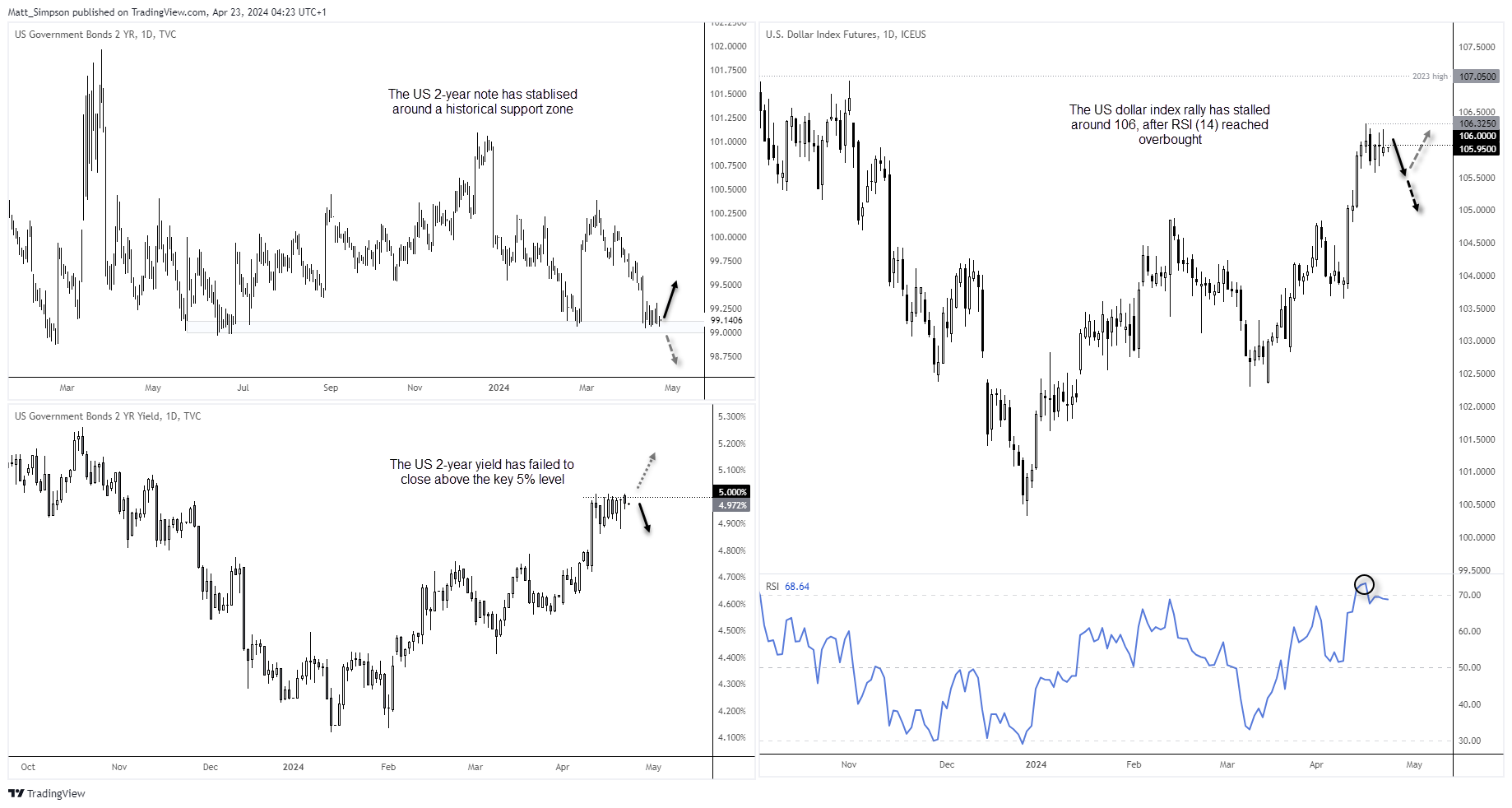

US dollar strength appears to be waning, if not pausing for breath

I noted some key developments about the US dollar, bonds and their yields last week. But they are worthy of mention again. If the current environment of a less-dovish-than-expected Fed is so ‘dollar’ positive, why has its rally stalled over the past week?

The 2-year bond note appears to have stabilised around a key support zone between 99 – 99.15. And this has seen the 2-year yield flirt (yet fail) to break above 5%. It is therefore no coincidence that the US dollar’s rally has stalled, as currency traders pay very close attention to the 2-year note due to its sensitivity to monetary policy expectations.

Perhaps the 2-year note remains supported because hawkish comments from Fed officials has convinced bond traders that the Fed will tame inflation and lower growth, which is good for bond prices further out. And this could be inadvertently capping gains on the US dollar index. Furthermore, RSI (14) reached overbought last week on the US dollar index daily chart, so a retracement for the US dollar would not seem overdue given the strong rally for the dollar of late.

Flash PMIs now in focus (time in GMT+1)

The focus now shifts to the slew of flash PMI reports for UK, Eurozone and the US. And if the lead from Japan and Australia is anything to go by, we may find numbers for the UK ad Europe to be better than expected or previously, which could diminish some hopes of earlier cuts from the ECB or BOE – even if only temporarily. Should they come in better than expected, the real move higher for GBP/USD or EUR/USD would likely require US PMIs to come in softer than expected, as this could weigh further on yields and the US dollar.

- 08:15 – France flash PMIs (manufacturing, services)

- 08:30 – Germany flash PMIs (manufacturing, services)

- 09:00 – Euro area flash PMIs (manufacturing, services)

- 09:30 – UK flash PMIs (manufacturing, services)

- 12:15 – BOE member Pill speaks

- 13:00 – US building permits

- 14:45 – US flash PMIs (manufacturing, services)

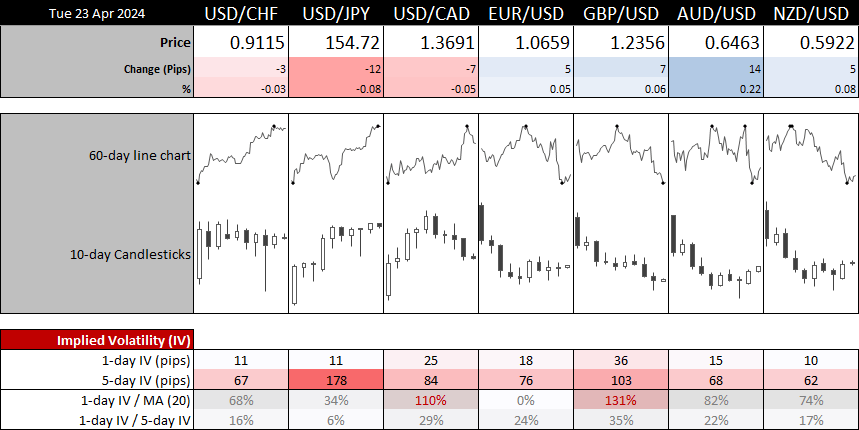

Forex dashboard for FX majors:

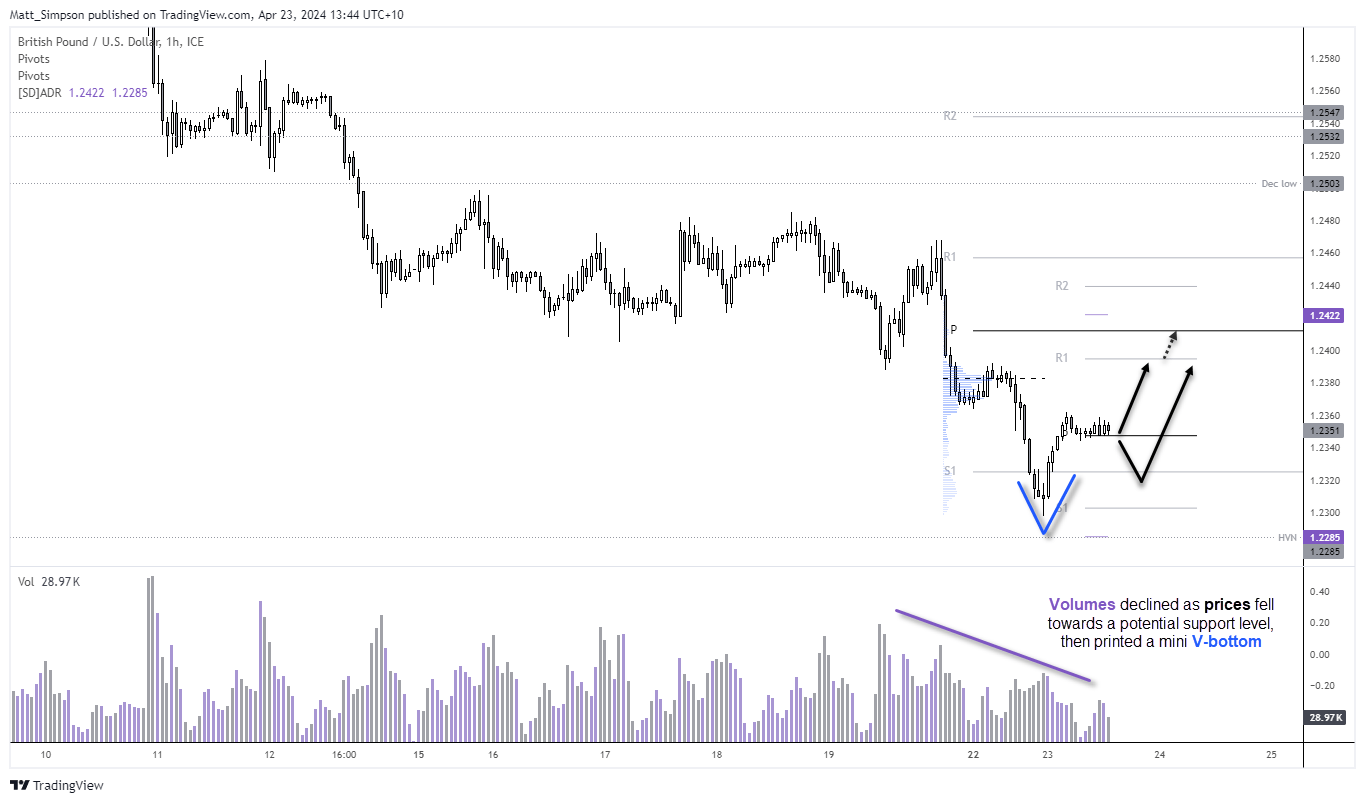

GBP/USD technical analysis:

It has been no secret that GBP/USD has been in a downtrend on the 1-hour chart, but there are early signs that the move is overextended. The daily chart shows a long tail which saw prices recoup over half of the day’s earlier losses. The daily low also held above a HVN (high-volume node), and the 1-hour chart shows a mini V-bottom which can be indicative of a swing low. Furthermore, trading volumes were declining with prices, which shows a lack of conviction from bears as the trend developed.

Prices are holding above the daily pivot point and the bias is for a countertrend move higher. Should prices move lower at the beginning of the session (as they tend to move in the opposite direction to the ‘real’ move that later unfolds), bulls could seek dips down to the weekly S1 pivot / 1.22 handle. Hopefully this can help improve the reward to risk ratio for the anticipated move higher.

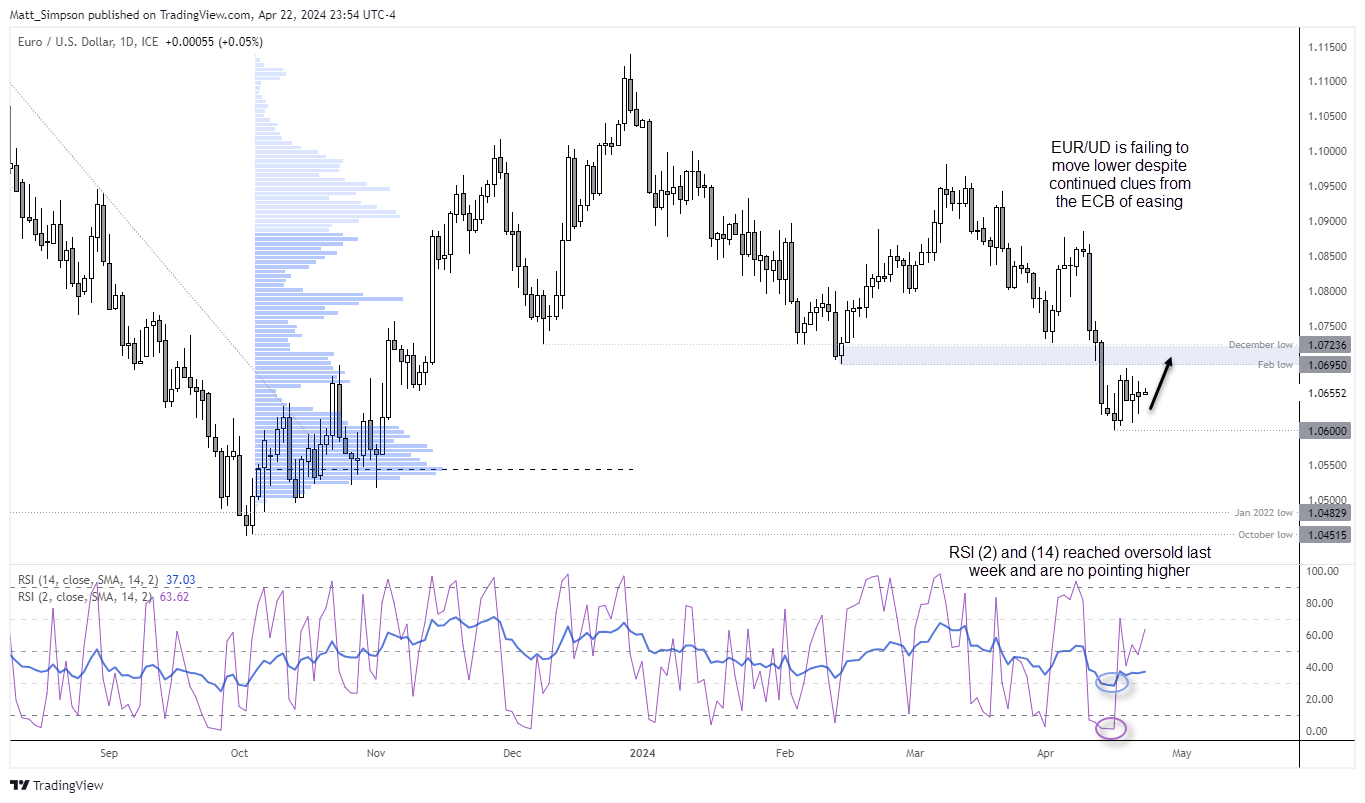

EUR/USD technical analysis:

If the US dollar rally has stalled, so has the decline for EUR/USD. And this is despite that the ERB continue to make dovish noises. And if the euro cannot fall on dovish noise, then it may not take much to see it pop higher. Weaker US yields could certainly help, as could a stronger-than-expected set of PMI figures later today.

The daily chart shows that EUR/USD rallied from 1.06 on Wednesday in line with my bullish bias for that day. Price action has been messy since, but each spike lower has been supported. And that keeps EUR/USD on my ‘buy the dip’ watchlist over the near term, for an anticipated move towards the 1.07 handle (near the December and February lows).

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge