GBP/USD rises ahead of the BoE & Fed rate decisions

- BoE and the Fed are expected to both cut rates by 25 bps

- The focus will be on the central bank’s outlook

- GBP/USD recovers from support at 1.2850

GBP/USD Is recovering from yesterday's sell-off as the dollar gives back some of its post-election rallies and as investors look ahead to the Bank of England and Federal Reserve interest rate decisions.

The BoE is expected to cut interest rates for a second time since 2020, reducing rates by 25 basis points to 4.75%. The move is priced in, and the big question will be whether the central bank signals further rate cuts following the government's budget last week, which is expected to increase inflationary pressures.

Currently, inflation has fallen to 1.7% and wage growth has eased to 4.9%. Following the Budget, the market has reined in rate cut expectations for 2025, down from 4-5 rate cuts to round 2-3. A less dovish-sounding Andrew Bailey could lift the pound.

The USD has fallen back from a four-month high reached yesterday as the Trump trade cools.

The USD had surged following Trump's victory in the elections and the increasing likelihood of a Republican sweep, which would have trump significant authority to push through an expansive agenda on tax cuts and trade tariffs.

The Fed is expected to cut interest rates by 25 basis points to 4.5% to 4.75%. As with the Bank of England, the focus will be on guidance in light of Trump’s return to the White House.

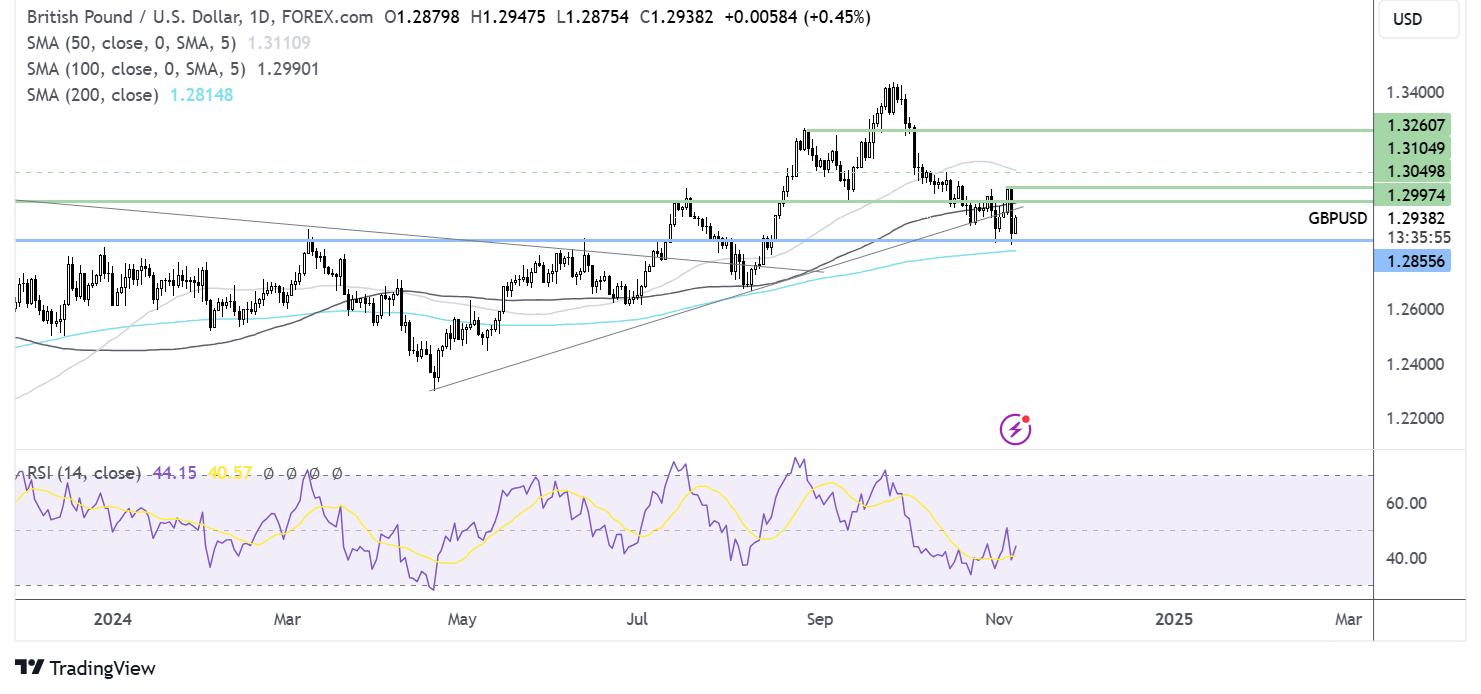

GBP/USD forecast – technical analysis

GBP/USD has fallen 5% from its September high. While the selloff broke below the 1.30 psychological level and the rising trendline dating back to May, the pair remained above the 200 SMA, finding support around 1.2850. It has corrected higher, bringing 1.30 back into focus.

A rise above 1.30 opens the door to 1.3050, and a rise above here creates a higher high.

Sellers will need to take out 1.2850 to extend the selloff to the 200 SMA at 1.2815 and 1.2665, the August low.

EUR/USD recovers from a 4-month low ahead of the Fed

- Fed is expected to cut rates but will it guide to a December cut

- The Trump trade & trade worries could limit gains in EUR

- EUR/USD recovered from a 4-month low

EUR/USD is rising after dropping 2% in the previous session and trades around the one 1.0750 level early in the European session. Although gains in the pair could be limited following Trump's re-election.

Donald Trump and the Republicans are set to take control of both chambers of Congress, providing a strong platform to push through inflationary policies on tax deregulation on trade tariffs.

The U.S. dollar index rose to a four-month high versus its major peers yesterday to 105.44. Today, it trades around 104.90 as U.S. Treasury yields also ease. The market’s reaction points to expectations that the Fed will cut rates at a slower pace.

Today, the Fed is expected to cut rates by 25 basis points, and the focus will be on any clues suggesting that the Fed may skip December's rate cut. The market's pricing is a 70% probability that the Fed will cut again in December; however, this could change if the Fed gives a different steer in light of Trump's election.

Meanwhile, the euro is recovering from sharp declines yesterday amid concerns that Trump's tariffs could cause Europe's fragile growth to stall, and the ECB may be forced to cut interest rates more aggressively in 2025. These worries could limit gains in the EUR.

Today, attention is on eurozone retail sales, which are expected to rise 0.4%, up from 0.2%. ECB president Christine Lagarde is also due to speak on Saturday.

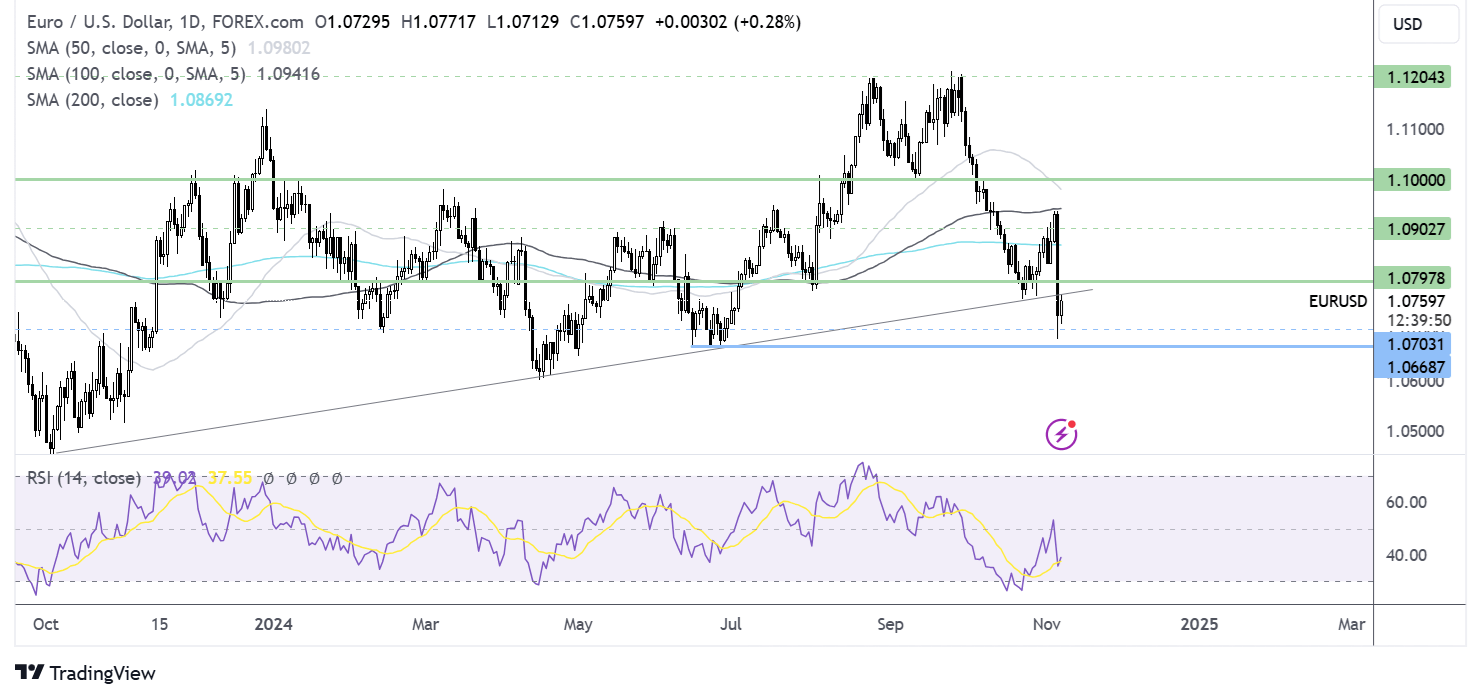

EUR/USD forecast – technical analysis

EUR/USD ran into resistance at the 100 SMA and rebounded lower, breaking below the 200 SMA, 1.08 round number, and the rising trendline dating back to October last year.

The price fell to a low of 1.0680 and has corrected higher, rising above the 1.07 level. It is attempting to retake the rising trend line. A rise above here and 1.08 negates the near-term downtrend and brings the 200 SMA into play at 1.0870.

Failure to retake the rising trendline could see sellers test 1.07, with a break below here opening the door to 1.0660 the June low.