GBP/USD steadies ahead of US consumer confidence & Fed speakers

- USD is falling after modest gains last week

- Fed rate cut expectations have been pushed back

- UK BRC shop price inflation slows to 0.6% MoM in May

- GBP/USD looks to 1.28

GBP/USD is trading modestly higher, around 1.2770 in early trade after reaching a 2-month high amid some US dollar weakness.

The US dollar is trading lower versus its major peers after modest losses yesterday. Traders look ahead to US Conference Board consumer confidence data later today and commentary from the Fed's Neel Kashkari, Mary Daly, and Lisa Cook.

The market has lowered bets on an interest rate cut by the Federal Reserve in September to 49% from 63% just a week ago. The market has pushed back rate cut expectations after Federal Reserve officials have warned that rates need to stay high for longer and after stronger than expected U.S. business activity data.

The focus this week will be on US core PCE, the Fed's preferred gauge for inflation. A hotter-than-expected reading could raise the US dollar, putting GBP USD lower near term.

Meanwhile, the pound has been gaining momentum on the expectation that the Bank of England could keep interest rates high for longer to cool inflation after hotter-than-expected CPI in April. Furthermore, the election in July could further reduce the chances of a Bank of England rate cut in the June meeting.

On the UK data front, the British Retail Consortium (BRC) reported that inflation in the sector is back to normal with the slowest shop price rises in 2 1/2 years. Shop price inflation slowed to 0.6% in May, down from 0.8% in April, the smallest increase in November 2021.

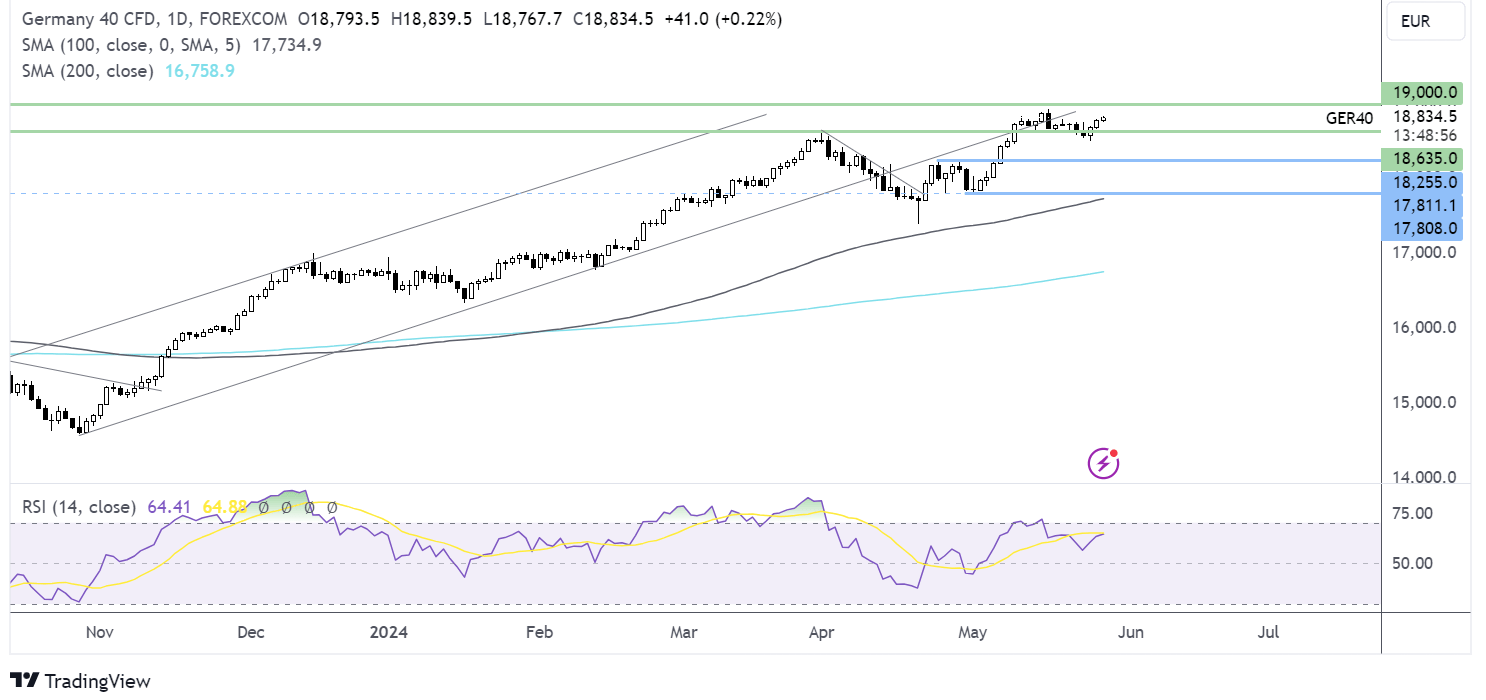

GBP/USD forecast -technical analysis

GBP/USD has extended gains, rising above the 200, 100 & 50 SMA and above 1.27 as it looks towards resistance at 1.28. A rise above here brings 1.2830, the 2024 high, into play.

On the downside, support can be seen at 1.27, the round number. Should sellers take out this level, 1.2640, the May 3 high, and the 100 SMA come into play.

DAX inches higher after wholesale prices fall & ahead of a big week for inflation

- German wholesale prices fell -1.8% YoY in April

- Eurozone inflation & US inflation are in focus this week

- DAX hovers just below record high

The DAX is edging higher on Tuesday as investors look cautiously ahead to a big week for inflation data.

German DAX is up 0.2% after German wholesale prices fell 1.8% YoY in April after falling 3% in March. The ECB remains vigilant over resurfacing inflationary pressures. Later in the session, the focus will be on the ECB, as it is due to publish inflation expectations surveys, which could reinforce market expectations that the central bank will cut interest rates next week. The market is pricing in a 91% probability of a 25 basis point rate cut by the ECB.

While the ECB is due to cut rates in June, there is some uncertainty over what will follow. Yesterday, ECB chief economist Philip Lane said that the central bank will cut interest rates at a slower or faster pace thereafter, depending on the strength of inflation and demand.

Looking out across the week, this week is key for inflation data, with figures from not only the eurozone but also Australia, Japan, and the US, which could provide further clues about the likelihood of central banks being able to cut rates.

US core PCE, the Fed's preferred gauge for inflation, is due on Friday and could set the tone for the next few weeks. The data comes after hawkish FOMC minutes last week and after recent Federal Reserve speakers have warned about the need for interest rates to stay high for longer.

US Federal Reserve speakers were in focus today, along with consumer confidence data, which is expected to fall slightly to 96 from 97 in the previous month. The figure dropped to its lowest level in 1 1/2 years in April as Americans fretted over high prices and job availability.

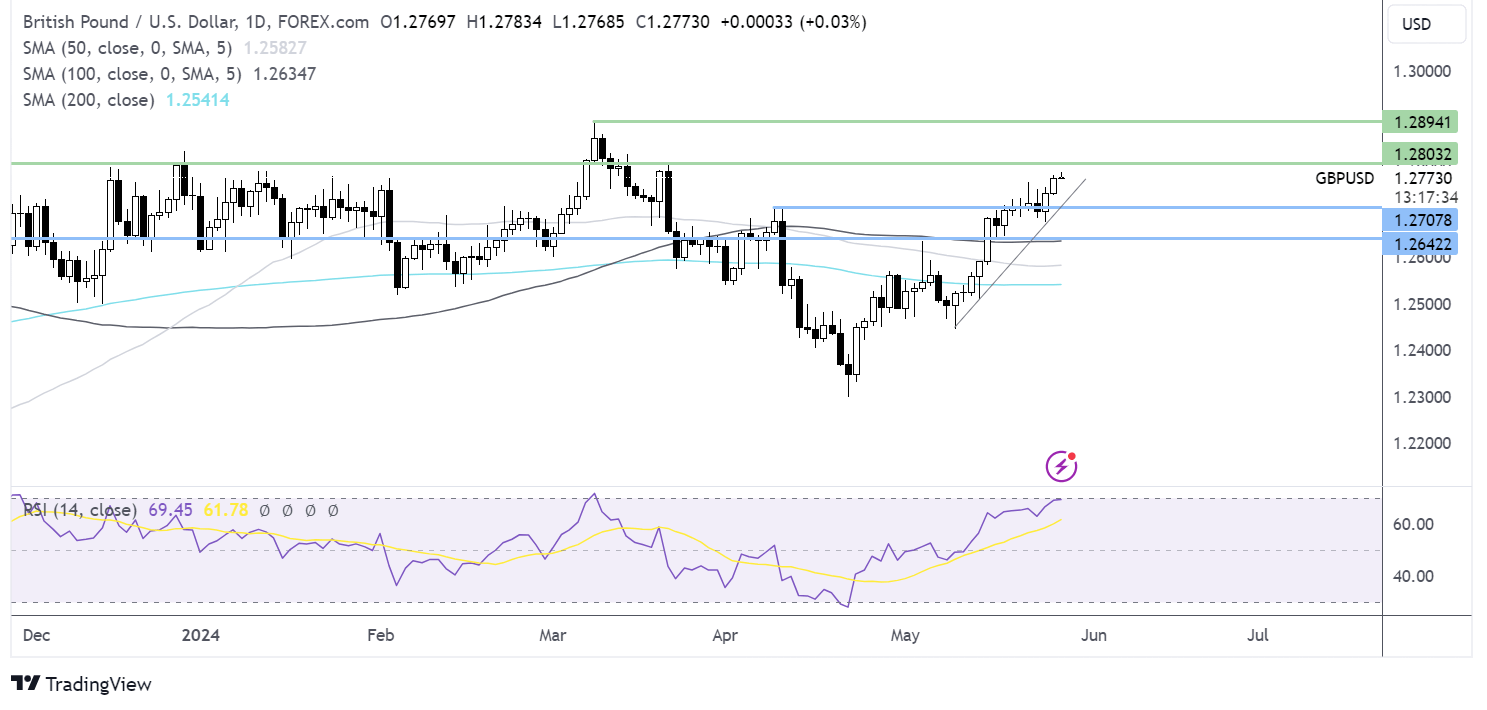

DAX forecast - technical analysis

After reaching an ATH of 18,928, the DAX prices are consolidating below this level and supported by the 18,500 – 18,600 zone, last week’s low, and the April high.

Supported by the RSI above 50, buyers will look to grind the price higher above 17928 to fresh record highs.

Sellers will look to remove the 18500-18600 support to bring 18255, the late April high, into focus ahead of 17800, the May low.