GBP/USD falls to a 2-week low after dovish BoE Governor comments

- BoE’s Bailey hinted at more aggressive rate cuts

- The market prices in a 90% chance of a November cut

- GBP/USD falls to 1.3150

The pound is falling sharply after Bank of England governor Bailey suggested that the central bank could cut interest rates more aggressively if inflation data supported such a move.

Andrew Bailey said that there was a chance that the Bank of England could become more activist in its approach to cutting interest rates if inflation continued to cool by more than expected. However, he also warned over the conflict in the Middle East, pushing up oil prices, which could lift inflation once again.

The pound had strengthened in recent weeks as investors considered that the Bank of England would cut UK interest rates more slowly than the Federal Reserve and other major central banks. However, Bailey's comments have seen the market reassess rate-card expectations, and now it is pricing in a 90% probability of a 25 basis point cut in November.

The BoE cut rates by 25 basis points in August, the first reduction in four years, bringing the rate to 5%

While the market is ramping up rate cut expectations for the Bank of England, investors are reining in the chances of an outsized rate cut by the Federal Reserve in November.

According to the CME fed watch, the market is pricing in a 65% chance of a 25 basis point rate cut, up from 40% last week, amid signs that the US economy is holding up better than expected, particularly the jobs market.

Yesterday, ADP private payrolls showed an increase after five months of declines, and JOLTS job openings were also stronger than expected. Today, attention is on jobless claims, Challenger job cuts, and ISM services PMI, which is expected to show grace in September.

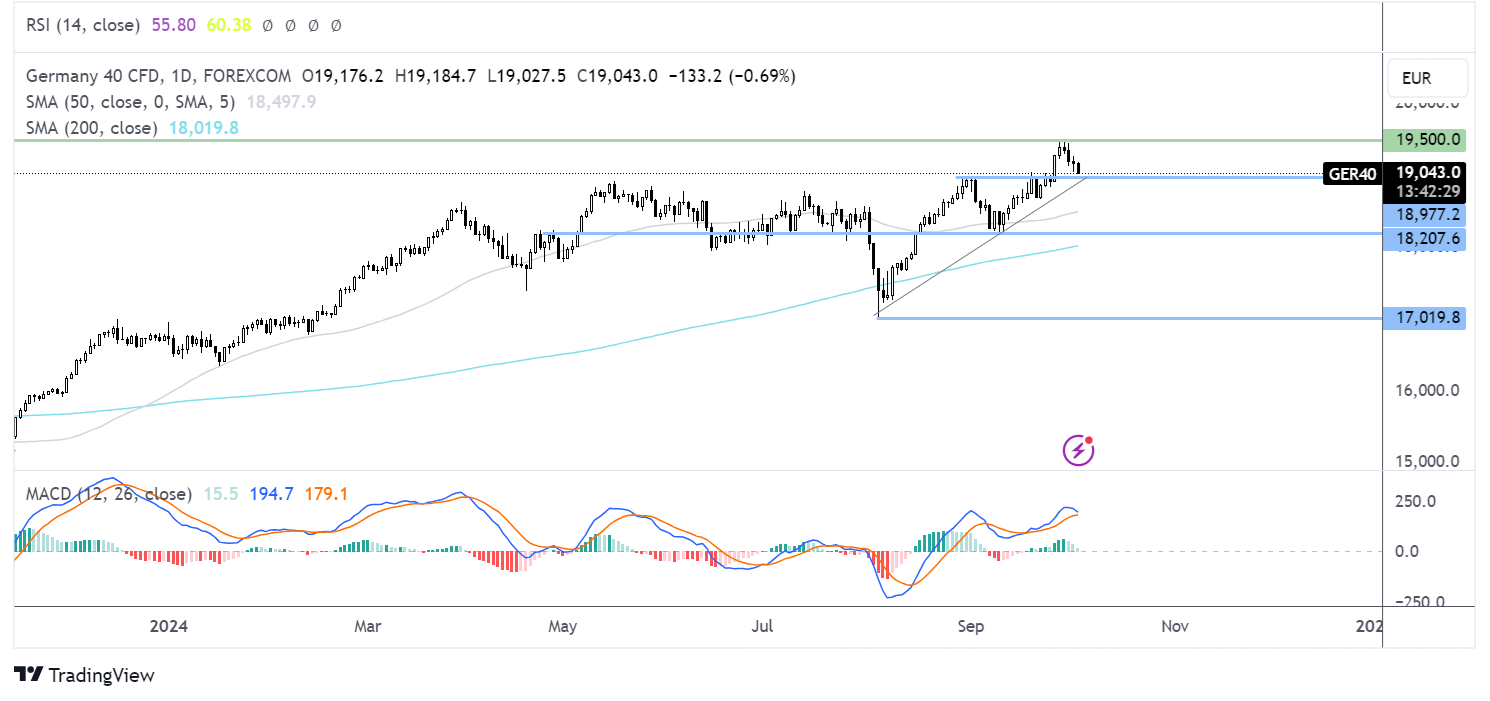

GBP/USD forecast – technical analysis

GBP/USD has fallen below the 1.3260 support as it heads towards 1.31. The bearish engulfing candle and the bearish crossover on the MACD keep sellers hopeful of further losses.

Sellers will look to remove 1.3150 and 1.31 round numbers before focusing on 1.30. A beak below 1.30 creates a lower low. Below here, 1.2860, the rising trendline support, comes into play.

On the upside, buyers will need to retake 1.32260, the August high, to extend gains towards 1.34.

DAX falls in risk-off trade, Middle East & PMI data in focus

- Middle East concerns weigh on the mood

- Eurozone Composite PMI was revised higher

- SAP falls on price fixing investigation developments

The DAX, along with its European peers, opened lower on Thursday, dragged down by a risk-off mood and as investors digest the latest PMI figures.

The market mood remained depressed on Thursday as investors continued to watch developments in the Middle East and fretted over a broader conflict breaking out. While Middle East worries hurt risk, sentiment, the energy sector is rising tracking oil prices higher.

On the data front, PMI figures were stronger than expected. The services PMI was upwardly revised to 51.4 from 50.5 in the preliminary reading, while the composite PMI was also upwardly revised to 49.6 from 48.9. However this was still below the 50 level that separates expansion from contraction.

Attention will now turn to PPI figures from the broader region which are expected to fall 2.4% annually after falling 2.1% in July. Cooling PPI bodes well for further lowering consumer price inflation and paving the way for further rate cuts from the ECB.

The ECB is expected to cut rates by 25 basis points in October and again at every meeting until June.

Looking ahead, attention will be on US jobless claims and ISM services PMI, which could impact risk sentiment. Expectations are for initial claims to increase to 22K, up from 218 K. Economists had forecast ISM services PMI increasing to 51.7 in September from 51.5 in September. The data this week has painted the US economy in an encouraging light and supports a 25 bps rate cut rather than a 50 bps cut.

Among the stocks, SAP is dropping 2% and bringing the technology sector down almost 1% amid reports that US prosecutors are widening a probe on potential price fixing by the German software developer.

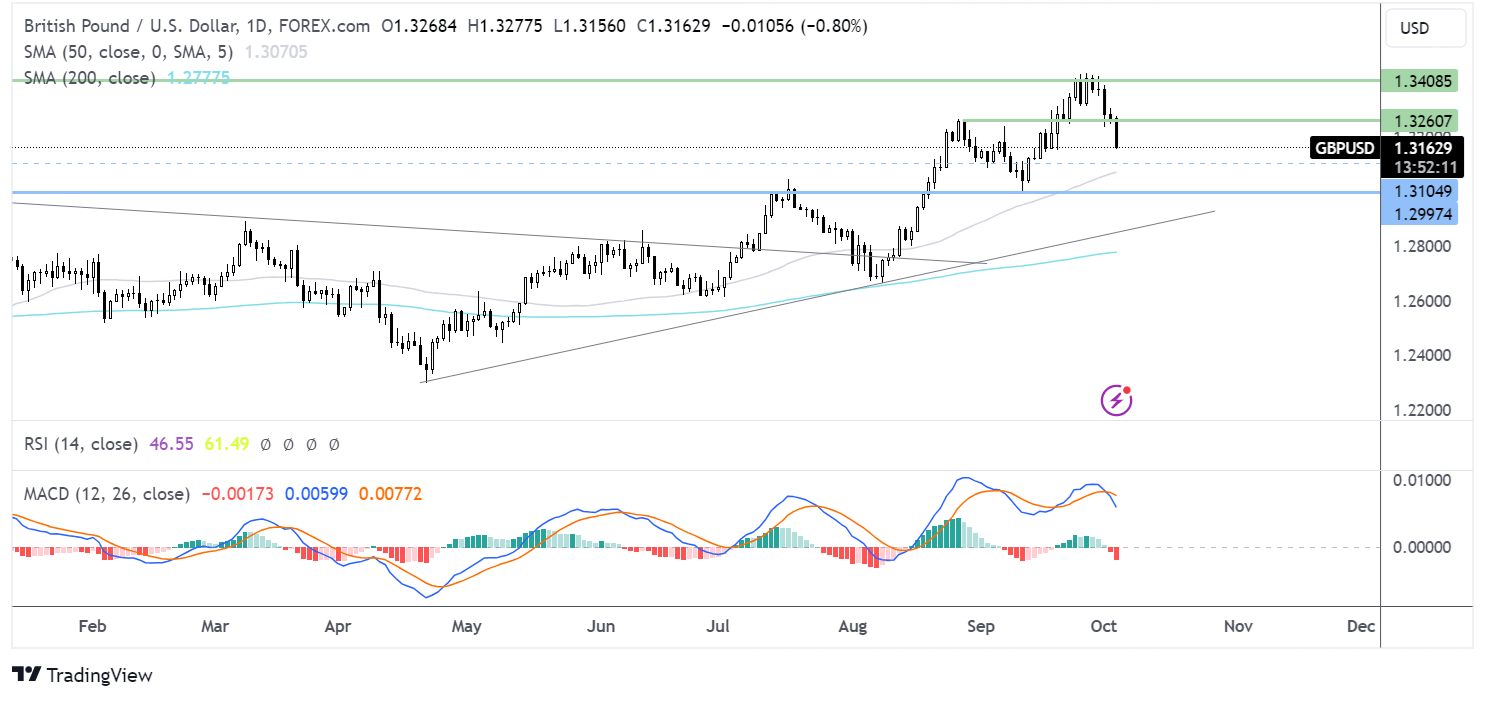

DAX forecast – technical forecast

After recovering from the August low of 17000, the DAX extended gains to a record high of 19480 before correcting lower. Sellers, encouraged by the receding bullish bias on the MACD, will look to break below 19000, the August high, and the rising trendline support.

A break below here exposes the 50 SMA at 18500. Below here, 18,200 comes into focus. Should sellers take out this level, a lower low is created.

Should buyers defend 19000, then a move back up towards 19480 could be on the cards.