US Dollar Outlook: GBP/USD

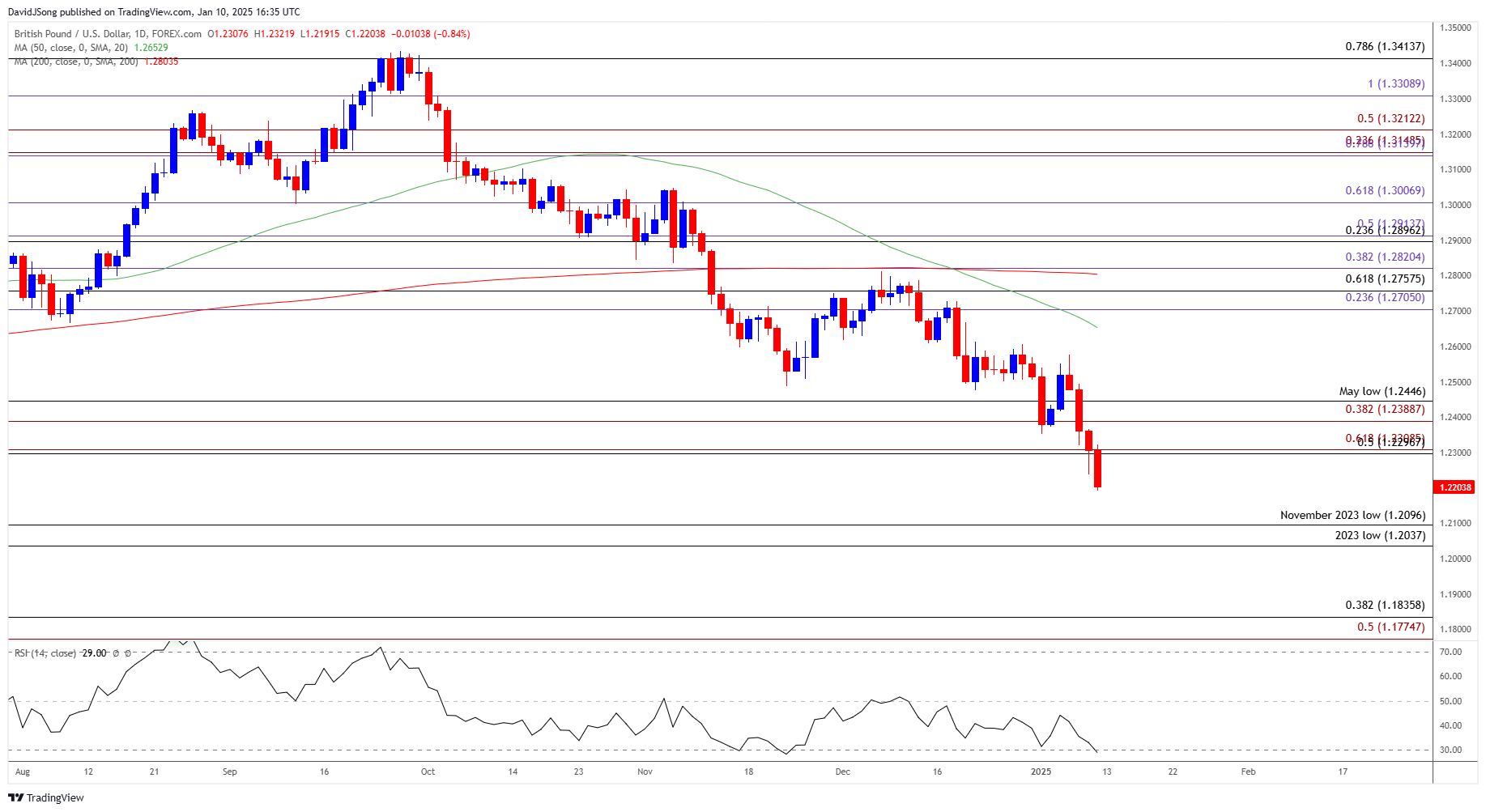

GBP/USD approaches the November 2023 low (1.2096) after failing to defend the 2024 low (1.2300), with the recent decline in the exchange rate pushing the Relative Strength Index (RSI) up against oversold territory.

GBP/USD Approaches November 2023 Low

GBP/USD falls to a fresh weekly low (1.2192) as the US Non-Farm Payrolls (NFP) report shows a 256K rise in December versus forecasts for a 160K print, and a move below 30 in the RSI is likely to be accompanied by a further decline in the exchange rate like the price action from last year.

Join David Song for the Weekly Fundamental Market Outlook webinar.

David provides a market overview and takes questions in real-time. Register Here

In turn, GBP/USD may continue to track the negative slope in the 50-Day SMA (1.2654) as it carves a series of lower highs and lows, and it remains to be seen if the Federal Reserve will respond to the better-than-expected NFP report as Federal Reserve Governor Michelle Bowman revealed that ‘I could have supported taking no action at the December meeting’ while speaking at the California Bankers Association.

Governor Bowman went onto say that ‘the current stance of policy may not be as restrictive as others may see it’ amid the ongoing strength in the US economy, and little signs of a recession may lead to a dissent within the Federal Open Market Committee (FOMC) amid the ‘lack of further progress on slowing inflation.’

With that said, the weakness in GBP/USD may persist as Fed officials adopt a less dovish outlook for monetary policy, but the RSI may show the bearish momentum abating should the oscillator hold above oversold territory.

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Senior Strategist; GBP/USD on TradingView

- GBP/USD marks a four-day selloff for the first time since November, and failure to defend the November 2023 low (1.2096) may lead to a test of the 2023 low (1.2037).

- Next area of interest comes in around 1.1780 (50% Fibonacci extension) to 1.1840 (38.2% Fibonacci retracement), but lack of momentum to test the November 2023 low (1.2096) may curb the recent decline in GBP/USD.

- Need a move back above the 1.2300 (50% Fibonacci retracement) to 1.2310 (61.8% Fibonacci extension) region for GBP/USD to clear the bearish price series, with a move back above the 1.2390 (38.2% Fibonacci extension) to 1.2446 (May low) zone bringing the monthly high (1.2576) on the radar.

Additional Market Outlooks

Gold Price Recovery Eyes December High

US Dollar Forecast: USD/CAD Stages Three-Day Rally

EUR/USD Weakness Brings January Opening Range in Focus

USD/JPY Clears December High Ahead of US NFP Report

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong