- US initial jobless claims data later Thursday will receive far more interest than usual

- GBP/USD sits near a key level, providing decent trade setups depending on how the price action evolves

- Most Federal Reserve speakers on Thursday lean hawkish, although that creates asymmetric risks should one or some flip dovish

GBP/USD one to keep on the radar

US jobless claims data will garner far more interest than usual later Thursday as traders assess whether last week’s unusually large increase was an anomaly or start of a new trend. Testing a key level on the charts, two-way risk created by the data makes GBP/USD a pair to keep on the radar.

This jobless claims report is important

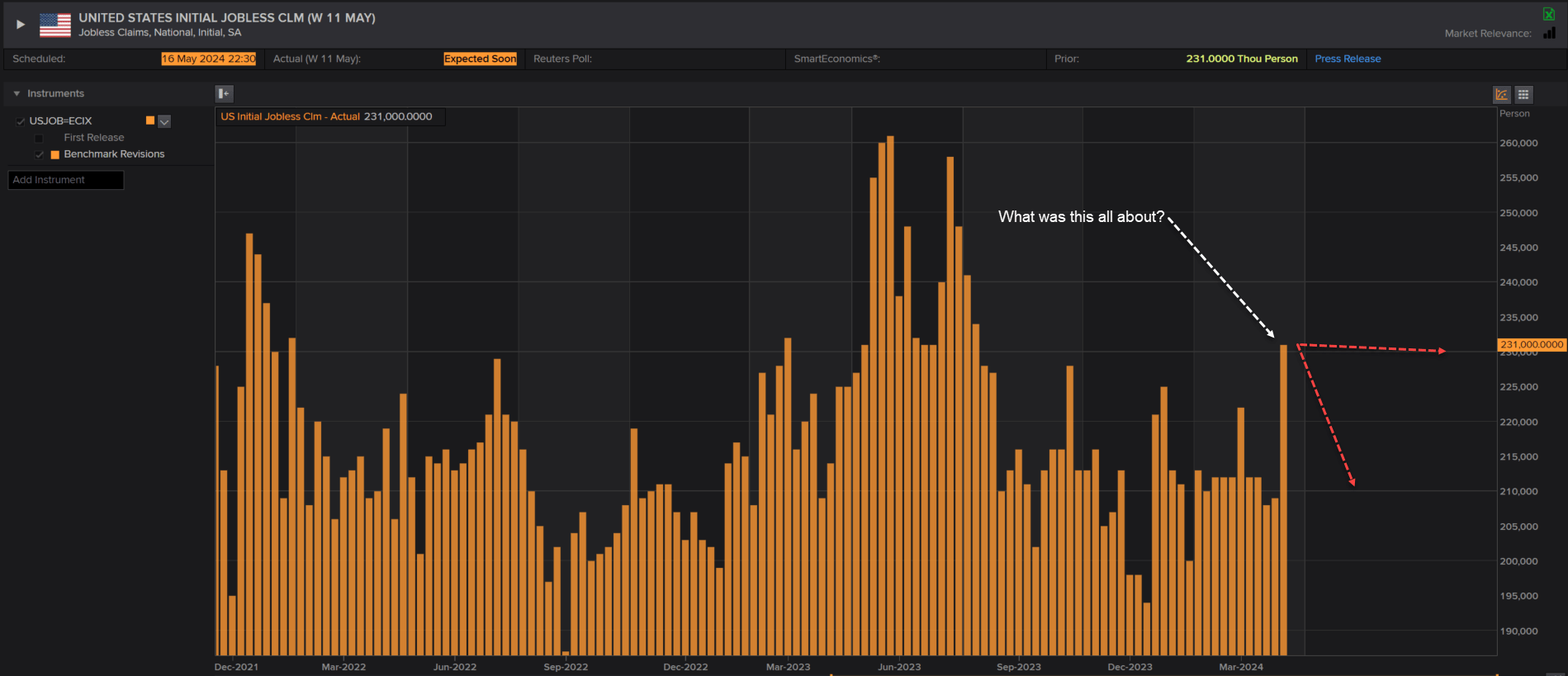

Before we look at trade setups, it’s worthwhile revisiting why the jobless claims data today is important. Last week, outside of holiday periods that can create one-off volatility in the series, the number of first-time unemployment benefit recipients spiked to 231,000, the highest number since August 2023.

The outcome was higher than even the most pessimistic forecaster polled by Reuters, and significantly above the low 200,000 figures seen consistently since the start of the year. While the spike could be interpreted as the start of a rapid deterioration in the US labour market, it may reflect claims being provided to workers temporarily stood down in New York state. If that is the case, the large increase could easily reverse today.

But nobody knows for sure, ensuring the release will dominate at the start of the North American session. Economists look for a decline to 220,000, which comes across as hedging their bets.

Source: Refinitiv

GBP/USD location generates decent setups

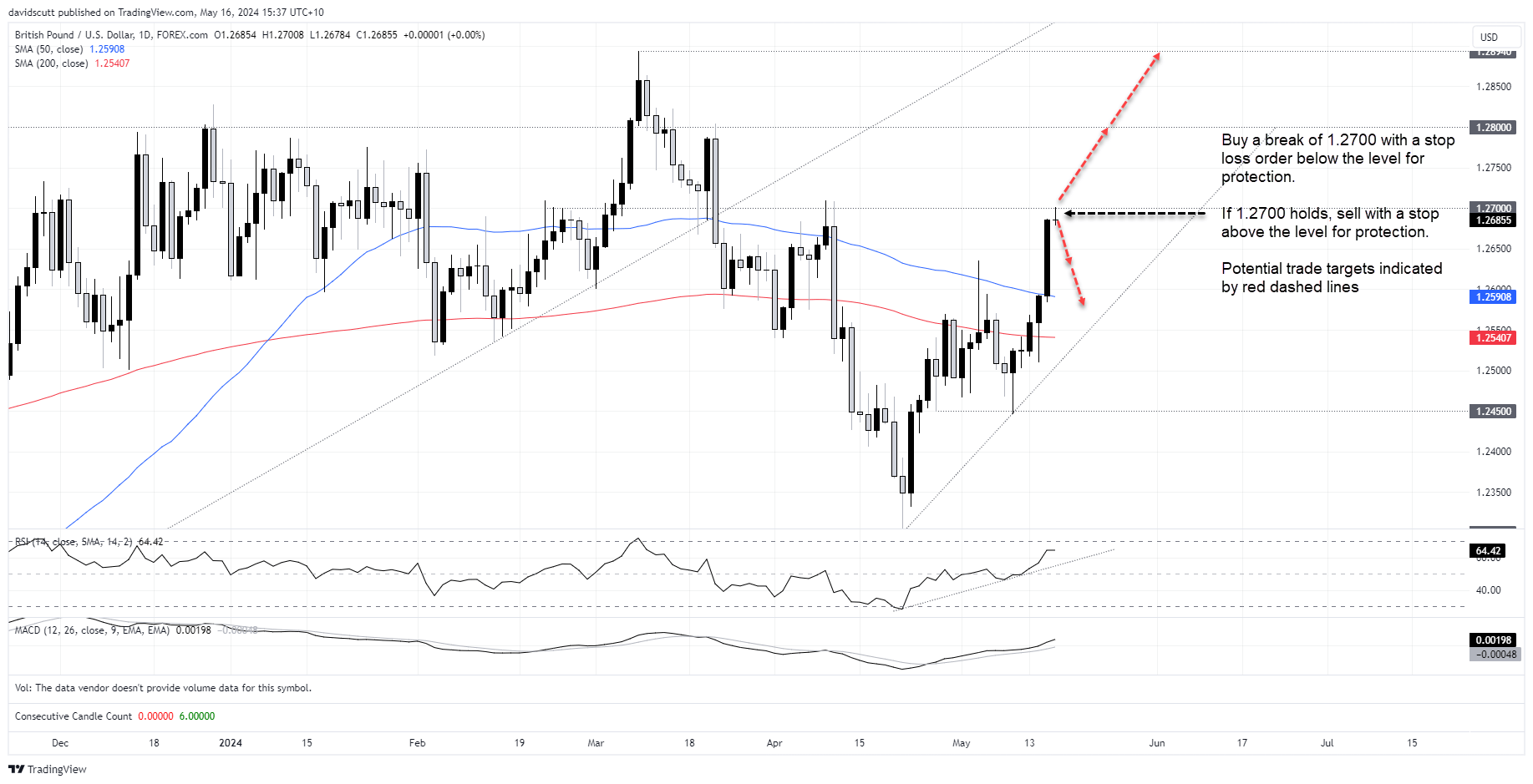

The reason I’ve nominated GBP/USD as a pair to watch is simply because of where it sits on the charts.

Sitting in an uptrend having rebounded from 1.2300 over the past month, it now finds itself testing 1.2700, a level it has done plenty of work either side of this year, including two failed attempts at a bullish break in April. Given its history around this level, it provided a decent trade setup to either buy a break or sell another failure, depending on what happens when the data is released.

Should 1.2700 give way, traders could initiate longs with a stop loss order below the level for protection. The initial trade target would be 1.2800, with the YTD high of 1.2894 the next after that. Alternatively, should 1.2700 hold, traders could sell with a stop above targeting a retracement lower. 1.2635 – the high struck on May 3 – would be the first target with the 50-day moving average located just below 1.2600 the next after that.

Should the price move in your favour post entry, you could consider lowering your stop to entry level, essentially creating a free trade.

The fine print

There are several second-tier US releases out at the same time as the data such as building permits, housing starts, trade prices and the Philly Fed manufacturing index, although none loom as being anywhere near as interesting to traders. Industrial production 45 minutes later may be more influential given market sensitivity to weak activity data right now.

On the central bank front, Megan Greene from the BoE will discuss UK labour market trends at midday London time. The BoE Financial Stability is not likely to be market moving when released at 9am in London.

On the Fed front, the schedule is loaded with FOMC members who typically lean hawkish with Barr, Barkin, Harker, Mester and Bostic doing the rounds. While that suggests they may push back on some of the market moves seen on Wednesday, such an outcome should be largely factored in. If anything, the cast of hawks creates asymmetric risks should one or some flip dovish.

Good luck!

-- Written by David Scutt

Follow David on Twitter @scutty