Jeremy Hunt, the UK’s Chancellor of the Exchequer, will unveil the UK spring budget on Wednesday Marth 6th. It makes sense that the Chancellor will want to present an optimistic budget ahead of the next general election, given the UK entered a technical recession in Q4. Although as he has already cautioned that there could be limited room for tax cuts, we may need to wait until the Autumn budget to see any real changes to personal or business levels. That, said there has been some speculation that he may unveil further adjustments to National Insurance Contributions, scrapping inheritance tax, or increase the ISA limit – all of which could create positive headlines without costing too much up front.

That is all well and good, but to currency traders it essentially comes down to how inflationary the budget is perceived to be, and its potential impact on the BOE’s monetary policy. Should the Chancellor surprise with favourable tax cuts or further adjust personal or business allowances, it could be seen as a net-positive for growth and pave the way for ‘higher-for-longer’ interest rates, and send GBP pairs higher. On that note, GBP/USD has actually fallen following Hunt’s first two budgets on March 14th and November 2nd 2023.

In fact, over GBP/USD has not performed too well on budget day (or either side of budget day) looking at its average returns around previous budgets.

GBP/USD forward returns around the UK Budget:

- Over the past 23 budgets, GBP/USD has averaged a negative return of -0.23% and a median return of -0.2%

- T-1 (the day ahead of the budget) and T+1 (the day after) has also resulted in negative returns

- Whilst T+1 has averaged negative returns, the relationship is less prominent than T+0

- GBP/USD has closed lower on the previous four budgets, or 6 of the past 7 (it closed flat five budgets ago)

- The daily High-low volatility on budget day is trending higher, with the previous three coming on above its average of 0.28%

The one data point that really stands out is ‘period 3’, with a -3.6% return. And that would be the day that then Chancellor Kwasi Kwarten delivered “The Growth Plan” which nearly thwarted the UK bond market and took the British pound down with it. But if we remove that outlier, budget day remains negative to average and median returns, although to a lesser degree of -0.7% and -0.15% respectively. Therefore, the basic takeaway are that forex traders generally do not see the UK budgets to be particularly inflationary, on the day before, during or after the release of the budget.

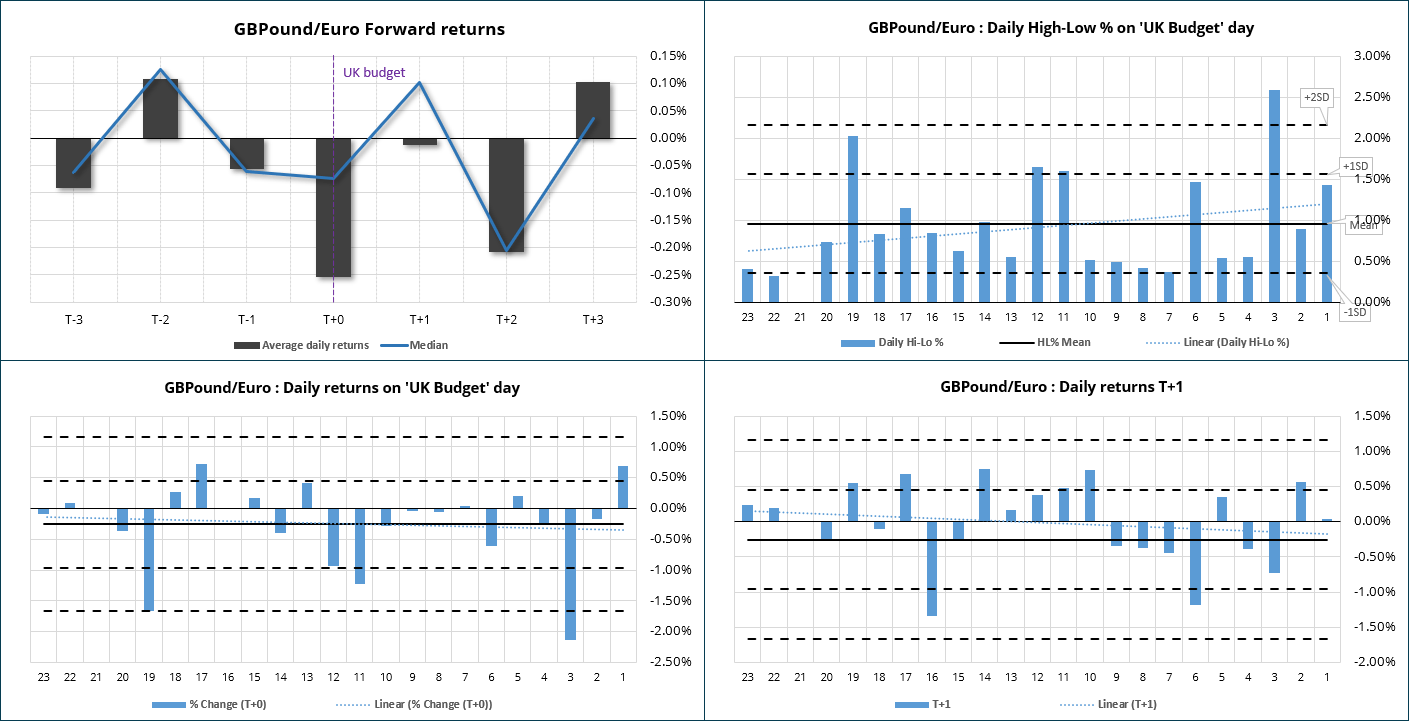

GBP/EUR forward returns around the UK Budget:

A similar patterns emerges against the euro, which shows that the British pound weakens against the euro on budget day (which would equate to a bullish EUR/GBP). Again we see the volatility levels on the daily high-low % range is trending higher, and the negative impact Kwarteng had on the British pound in 2022.

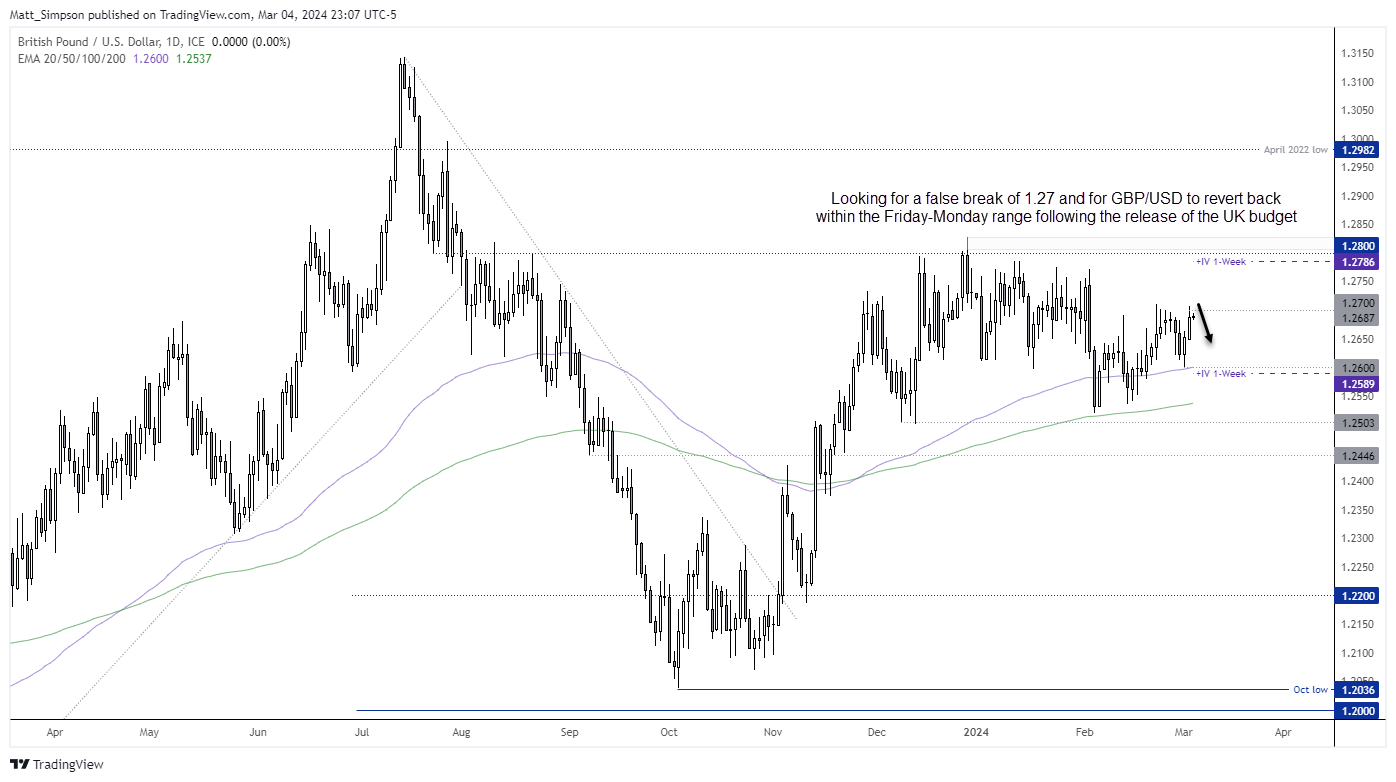

GBP/USD technical analysis:

If GBP/USD is to follow the average returns, it could closer lower today, tomorrow and Thursday. But we also have to factor in US data which includes a key ISM services report and Jerome Powell’s testimony to the House Committee.

- A strong ISM report and hawkish comments combined with a less-than-impressive budget could be the most bearish scenario for GBP/USD over the next 48 hours and lower from current levels.

- Whereas the most bullish case for GBP/USD would be to see weak ISM, relatively dovish comments from Powell and an inflationary budget for the UK.

The daily chart shows GBP/USD rose for a second day after finding support at the 1.26 handle and 100-day EMA. Were it not for the UK budget, my bias would be for GBP/USD to continue rising. Yet the rally has stalled around 1.27, so I feel more inclined to watch prices for a false break above 1.27 and move back below it to mark a potential ‘fakeout’ and revert back within the range of the past two days.

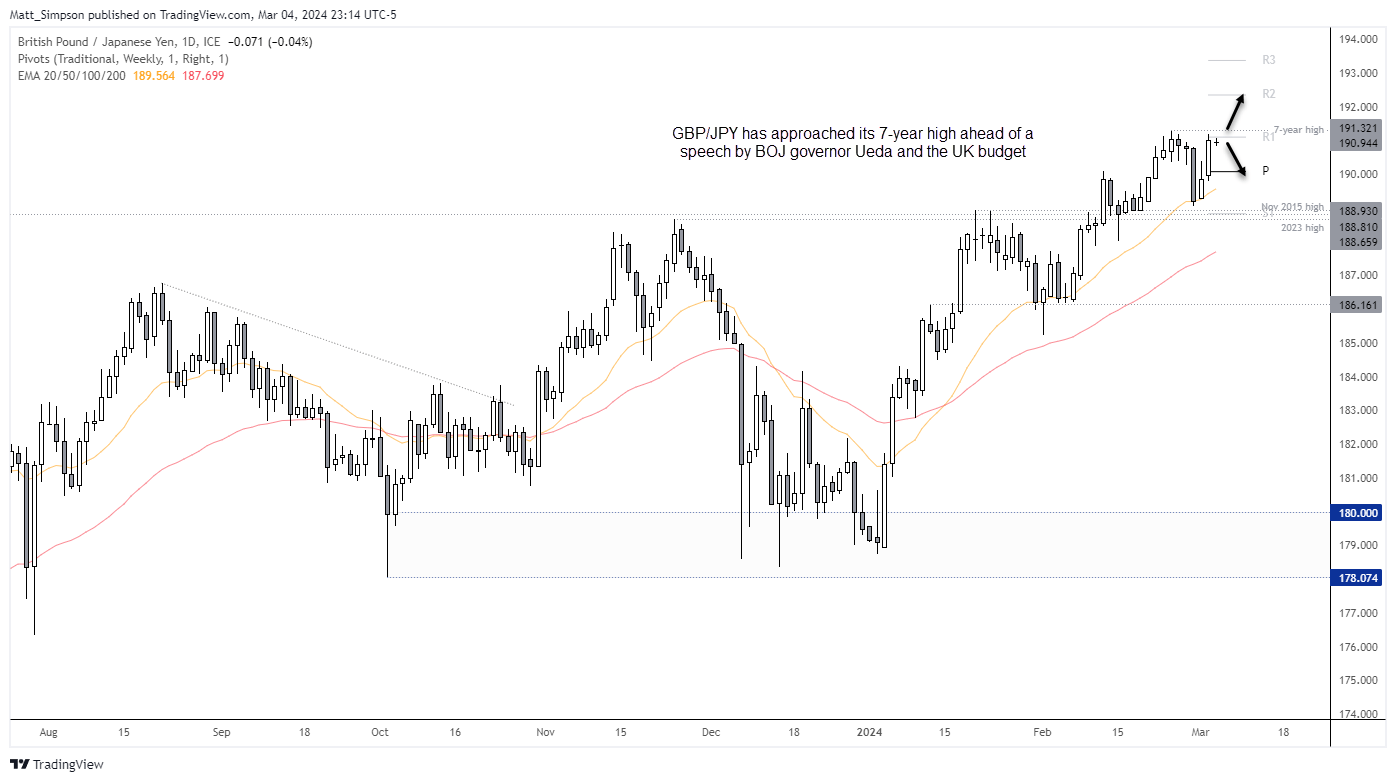

GBP/JPY technical analysis:

Another market worth keeping an eye on is GBP/JPY, as it trades just pips away from its 7-year high. The pair fell back and nearly tested the 2023 high on hawkish remarks from a BOJ member, yet those losses have been fully regained. For GBP/JPY to roll over from here likely requires hawkish comments from VOJ governor Ueda today, otherwise it seems like a candidate for a potential bullish breakout.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge