There has been quite a bit of excitement surrounding the potential BOE cuts over the past couple of months. Whilst the BOE opted to hold rates at last week’s meeting, the door has been opened for a cut in June. Assuming incoming data leans the right way. And that places today’s wages and employment data firmly into view, as it could easily sway opinions either way over the likelihood of BOE action next month.

BOE Chief economist Huw Pill at 90 mins later at 08:30 UK, delivering opening remarks at the Institute of Chartered Accountants. I’m not sure if it will prove to be a market mover, but worth keeping tabs on – as is Megan Green’s speech on Thursday at 12pm UK, titled “The Current State of Britain’s Labour Market”.

We know that employment data has been rolling over and that has been a key reasons for rate-cut bets. Unemployment rose to 4.2%, the claimant count increased to a 9-month high and the -67k jobs lost was its fastest pace since November 2020. If we were to see similar figures form the US then bets would be on for an imminent rate cut. Yet the fly in the ointment is wages data which remains sticky at relatively high levels. So perhaps the easier way to expect the BOE to pull the trigger in June is if we see wages come in well below expectations, assuming we do not see a surprise rebound in the employment figures.

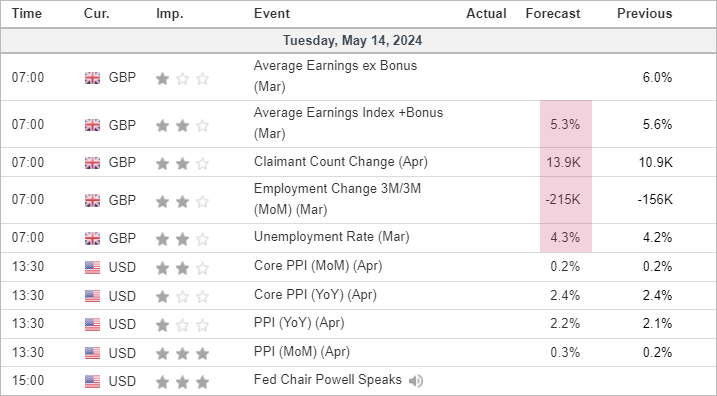

As things stand, UK unemployment is expected to rise to 4.3%, jobs claims increase to 13.9k, 3M/3M job change to plunge -215k and wages soften to 5.3% y/y. If all of those boxes are ticked, I suspect the British pound to face selling pressure on bets of a June cut. Anything short of these figures could simply sew doubt and send GBP higher. Also take note that US producer prices are released which could set the tone for tomorrow’s CPI figures, as could Jerome Powell’s speech. And that makes GBP/USD a key pair to minor today for FX traders.

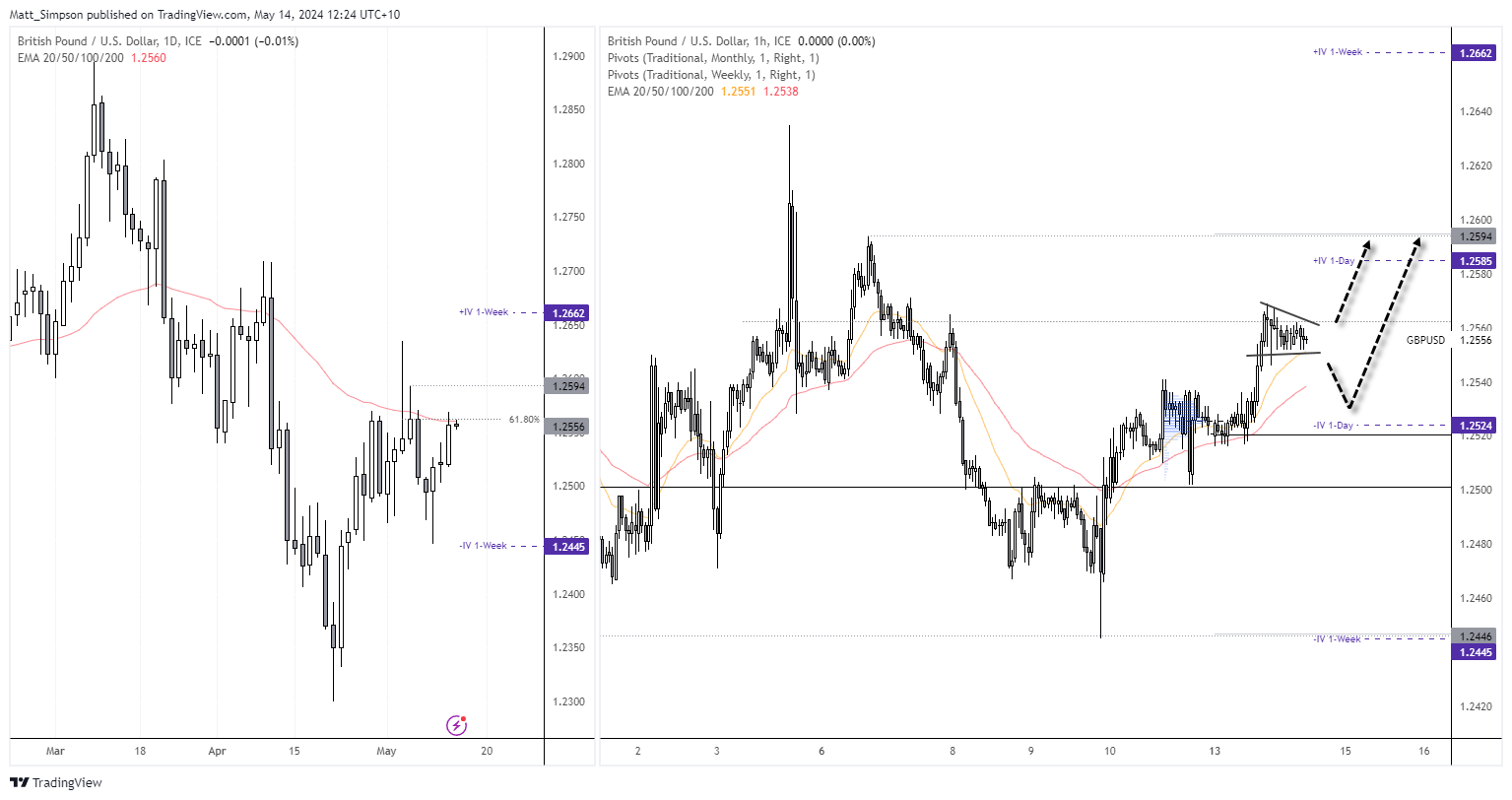

GBP/USD technical analysis:

The daily chart shows that bullish momentum has increased since GBP/USD broke above 1.25. And it may have traded higher on Monday, yet resistance was found at the 50-day EMA and 61.8% Fibonacci level. And that makes a pivotal level for traders to construct their plans around.

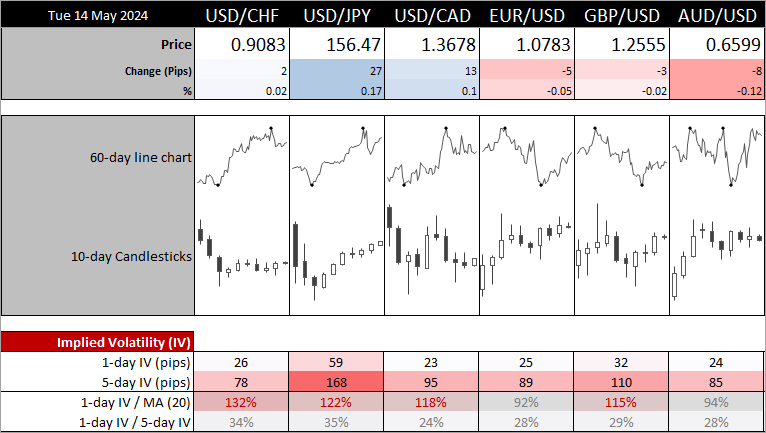

From a purely technical perspective, GBP/USD looks like it wants to pop higher. Prices are trading in a tight consolidation / pennant near Monday’s high following a strong rally into these levels. Even if prices initially retrace lower towards 1.2520, a high-volume node from the previous consolidation, weekly pivot point and lower 1-day implied volatility level suggest dips buyers may be tempted to return. Of course, should today’s data disappoint BOE doves, we may find that GBP/USD simply moves higher towards the highs just below 1.26.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge