While the European Central Bank and Swiss National Bank both cut interest rates last week, UK’s sticky services inflation is likely to prevent the Bank of England from following its European counterparts. However, the pound could still fall because of the potential that we could see a more aggressive easing stance by spring of 2025. The GBP/USD will find additional pressure in the event the US dollar extends its rally. Investors are eagerly anticipating what could be the final hurrah for volatility in 2024, with the Federal Reserve, Bank of Japan, as well as the BoE, all poised to reveal their rate decisions and provide outlook for the upcoming year. The GBP/USD forecast remains bearish.

UK PMI data underscores challenges facing the BoE

The UK’s Composite PMI was unchanged in December, although the UK private sector employment showed the fastest decline for nearly four years. The services PMI climbed to a two-month high of 51.4 from 50.4, beating estimates, while the manufacturing PMI hit an 11-month low of 47.3 compared to 48.0 in November. A similar story was also evident for the Eurozone, where the services PMI expanded at a faster pace than expected while the manufacturing once again declined more than forecast.

In the UK, new orders decreased for the first time in 13 months amid widespread reports of weaker business and consumer spending patterns, according the report by S&P Global. This is in part because of the still-strong inflationary pressures in the UK compared to other economic regions – the precise reason why the BoE may well decide cutting rates this week.

The report noted that “Rising salary payments and elevated domestic inflationary pressures continued to push up cost burdens across the private sector in December… the rate of input price inflation accelerated for the second month running to its strongest since April. Manufacturers recorded the steepest rise in purchasing prices since January 2023.”

The latest PMI data comes after Friday’s soft UK growth data, which caused the GBP/USD to slide towards 1.26 handle as the EUR/GBP jumped back up from near 0.82 to above 0.83 and in the process turned positive on the week. The recovery in the EUR/GBP helped to push the EUR/USD back up to $1.05 ahead of this week’s central bank bonanza.

US dollar support ahead of potential hawkish FOMC cut

Last week’s US CPI data brought no unexpected surprises, though the hotter-than-expected PPI did raise a few eyebrows. Even so, traders seem confident in their expectations of a rate cut at the Federal Reserve’s final meeting of the year on Wednesday. With a 25-basis-point reduction now almost fully priced in, the Fed has little room to diverge without causing notable market disruption. The real question is whether the Fed will pause rate cuts in early 2025 or stick to the current pace of 25-basis-point reductions at upcoming meetings.

Jerome Powell’s comments last month – noting that risks to the labour market had diminished while inflation remained more persistent than anticipated – have fuelled speculation of a hawkish cut. As a result, Powell’s remarks at the post-meeting press conference and the Fed’s updated economic and rate projections will be pivotal in shaping market sentiment.

For my part, I expect the Fed to deliver a hawkish cut. President-elect Trump’s policy plans – featuring immigration controls, tariffs, and both personal and corporate tax cuts – are likely to push the Fed towards signalling a more cautious and measured path of easing through 2025. This should keep the dollar well-supported, leaving the GBP/USD outlook forecast bearish.

Looking ahead to the week: BoE and Fed could influence GBP/USD forecast meaningfully

In the week ahead, we will hear from the US Federal Reserve (Wednesday), Bank of England and Bank of Japan (both on Thursday) among others. Of particular importance for the GBP/USD forecast, traders will want to pay close attention to the rate statement and comments from the heads of the BoE and FOMC.

Ahead of Thursday’s Bank of England rate decision, we will have already heard from the Fed and BoJ, both expected to have trimmed rates. Last week, the ECB delivered an expected 25 basis point cut while the SNB surprised with 50.

As mentioned, the BoE is not expected to cut rates even after Friday’s release of poor UK GDP and other macro data. But could we see a surprise cut anyway? That is the key risk that is not priced in. Influencing the BoE’s decision, we will still have UK wages and CPI data on Tuesday and Wednesday, respectively.

GBP/USD technical analysis

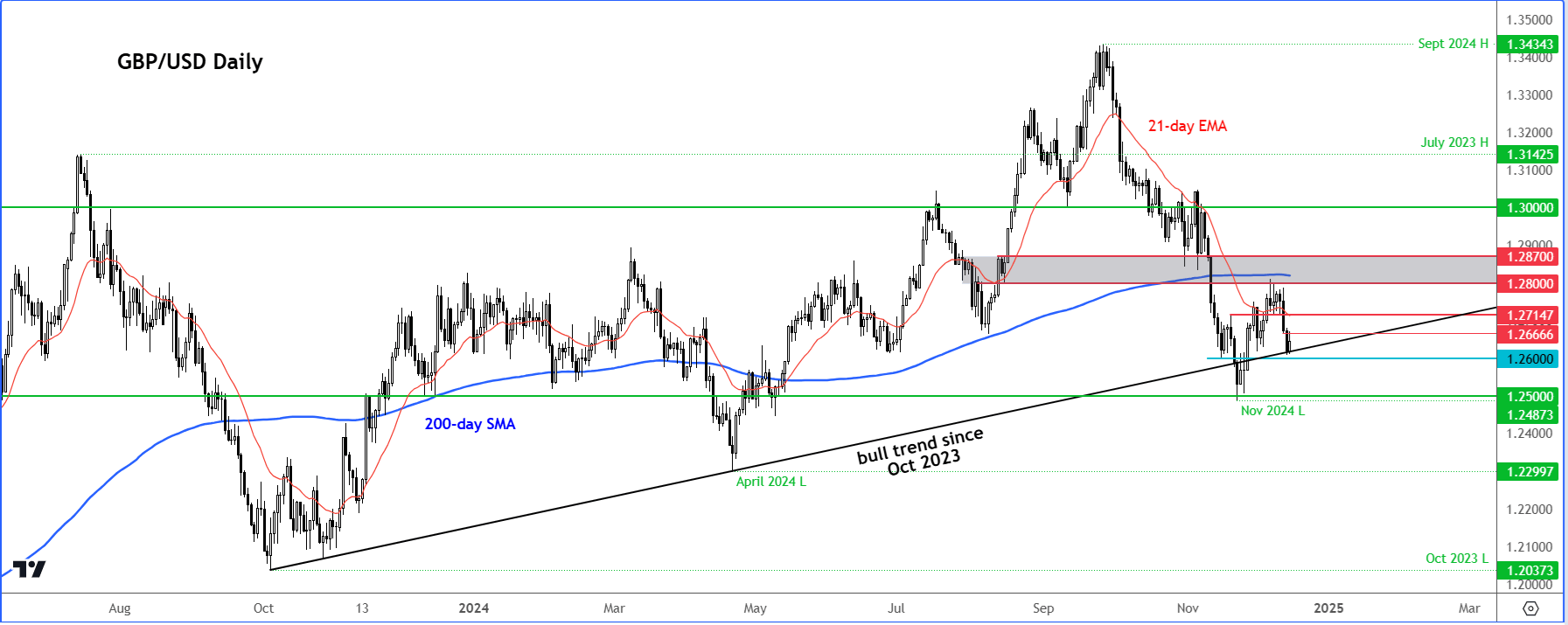

Source: TradingView.com

From a technical standpoint, the GBP/USD forecast is leaning bearish again after rates hit resistance at around the 1.28 handle last week.

For now, key short-term resistance lies around the 1.2715/20 level after we broke decisively below this point last week. This may well have opened the door for a drop below the 1.2600 zone. Beneath that, the psychologically significant 1.25 level comes into focus, which previously acted as support after a brief dip to November’s low of 1.2487.

As before, the next big resistance above the 1.2715/20 area to watch is in the 1.2800–1.2870 range. This area has served as both support and resistance in the past and coincides with the 200-day moving average, making it a critical level to monitor the cable were to make a recovery in the week ahead.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R