The US dollar eased back in the first half of Thursday’s session after reaching its highest point since July against a basket of foreign currencies, yesterday. A firmer risk tone owing to positive company earnings, slight easing of bond yields and technical selling all weighed on the US dollar. However, the trend remains bullish for the greenback, especially as we are now getting quite close to the US presidential election, with Trump starting to lead in the polls. This should keep the ongoing GBP/USD forecast mildly bearish, despite today’s recovery in the cable.

US jobless claims beat ahead of PMI data

The dollar’s weakness comes a day after Treasury yields rose to a three-month high with the market expecting economic data to remain strong and the US presidential elections to persuade the Fed to cut rates at a slower pace.

Indeed, today’s main US data release – the weekly jobless claims figure – came in better than expected at 227K vs. 243K eyed. Looking ahead, US PMI figures are in focus and are expected to show the services PMI essentially remained unchanged at 55.0 in October, whilst manufacturing PMI is expected to increase only slightly to still remain below the expansion threshold at 47.5.

GBP/USD forecast: UK PMIs disappoint

Earlier today, we had the European PMIs showing an overall mixed picture from the region. But the latest UK PMIs won’t help the pound much, if at all. Both the services (51.2) and manufacturing (51.8) PMIs were slightly below expectations, although still managed to remain in the positive territory. However, the recent publication of softer UK CPI data and BoE Governor Andrew Bailey’ indications that the pace of policy easing could increase if inflation data allowed it, means sterling will struggle to gain upside traction without an improvement in UK data, or a sharp deterioration in US data.

US election is the most important risk to GBP/USD forecast

So, the broader trend for GBP/USD continues to lean bearish, with the US dollar staying strong as we approach the US presidential election. Donald Trump gaining momentum in the polls has markets factoring in a possible win, which could keep the greenback well-supported. He has gained a slight advantage in the race, leading by two percentage points in the Wall Street Journal survey. If Trump secures victory, we’re likely to see currencies like the Chinese yuan, Mexican peso, and euro under pressure, with the British pound also feeling the strain. Trump's tough stance on tariffs, particularly on European and Mexican car imports, has already given the dollar a boost. His policies are also considered to be inflationary, which could result in more gradual Fed rate cuts. But given this is a very close race, there still remains plenty of room for the dollar to run if Trump wins. The recent wave of dollar buying certainly hints at growing confidence in this outcome.

Technical GBP/USD forecast: Key levels to watch

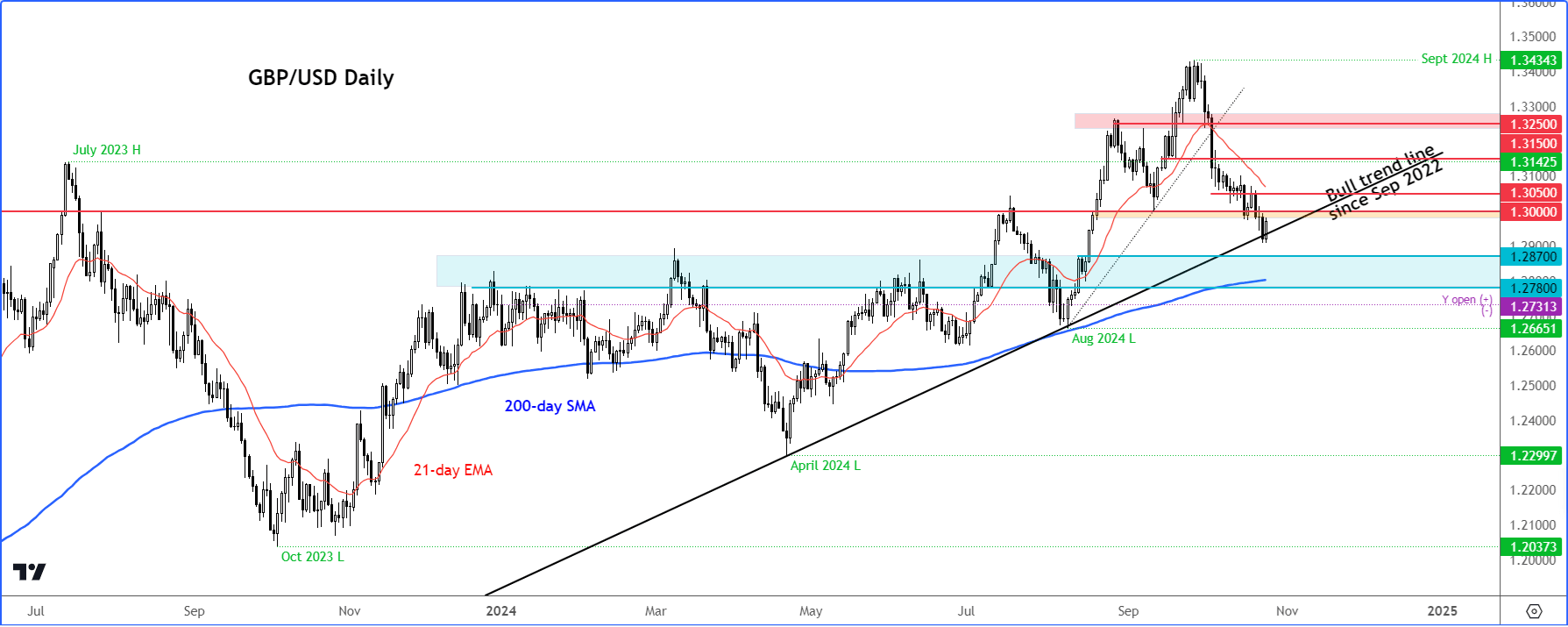

Source: TradingView.com

The GBP/USD managed to bounce right where it needed to: at just over the 1.2900 handle. This is where the trend line going back to September 2022 comes into play. But now, price is approaching key resistance around the 1.2980-1.3000 area, which must be reclaimed to boost the appeal of the cable for the bulls. If reclaimed, we could see price squeeze higher towards 1.3050 initially and then potentially climb to the next area of resistance around 1.3150. However, if resistance holds here, then the bears will likely have another crack at the bullish trend line. Potential supports below the trend will come in around 1.2870, followed by 1.2800.

All told, the technical GBP/USD forecast still remains bearish despite today’s recovery, as are yet to see a clear bullish reversal pattern on the chart.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R